Is LAMF a Better Alternative to Breaking Investments?

In today’s fast-paced world, financial needs often arise unexpectedly, demanding immediate attention and quick access to funds. While traditional options like personal loans or redeeming investments may seem viable solutions, they often come with significant drawbacks that can impact long-term financial goals.

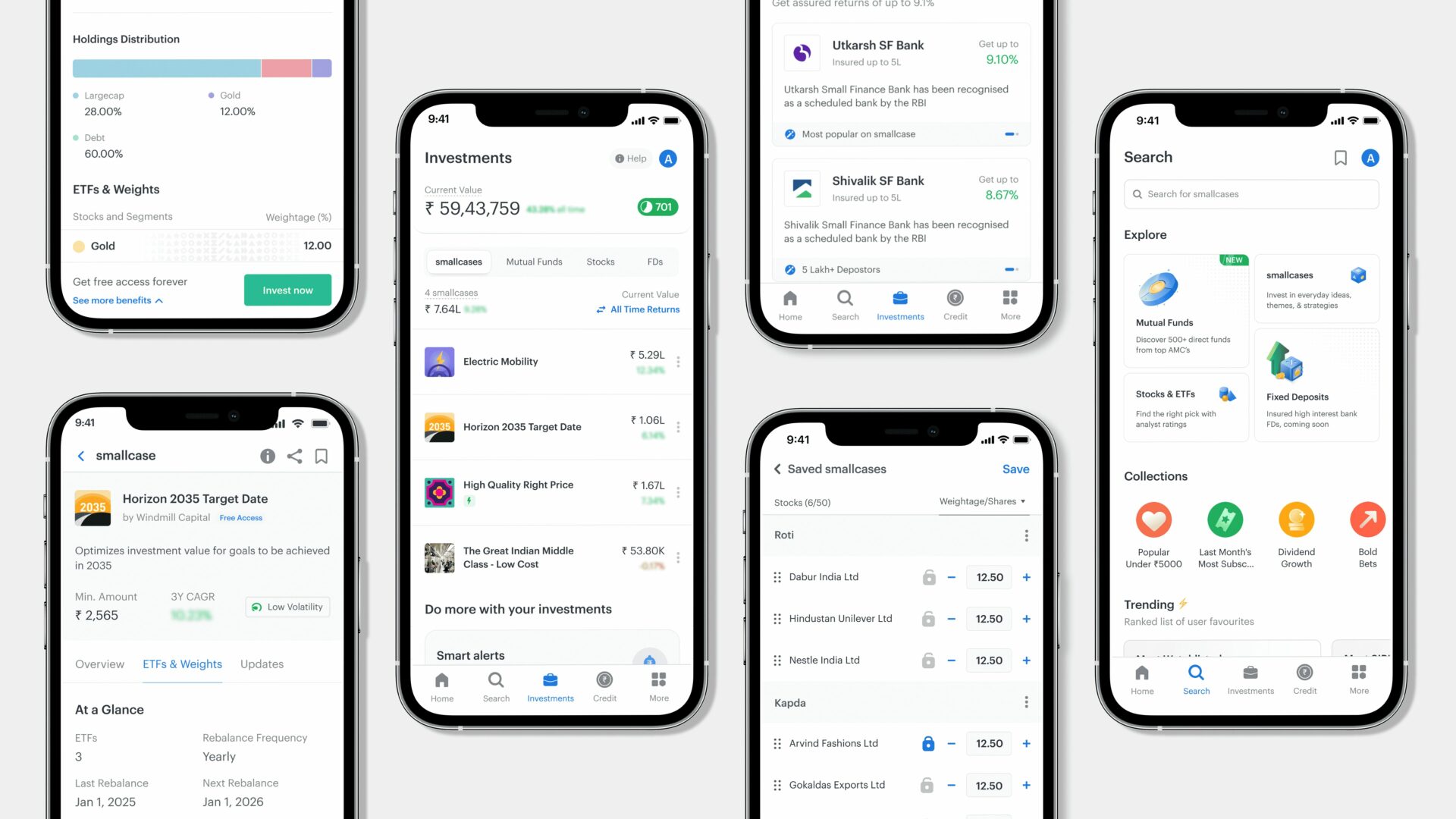

At smallcase, we wanted to solve this exact problem, and that is how we came up with our latest offering – Loan Against Mutual Funds. With LAMF, we aim to empower investors with a financial tool that ensures they stay on track with investment plans while accessing the required funds conveniently.

Why is taking a LAMF better than exiting investments?

| Loan Against Mutual Funds (LAMF) | Selling Mutual Funds | |

| Impact on investment | No impact, investments continue to earn returns | Investment liquidated, no future returns |

| Capital gains tax | No capital gains tax | Capital gains tax may apply, depending on holding period |

| Discipline | Maintains investment discipline | Can break long-term investment strategy |

| Suitability | For short-term needs while remaining invested | When selling is unavoidable or capital gains tax benefits outweigh future growth |

LAMF vs Selling mutual funds – An Example

For instance, say you urgently need Rs. 2 lakhs for a critical expense. Let’s compare what happens when you choose to fund these expenses by selling your mutual funds versus. by taking a loan against them.

Scenario

- You have Rs. 4 lakhs worth of mutual funds.

- You urgently need Rs. 2 lakhs for a critical expense.

Option A – Selling Mutual Funds

- Sell Rs. 2 lakhs worth of equity mutual funds

- Potential loss of returns: Rs. 24,000 (assuming 12% returns on Rs. 2 lakhs)

- Returns assumed at 12% p.a. are for illustrative purposes only. Actual returns may vary depending on various factors.

Option B – Taking a Loan Against Mutual Funds (LAMF)

- Pledge Rs. 4 lakhs worth of equity mutual funds

- Loan disbursed: Rs. 2 lakhs (Per lending norms, 50% of the value of equity mutual funds can be taken as a loan)

- Interest rate: 10.5% p.a.

- Interest payment over 1 year: Rs. 21,000 (10.5% of Rs. 2 lakhs)

- Retain potential returns on the entire Rs. 4 lakhs (Rs. 48,000)

Comparison

In Option A (selling), you lose Rs. 24,000 in potential returns but gain liquidity. In Option B (LAMF), you retain the entire investment but incur interest costs of Rs. 21,000.

Hence, your total investment stands at Rs. 4.48 lakh by the end of the year. Even after accounting for Rs. 21,000 interest that you pay, your investment has still grown overall. Additionally, your urgent need is taken care of while your investments can continue growing in the future.

| Aspect | Selling Mutual Funds | Loan Against Mutual Funds |

| Cash Received | Rs. 2 lakhs | Rs. 2 lakhs |

| Time to get funds | 1-3 working days | 2-3 hours |

| Investment Value | Drops to Rs. 0 | Pledged Rs. 4 lakhs |

| Returns | Miss out on potential returns of Rs. 24,000 (12% of Rs. 2 lakhs) | Retain potential returns of Rs. 48,000 (12% of Rs. 4 lakhs) |

| Loan Interest Rate | – | 10.5% p.a. |

| Interest Paid Over 1 Year | – | Rs. 21,000 (10.75% of Rs. 2 lakhs) |

| Total Investment at the End of the Year | Rs. 0 | Rs. 4.48 lakhs (Rs. 4 lakhs + Rs. 48,000) |

Make the most compounding with LAMF

Even when your mutual funds are pledged for a loan, you continue to earn returns and can choose to invest as usual. So you can continue to harness the power of compounding even when your mutual funds are pledged! To illustrate this, consider two individuals, both having Rs. 10 lakh in mutual fund holdings.

Person A decides to sell Rs. 4 lakh of their mutual funds for cash, while Person B takes a loan against their funds instead.

Person A ends up with Rs. 8.42 lakhs, but Person B’s portfolio grows to Rs. 14 lakhs, that’s a 66.6% difference! This shows how making smart choices can really boost your investments over time.

| Person A | Person B | |||

| Sells 4 lakh of MFs | Uses loan against mutual funds | Change in portfolio value | ||

| Year 1 | Total Portfolio Value (assuming 12%) | 6,72,000 | 11,20,000 | 66.67% |

| Year 2 | Total Portfolio Value | 7,52,640 | 12,54,400 | 66.67% |

| Year 3 | Total Portfolio Value | 8,42,956 | 14,04,928 | 66.67% |

In a nutshell

The importance of investment continuity cannot be overstated when it comes to long-term wealth building. Redeeming investments to meet short-term financial needs can lead to significant opportunity costs, as it may impede the potential returns that could have been earned had the investments been left untouched. Here is where LAMF proves to be a prudent choice.

With LAMF, borrowers can access the required liquidity without disturbing their well-thought-out investment strategies. By leveraging their mutual fund investments as collateral, they can unlock the necessary funds while maintaining their long-term financial goals intact, ultimately enhancing their overall financial well-being.