Low Risk – Smart Beta

When you invest in the markets, there are a lot of moving pieces. In that process, if you’re expecting outcome A to happen but outcome B happens, that is the risk you’re running. Risk refers to the uncertainty associated with one’s investments and its potential to negatively affect the investment. It is commonly measured with the help of volatility. While different people have varying perceptions of risk, the effect of risk on investments of different people is uniform.

The obvious question that should follow is – how does risk impact returns? As far as the relationship between risk and return is concerned, a simple graphic shall come in handy to explain the same –

The graph seems straightforward and indicates that higher the risk, higher the return. According to Howard Marks, founder of Oaktree Capital, it is important to understand that the relation between risk and return is not a perfect linear one in nature. The graph should be interpreted as “investments that seem riskier have to appear to promise higher returns, so that people buy into them.” Usage of words like “seem” and “appear” is deliberate, as these words indicate that risk and potential return can only be estimated.

Contrary to expectation that higher risk should ideally yield higher returns, research has shown that low volatility stocks have consistently outperformed high volatility stocks and provided higher returns. This effect, termed as the “Low Risk Anomaly”, challenges the basic notion of risk-return trade off discussed above and is the bedrock of low volatility investing. The Low Risk – Smart Beta smallcase is based on this anomaly.

Now let’s attempt to understand the concept of Smart Beta. The risk of investing in equities is measured via beta. It measures the volatility, which is the fluctuation in the investment value, compared to benchmark indices like Nifty. A beta value of 2 means the stock or portfolio value is expected to change by twice as much as the change in the value of the corresponding benchmark. Thus, higher the beta, the riskier the investment. Smart beta aims to increase the return potential without any corresponding increase in risk usually by adopting a superior weighting criteria.

You see, the smallcase is structured in such a fashion that defensive sectors, such as the likes of FMCG and Pharma get self-selected into the composition. Now you ask, why is that? This is because sectors like (Pharma and FMCG) are generally sectors that are immune to market cycles and economic downturns. For the uninitiated, defensive sectors are those sectors whose demand does not change much with the overall economic sentiment. For instance, even if an economy is going through a recession, people will consume essentials like salt, medicines, and so on, however they might delay the decision to buy a house or any other discretionary commodity. Hence stocks of companies from such sectors have low volatility, leading to their self selection into the smallcase.

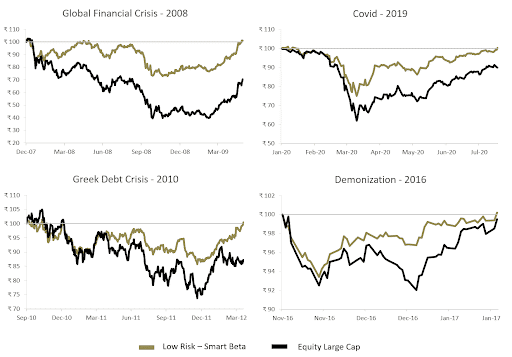

Lastly, let’s take a look at the performance of the Low Risk- Smart Beta smallcase during historic market downturns.

The above illustration makes it clear that the Low Risk – Smart Beta smallcase has lower drawdowns as compared to the benchmark, while rising back sharply to its initial value. Drawdown measures the downside risk of a stock / portfolio. Since the stocks in the basket exhibit low volatility, it translates into lower drawdown during bear markets. Extrapolating this to the general scheme of things, this smallcase tends to outperform the markets during bearish cycles and tends to underperform during bullish phases. However due to lower drawdowns, recovery is quicker as can be seen in above chart, because of which compounding effect kicks in. Now even if the low risk strategy may underperform the market during bullish phases (as happened after the COVID-19 crash), over the long term this strategy has been seen to outperform the broader markets handsomely while taking lesser risk throughout.

The intention behind delving deep into the workings of the smallcase is to convey that at Windmill Capital we do not simply apply market strategies. We apply our discretion behind these strategies and work towards making the strategy more effective for our investors.

Follow us on Twitter @windmillcapHQ for updates on our latest and existing offerings and interesting market insights. Also, feel free to let us know what else you wish to read!

Disclaimer: The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary. Refer to our disclosures page, here.