ITC stock is near ₹500 mark, what’s next in store?

Shares of ITC can cross the ₹500-mark over the next few trading sessions and could gain another 10% from there, but experts said that investors should consider buying at the current levels only if they are willing to hold on to the stock over a long term.

This conglomerate has become the seventh Indian company to cross a market capitalization of ₹6 lakh crore.

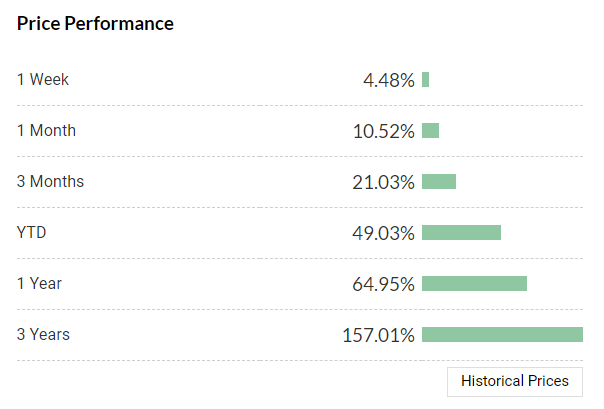

1 Yr Stock Performance:

Market Buzz:

Apart from its flagship cigarettes business, ITC also has a presence in hotels, paper products and fast-moving consumer goods.

Market buzz is that the company is likely to signal the timing of the de-merger of its hotel business at its annual general meeting on 11st August 2023, along with the strength in the broader market, drove the gains in the shares according to analysts.

But, the point to note is that demergers don’t happen overnight and can take up to 12 months for approvals to come from NCLT and other government bodies.

Message from smallcase Manager: Alok Jain, Founder, Weekend Investing

ATH (All Time High) has been an great vehicle to chase all time high stocks since many years. All time High stocks have a special importance as all significant gains in any stock happen mostly above its all time highs and hence this becomes a great filter to catch such high potential stocks.

ITC has been in several of our portfolios for long. Yes while it was correcting sub Rs.200 levels as per principles of momentum investing the opportunity cost was more favorable elsewhere but after Mar 22 strong momentum in ITC caused many of our strategies to invest in it and we stay invested in ITC as of date.

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

To discover interesting stocks like Apar Industries, check out Mi20 smallcase

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst

Disclosures: https://www.smallcase.com/smallcase/mi_st_ath-WKIMO_0007#disclosures