Key Insights from Q4 FY24 Earnings!

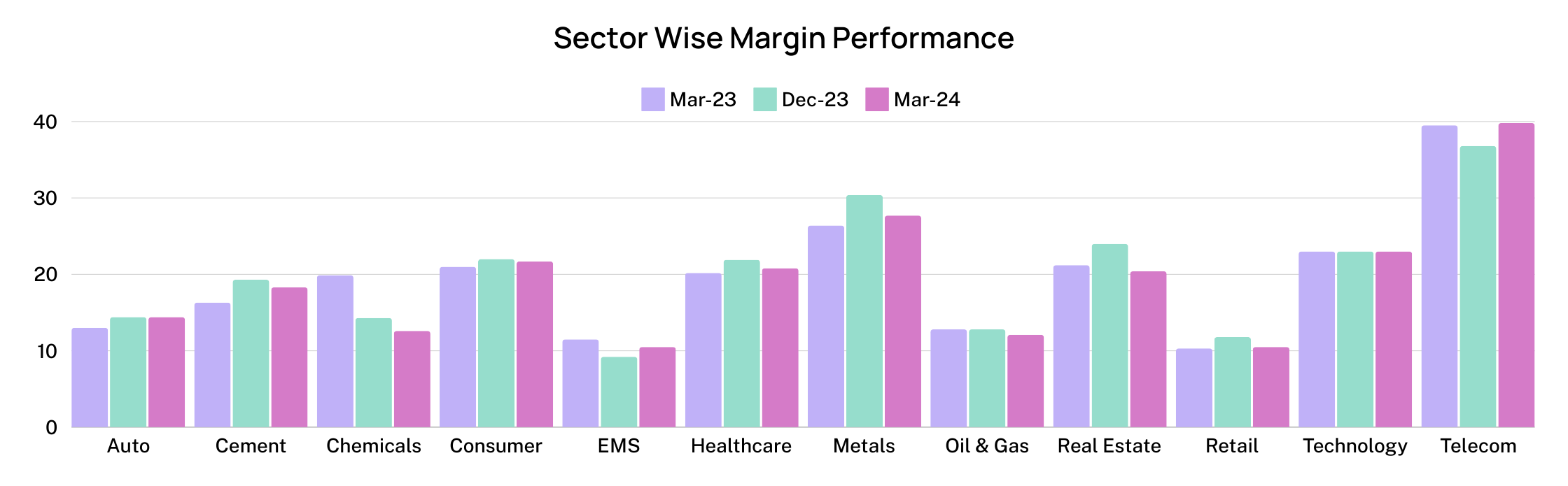

For Q4FY24, there’s a notable divergence in performance across different sectors, with domestic cyclicals such as financials, industrials, and autos showing robust year-over-year net profit growth of 44%, translating to Rs 76,300 crore. This growth is particularly impressive compared to the relatively muted performance in defensive sectors like IT and consumer staples. Excluding the financial sector, profit after tax (PAT) growth is more subdued at 12% year-over-year. This suggests that the financial sector’s strong performance is a significant driver of overall growth, masking weaker performance in other areas.

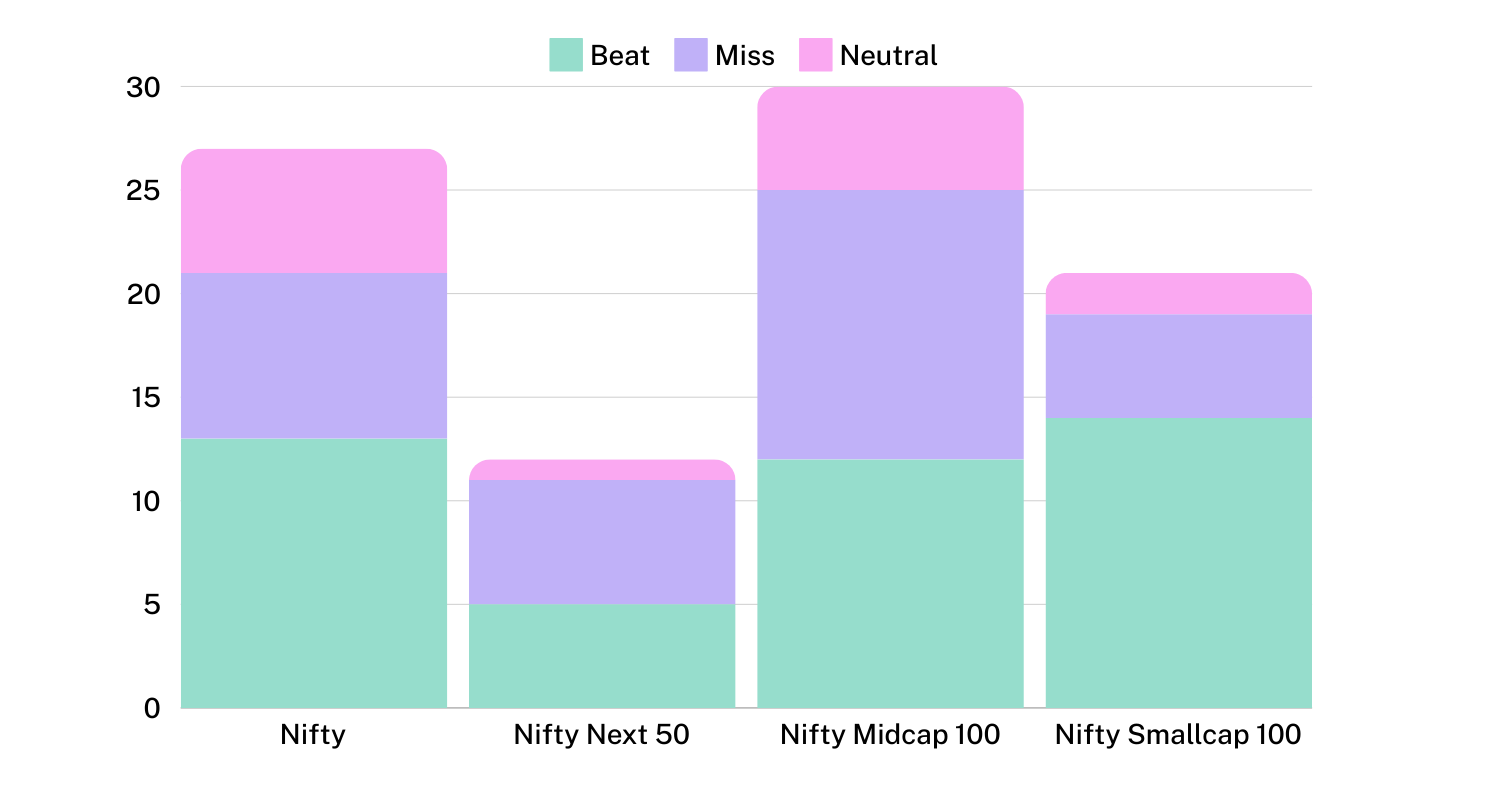

The Nifty is currently trading at a forward P/E of 19.3x, which is a 5% discount compared to its long-period average. As of last week, the earnings season for the fourth quarter of the fiscal year 2024 (4Q FY24) has seen 28 from Nifty 50 release their results. Collectively, these companies represent 62% of the projected Profit After Tax for the Nifty 50 universes and carry a 66% weight in the Nifty index. Overall, the earnings are showing that the majority of sectors are either meeting or exceeding expectations, with significant contributions from the BFSI and Automobile sectors, driving positive momentum in corporate earnings.

Earlier we had deep dived into the earnings expectation for Q4 FY24 , let’s look at the interim performance of Indian companies in Quarter 4 FY24.

Key Highlights of Quarter 4 FY24 Earnings Season

Earnings Performance & Growth:

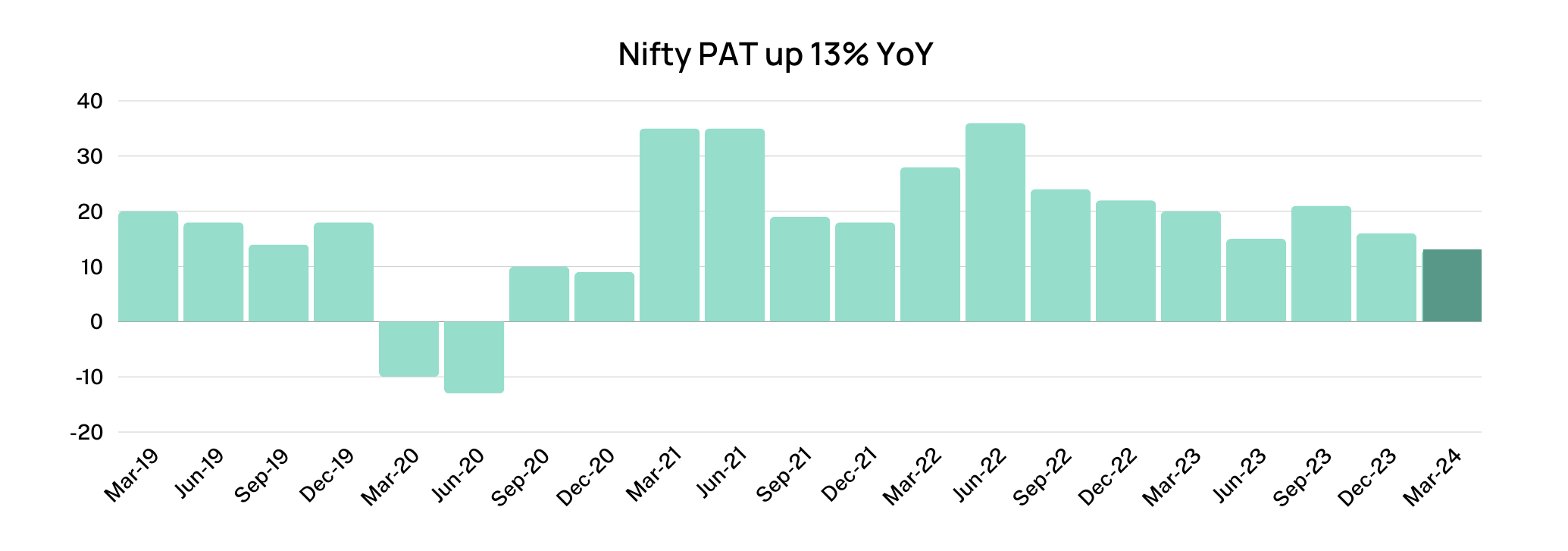

- For the 28 companies in the Nifty, earnings have risen by 13% year-over-year (YoY), surpassing the anticipated 8% increase.

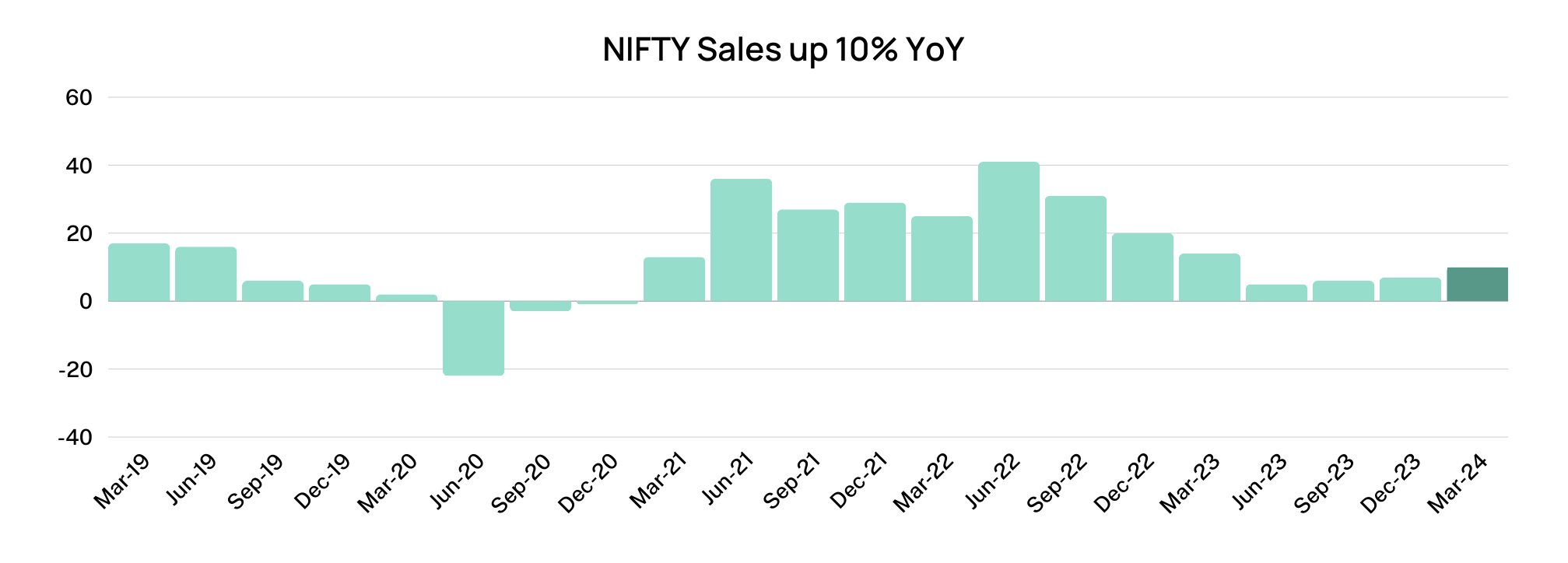

- Sales & EBITDA for these 28 stocks have increased by 10% & 15%, outperforming most estimates.

- Key contributors to this growth include HDFC Bank, Coal India, ICICI Bank, Maruti Suzuki, and TCS, which together accounted for 75% of the incremental YoY earnings growth.

- In contrast, Tech Mahindra, Reliance Industries, and Wipro had a negative impact on the Nifty earnings.

- So far, 19 of the 27 companies have seen earnings forecasts adjusted by more than 3%, resulting in a negative upgrade-to-downgrade ratio for the fiscal year 2025 estimates (FY25E).

- Among these companies, only 5 reported earnings below expectations, 10 exceeded forecasts, and 13 were in line with predictions.

Sector Performance:

- Growth was predominantly driven by domestic cyclicals, notably the BFSI (Banking, Financial Services, and Insurance) and Auto sectors.

- BFSI reported a 22% YoY increase, while Auto, led by Maruti Suzuki and Bajaj Auto, saw a 38% YoY rise, exactly meeting expectations. Cement Sector showed a robust performance with a 33% YoY increase, exceeding the predicted 25%.

- However, the Oil & Gas (O&G) sector faced a downturn, with a 20% decline in earnings, significantly impacted by a 52% drop in IOCL’s profits.

Let’s look at the different key sectors.

Banking Sector Performance Q4 FY24 Earnings Season

Private banks such as Axis Bank, Kotak Mahindra Bank, and RBL Bank reported earnings surpassing expectations. However, institutions like HDFC Bank, Axis Bank, Kotak Mahindra Bank, Federal Bank, ICICI Bank, IDFC First Bank, and IndusInd Bank displayed mixed margin performances, despite a slowdown in Net Interest Margin compression amid rising funding costs.

Margin Performance:

- NIM Expansion: HDFC Bank, Axis Bank, Kotak Mahindra Bank, and Federal Bank experienced Net Interest Margin expansion.

- NIM Compression: ICICI Bank, IDFC First Bank, and IndusInd Bank saw slight NIM compression.

Despite the mixed individual performances, the overall trend in NIM compression across the sector has moderated, which is a positive signal, especially as funding costs have continued to increase.

Growth and Operational Focus:

- Advances Growth: There has been a healthy quarter-on-quarter growth in advances of about 3-5%, predominantly driven by expansions in the Retail and MSME segments.

- Liability Management: With an enhanced focus on the Credit-Deposit ratio, banks have intensified their attention towards liabilities. This strategic shift has resulted in robust deposit growth during the quarter, accompanied by resilience in the Current Account Savings Account mix.

- Asset Quality: Banks have reported improvements in asset quality. The SME and restructured loan pools have been well-managed, contributing to controlled provisioning expenses.

Although the general credit environment remains stable, some caution is advised as lenders like SBI Cards, AU Small Finance Bank, and IDFC First Bank have reported a normalization in credit costs. This normalization suggests a return to typical levels of credit expenses following periods of unusually low or high charges.

Non-Banking Financial Companies (NBFCs) Sector Performance Q4 FY24 Earnings Season

Volatility persisted in capital market activities with Futures & Options and cash volumes reaching new highs. Demat account additions hit 12.1 million, and NSE active clients rose to 40.8 million. This resulted in significant revenue growth for firms like Angel One, which reported a 65% YoY increase. Despite strong revenue, operating margins were under pressure due to high costs associated with customer acquisition and Indian Premier League advertising.

The NBFC sector saw robust premium growth driven by auto sales, sustained demand for health insurance, and growth in commercial lines. Profitability in the motor segment improved notably, although Star Health experienced an increased claims ratio. However, the overall combined ratio remained stable due to cost rationalization. Diversified lenders with a presence in personal/consumer loan segments have adjusted their growth strategies, particularly reducing exposure to small-ticket loans.

Demand in Vehicle Segment:

The demand momentum for vehicle financiers, especially in the CV segment, has been subdued due to the ongoing elections. However, expectations are set for a recovery post-elections and following the Union Budget presentation.

Cost of Borrowing (CoB):

Despite rising Marginal Cost of Lending Rates and increased risk weights on bank loans to NBFCs, most NBFCs have reported a stable or declining CoB. However, those reporting a sequential rise in CoB experienced Net Interest Margin (NIM) compression.

Asset Quality and Credit Costs:

Generally, asset quality and credit costs remained benign across the sector. Notably, Bajaj Finance observed higher delinquencies in its B2C business and increased its guidance on credit costs.

Operating Expenses:

Operating expense ratios have remained high due to continued investments in distribution, manpower, and technology enhancements.

Overall, the NBFC sector in 4QFY24 faced several challenges but also highlighted areas of strong performance and growth, particularly in segments benefiting from economic and sector-specific dynamics.

Cement Sector Performance in Q4 FY24 Earnings Season

Cement sector’s volume increased by approximately 14% year-over-year (YoY), which is 2% higher than our forecasts. This indicates a strong demand and operational execution during the quarter. We saw robust performance among 5 cement companies namely, ACC, Ambuja Cements, Birla Corporation, Dalmia Bharat and UltraTech Cement. Aggregate revenue for these companies rose by 10% YoY, reflecting the healthy volume growth despite some pricing challenges

Operational Expenses per Ton:

There was a significant reduction in operational expenses per ton of 6% YoY and 5% QoQ, about 1% better than expected. This decrease is attributed to favorable fuel prices, reduced freight costs, and positive operating leverage (efficiency gained from higher production volumes reducing fixed costs per unit). EBITDA per ton also improved by 8% YoY which reflects effective cost management and operational efficiency.

Demand Outlook:

Most management teams expect a moderation in demand in the first half of FY25 due to general elections followed by monsoons, which are typically slower periods for construction activity.

Cement Pricing:

The price at which the cement is sold (blended realization) decreased by 4% YoY and 3% quarter-over-quarter (QoQ)s. This drop in prices could impact overall profitability but was somewhat offset by volume growth.Prices have corrected sharply in 4QFY24 and are expected to remain stable without significant improvements in the near term.

Fuel Prices:

Stability in fuel prices over the past 6 months is anticipated to gradually reduce power and fuel costs, which are significant components of cement production expenses.

Overall, the cement sector exhibited strong volume growth in 4QFY24, although price realizations were lower than expected. The near-term outlook is cautious due to expected demand softness and stable pricing. Companies that continue to manage costs effectively and navigate the post-election and monsoon seasons will likely maintain financial stability.

Explore our in depth cement sector dashboard.

Automobiles Sector Performance Q4 FY24 Earnings Season

Automobile sector’s results for the quarter were generally as expected, driven by robust volume growth (excluding commercial vehicles – CVs), improved product mixes, lower commodity costs, and operational leverage. Most segments have experienced robust sales volume growth, which is a strong indicator of healthy market demand. However, margin pressures are anticipated to persist due to recurring costs.

Positives of Automobile sector:

- Companies have optimized their product offerings to better align with market demands and profitability goals.

- Reduced costs for key materials have contributed to better margins during the quarter.

- Increased efficiency in operations has allowed companies to spread their fixed costs over a larger production volume, enhancing profitability.

Challenges of Automobile sector

While the current quarter has shown promising growth, there are challenges ahead:

- Prices for commodities like aluminium, copper, and rubber are beginning to rise, which could negatively impact gross margins in future quarters.

- Expected recurrence of certain costs and rising commodity prices are likely to maintain pressure on profit margins.

Different segment performance:

- Passenger Vehicles: The market for SUVs remains strong, while demand for entry-level cars is weaker.

- Two-Wheelers: Original Equipment Manufacturers (OEMs) are optimistic about further growth in both domestic and global volumes.

- Commercial Vehicles: Although current demand is low, recovery is expected to commence in the second half of FY25.

The 4QFY24 has generally met expectations with strong performance in several key segments. However, the outlook remains cautious due to rising commodity prices and other cost pressures.

Explore our in depth automotive sector dashboard.

Introducing our largecaps focused portfolio investing across different sectors for safety & stability, protecting you in volatile markets.

Technology Sector Performance Q4 FY24 Earnings Season

The IT Software Sector has underperformed for Tier-1 IT companies, experiencing lower-than-expected growth, weak demand across the board, and several operational hurdles such as contract rescoping and cancellations notably affecting Infosys and L&T Infotech. The FY25 guidance was lower than expected, reflecting a gloomy short-term outlook.

Discretionary Spending:

There has been no significant recovery in discretionary spending, which typically includes expenditures on non-essential projects or new technologies. The lack of increase in this area contributes to the bleak near-term outlook.

Guidance for FY25:

Forward-looking statements for FY25 are subdued, with Infosys projecting a modest 1-3% growth in constant currency terms and HCL Technologies forecasting a 3-5% CC growth. Both are below the initially muted expectations.

Deal Bookings vs. Revenue Conversion:

While deal bookings remain robust, with Tata Consultancy Services signing record deals, the revenue conversion from these deals has been muted. Issues include leakages in existing portfolios and slower conversions, especially amid deals with longer durations.

Margins:

Margin performance varied among companies. Except for TCS, which managed to align with expectations, other Tier-1 firms generally reported margins that either met or fell below expectations.

Headcount Trends:

Overall headcount additions were weak, with most companies reporting a net decline. This indicates cautious staffing strategies amid uncertain demand conditions.

Looking forward, companies are adjusting strategies to navigate a slow recovery in discretionary spending and contractual complexities.

Explore our detailed IT Hardware & IT Software sectors dashboards.

Consumer Goods Sector Performance Q4 FY24 Earnings Season

The fourth quarter results for FY24 in the consumer and consumer discretionary sectors have been in line with expectations, showing an improving consumption trend. Consumer staples showed steady trends with a slight YoY volume increase. The sector anticipates price adjustments settling in the first half of FY25, followed by potential price increases in the second half which could impact consumer behavior and profit margins. While there has been a slight improvement in volumes YoY, it is anticipated that a more noticeable volume recovery will occur in FY25.

Staple Goods Sector:

Demand trends in the staple universe have remained largely consistent with those observed in the third quarter of FY24. There has been a marginal improvement in volumes. The effects of recent price cuts are expected to stabilize in the first half of FY25, with potential price hikes anticipated in the second half of the year.

Jewellery Sector:

The jewellery segment has experienced relatively better growth trajectories due to sustained gold inflation, store expansion, and stronger growth in the formal jewellery market. Despite the growth, the sector faces tough competition, which has put pressure on profit margins.

Rural vs. Urban Markets:

There’s a positive outlook on rural markets, where Dabur’s rural business performance has surpassed its urban counterpart. Companies like Nestlé, Dabur, and Procter & Gamble have witnessed double-digit EBITDA growth YoY. Hindustan Unilever and Britannia Industries reported a marginal decline in EBITDA.

Volume Growth:

Expectations of volume recovery becoming more noticeable in FY25 suggest potential improvement in sales and overall sector health.

Overall, the consumer and consumer discretionary sectors are navigating a phase of steady demand with specific challenges in competitive areas like jewellery. The anticipation of volume growth and pricing adjustments in FY25 indicates a cautiously optimistic outlook for the sector, particularly in rural markets which are showing promising growth dynamics.

Explore our detailed Consumer Goods sector dashboard.

Oil & Gas Sector Performance Q4 FY24 Earnings Season

Mixed results were observed within the sector. Reliance Industries (RIL) exceeded expectations mainly due to robust Oil to Chemicals (O2C) performance, whereas Indian Oil Corporation Ltd. (IOCL) fell short, impacted by weaker refining margins.

- Reliance Industries: RIL outperformed estimates, primarily due to strong performance in the Oil to Chemicals (O2C) segment. This success was driven by effective feedstock sourcing strategies, efficient ethane cracking processes, and increased placement of products in domestic markets. Favorable conditions and strategic operations in O2C underpinned RIL’s robust earnings for the quarter.

- Indian Oil Corporation: IOCL’s performance fell short of our expectations primarily due to a weaker-than-expected refining margin of USD 8.4 per barrel, significantly lower than our estimate of USD 15.0 per barrel. The core Gross Refining Margin was at USD 10.6 per barrel, indicating an inventory loss of USD 2.2 per barrel during the quarter, which negatively impacted earnings. The petrochemical segment recorded an operating loss for the second consecutive quarter, exacerbated by weak price spreads in key products.

- Castrol India: Castrol missed earnings estimates due to higher-than-expected costs for raw materials and other operational expenses. Additionally, an unfavorable sales mix further adversely impacted the profit margins during the quarter.

The mixed results within the Oil & Gas sector reflect varied operational successes and challenges among the companies. RIL’s strong performance contrasts with the difficulties faced by IOCL and CSTRL, highlighting the impact of strategic management and market conditions on profitability. MRPL’s success demonstrates the potential benefits of focusing on high-margin product lines.

Overall, the sector’s performance suggests a complex landscape where strategic operations, particularly in product placement and raw material management, play crucial roles in determining financial outcomes. Companies that effectively navigate these challenges are likely to see better performance, while others may continue to face pressures on margins and earnings.

Real Estate Sector Performance Q4 FY24 Earnings Season

Excluding DLF, all other large realty companies have reported operational performance with cumulative bookings for 4QFY24 standing at INR 264 billion, marking a 63% Y-o-Y increase. This substantial increase in bookings was primarily driven by successful project launches.

Explore our detailed real estate sector dashboard.

Introducing our largecaps focused portfolio investing across different sectors for safety & stability, protecting you in volatile markets.

Interim Outlook of Q4 FY25 Performance & Beyond

Revenue growth, while positive, is less impressive at 8% year-over-year across 28 Nifty companies. This figure contrasts with the sharper PAT growth, indicating effective cost management or possibly lower tax rates impacting the bottom line more significantly than top-line growth. EBITDA growth at 10% year-over-year also supports the notion of effective operational management.

In contrast, the Nifty Next 50 index shows a much more challenging environment, with a significant 39% drop in PAT excluding financials. This stark difference highlights the varying fortunes between larger and slightly smaller companies within the broader market indices.

Looking forward, the projections for the Nifty50 index suggest optimism with a one-year forward target implying a 9% upside, despite more conservative expectations of long-term returns. Sectoral analysis indicates that cyclicals and capital-intensive sectors may continue to outperform, while defensives and discretionary consumption sectors lag, which could influence investment strategies moving forward.

Overall, while some sectors show strength, particularly those linked to domestic cyclicality, the broader market faces challenges that may temper investor enthusiasm, particularly in sectors like IT and consumer goods, which are currently underperforming. This mixed sector performance and cautious optimism in forecasts suggest a selective approach to investing in the current market.

Check out smallcases from Wright Research

Liked this story and want to continue receiving interesting content? Watchlist Wright Research smallcases to receive exclusive and curated stories.

Disclosures: https://www.smallcase.com/manager/wright-research#disclosures

SEBI Registration Details: Corporate Registered Investment Advisor | Company Name: Wryght Research & Capital Pvt Ltd Reg No: INA100015717 | CIN: U67100UP2019PTC123244. For more information and disclosures, visit our disclosures page here.