ITC Ltd Story: A Century of Innovation

Company Background & Introduction

Founded in 1910 as the Imperial Tobacco Company, ITC Ltd. has transformed remarkably into one of India’s most diversified conglomerates. While its origins lie in tobacco, ITC now spans many sectors, including Fast-Moving Consumer Goods (FMCG), Hotels, Paperboards & Packaging, agribusiness, and Information Technology. Today, ITC stands as a leader in India’s FMCG industry, boasting a robust portfolio of over 25 brands across key categories like personal care, food, and stationery, further solidifying its status as a powerhouse in multiple industries.

FMCG Sector in India – An Analysis

India’s FMCG (Fast-Moving Consumer Goods) sector is the 4th largest sector in the Indian economy, with a market size of around $170 billion. This is expected to touch $220 billion by 2025. The sector has grown rapidly over the years, driven by a young population, rising disposable incomes, and urbanization.

Though the sector has seen impressive progress, what’s interesting is the low per capita consumption in many FMCG categories. For example, the per capita consumption of biscuits in India is less than 2 kg per year, compared to the UK’s 10 kg. This underlines the massive growth potential in untapped markets, particularly rural India, which contributes nearly 40% to FMCG sales.

The way companies sell in this sector has also changed drastically over the years. Initially being a touch-and-feel product segment, post-COVID, online sales have become the go-to strategy for the majority of companies. Online sales are growing at a rapid pace, expected to contribute more than 10% of FMCG sales by 2025.

ITC’s Performance vs. FMCG Sector

ITC’s performance stands out in comparison to its FMCG peers. While major players like Hindustan Unilever (HUL), Nestlé, and Dabur have delivered steady growth, ITC has shown higher revenue growth in its FMCG business.

Over the last five years, ITC’s FMCG segment has grown 168% from ₹12,505 crores to ₹20,967 crores. In other words, they have achieved a compound annual growth rate (CAGR) of 14%, surpassing many competitors in the industry. Hindustan Unilever has seen a jump of 157% in their revenues in the said period while Dabur has witnessed a jump of 146%,

This can be attributed to ITC’s diverse portfolio, constant innovation, and robust rural distribution network. What differentiates ITC is its ability to maintain significant margins in its FMCG business, which is typically lower for its competitors. Despite inflationary pressures, ITC has managed to enhance its Operating Profit margins ahead of the industry currently hovering around 32% as compared to HUL’s 21.5%, Dabur’s 16.3%, and Tata Consumer’s 12%. Well, we need to take this number with a pinch of salt, as this margin profile includes all the business verticals.

Segmental Contribution: Growth and Challenges

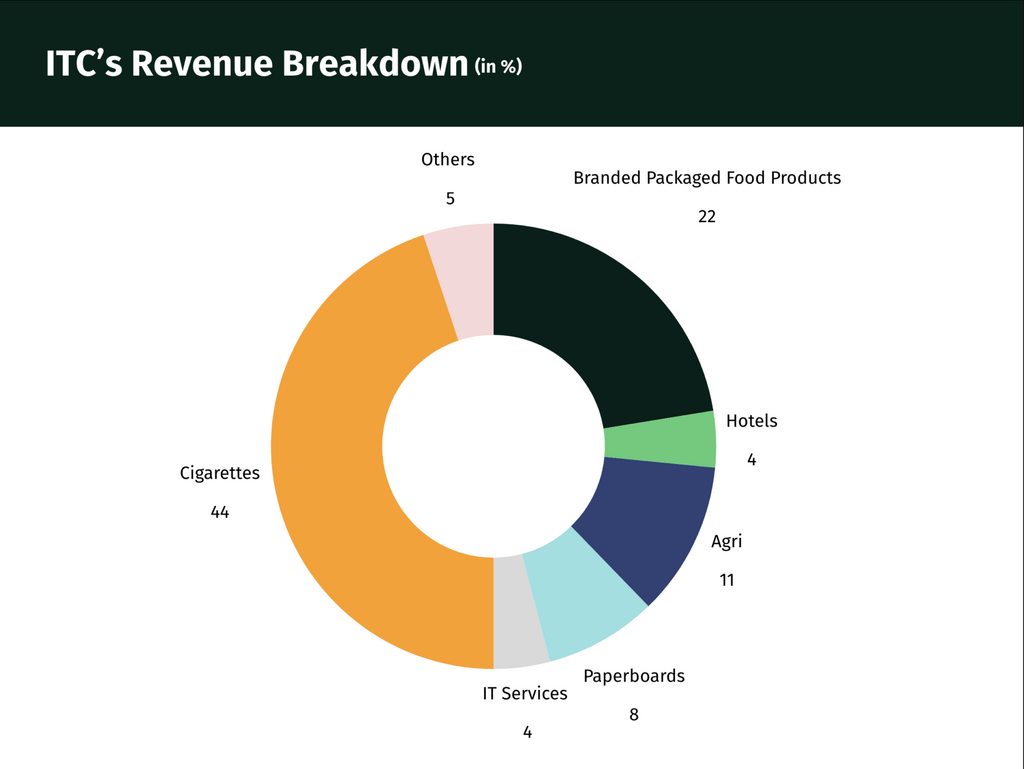

ITC operates through four main business segments:

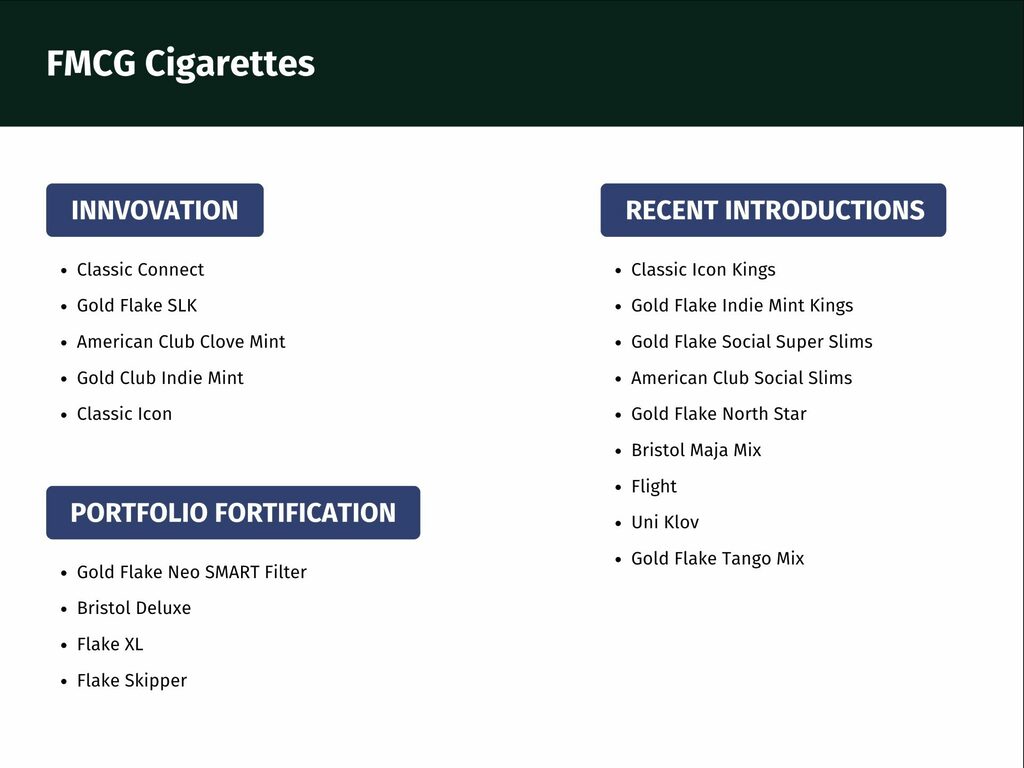

- FMCG (Cigarettes): Despite the regulatory pressures and declining cigarette volumes globally, ITC remains the market leader in India, with over 75% of the market share. The cigarette segment continues to be the largest contributor to ITC’s revenue with about 44% contribution to topline as of FY24. A few green shoots available for ITC in this segment are:

- The cigarette market in India is highly unorganized. This provides a huge headroom for a market leader like ITC to capture incremental market share.

- Favorable tax environment for cigarettes in India. In recent years, the government has not increased the tax rates on cigarettes which has served as extremely positive news for this company. This has been one of the key drivers of the ITC’s stock price.

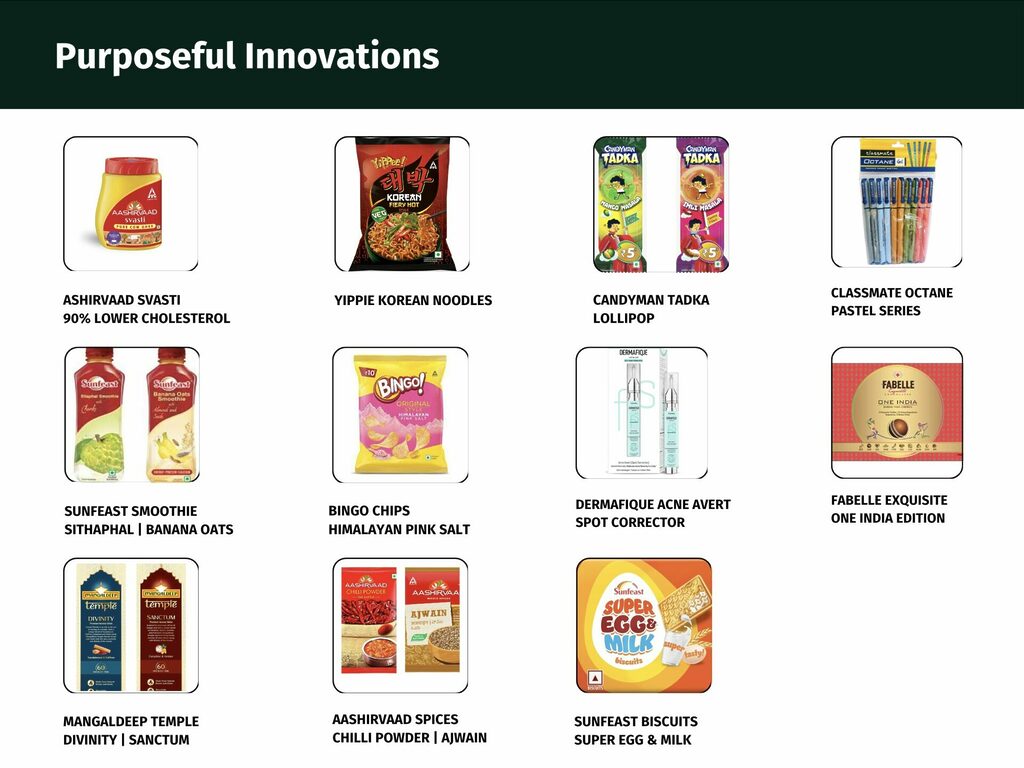

- Now common consensus would guide that since ITC is a major cigarette player would not be too keen on doing new things on this front. But that hasn’t been the case and they have constantly been innovating across their product lines. The image below refers to the same.

- FMCG (Non-cigarette): FMCG (Non-cigarette) includes everything from staples to stationery. This segment contributes 28% of ITC’s revenues. This portfolio is wide and manages to cater to all sections of the society. They have been continuously riding on innovation to plug any portfolio gaps and make it a holistic offering. Around 2020, they also acquired Sunrise which specializes in kitchen spices. A reference image is attached below for you to take a look at their diversified range of products.

In this segment as well ITC has brought about interesting innovations. Take a look.

- Paperboards, Packaging & Agri-business: ITC is also a leader in paperboards and packaging, with this segment contributing around 20% to its revenues. This segment has seen consistent growth, driven by higher demand for sustainable packaging solutions. That being said, the company has been struggling with this segment over the last three to four quarters on account of multiple issues like central elections which had put a pause on their agribusiness while low pulp prices, higher input costs and weak demand led to issues in the paperboard business.

- Hotels: The hotel segment contributes 4% to ITC’s topline. This segment has done well for them post-COVID on the back of pent-up demand. The company is focused on having an Asset Right Strategy when it comes to its hotel business. As a result, they are venturing into managed hotels, with a pipeline of 28 managed hotels in the next two years. Managed hotels refer to properties that are owned by a third-party investor or entity but are operated and managed by a hotel management company, which saves a sizable amount of capex.

Additionally, ITC has also planned to demerge its hotel business into a separate entity for which they received the shareholder approval back in June 2024. This might lead to further value unlocking in the business.

Dividend History: A Key Factor for Investors?

ITC has long been a favourite for dividend-focused investors, consistently maintaining a strong dividend payout ratio. The company’s average dividend yield over the last five years stands at an impressive 3-4%, making it one of the most attractive stocks for income-seeking investors. The dividend yield of the company is materially higher than that of the sector.

Now, the question is whether the dividend is a key factor for investors to consider ITC. For long-term investors, ITC’s dividend track record provides a stable return, which is particularly appealing in uncertain market conditions. While the stock price has not always reflected the company’s earnings growth, its high dividend yield compensates for this, making it a defensive play in portfolios.

Conclusion

ITC’s transformation from a cigarette-centric business to a diversified conglomerate with a strong FMCG focus makes it a compelling investment opportunity. The company’s ability to outperform peers in the FMCG space, its leadership in cigarettes, and its resilience across challenging market conditions are key factors in its strong performance. While regulatory challenges in cigarettes remain, ITC’s consistent dividend history, strong financials, and growing FMCG business offer a balanced mix of growth and stability for long-term investors. As India’s FMCG sector continues to grow, ITC’s multi-pronged strategy positions it well for future growth, with room for value creation across its segments.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of a SEBI recognized supervisory body (if any) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital Team: Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.