Understanding Glide-Path Investing

Before we begin, let’s set some context. As you may already be aware, our newest offering was rolled out to address the problem of goal-based investing – in that, we wanted to give investors the most efficient way to build wealth that could be used to realize their life goals. We wrote a detailed post outlining the research that went behind constructing such portfolios, how they compare to existing options out there, their performance, etc. One thing that we left out in that discussion was the inherent methodology we used to build those smallcases because we thought it deserved a dedicated blog to help everyone best understand how it works. In technical terms, it’s called glide-path investing.

Now that we understand what we’re looking to learn, let’s dive right in!

One of the basic philosophies that we followed while building these goal-based portfolios was that the portfolio invests in one of the following asset classes – equities, bonds, gold and cash using ETFs as it is a fool-proof way to efficiently create wealth with low costs. Next was the problem of allocating the money among these different asset classes. That’s when the concept of glide-path investing comes to play.

You see, the inherent nature of these 4 asset classes are unique in their own ways and optimally allocating money among them can help give the investor a smooth wealth creation journey. For example, equities/stocks are aggressive investments that are considered excellent wealth creators over the long-term but can be very volatile over the short term. Bonds or fixed income are more conservative as compared to equities and hence are less risky. Gold is also considered an aggressive investment but it is less volatile than stocks and moreover the price of gold generally follows an inverse correlation with equities and hence makes for a good hedge. And lastly, cash/liquid bees is the safest asset class with almost no risk.

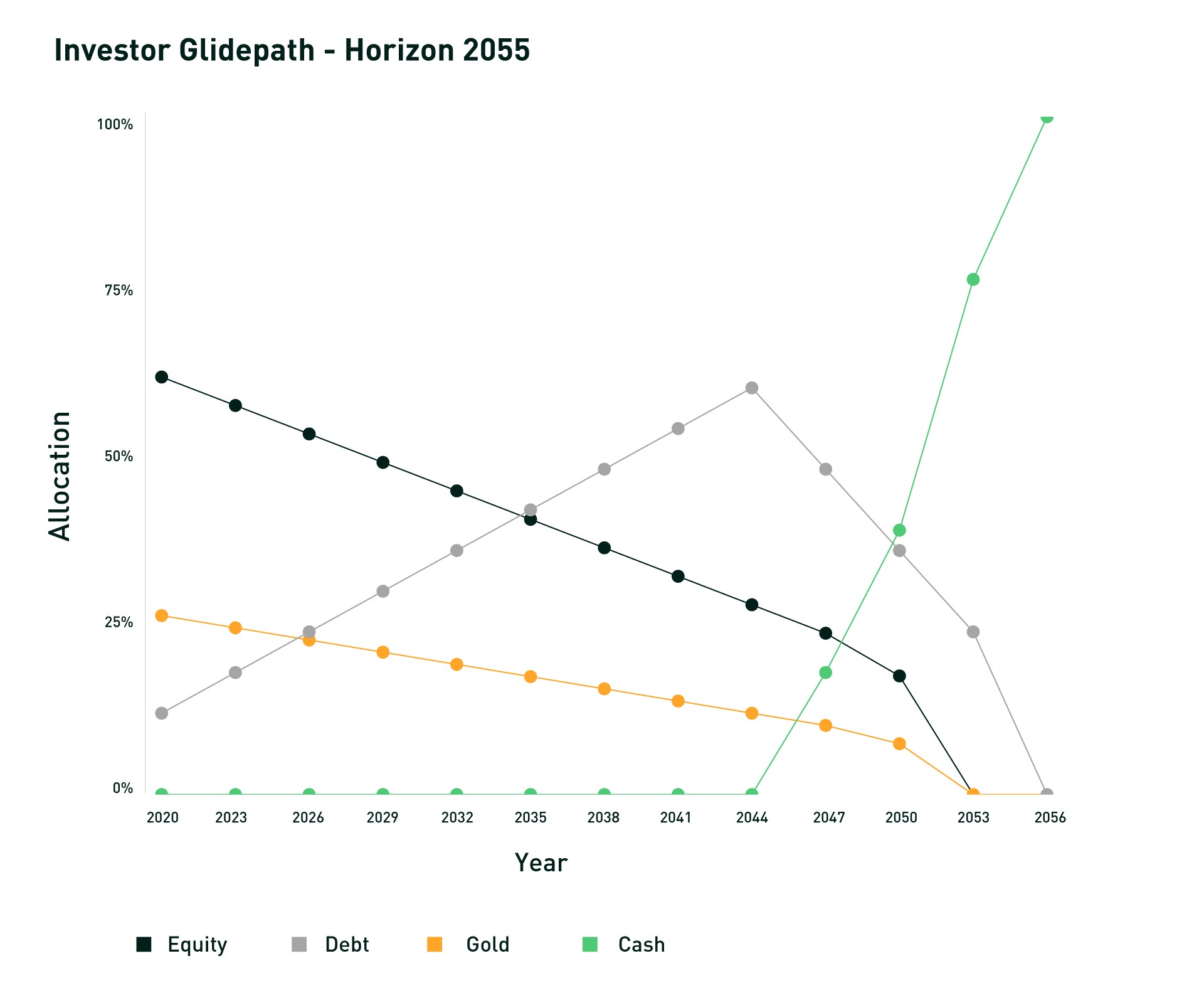

Now, each Horizon smallcase follows a particular glide path, which begins with greater equity & gold allocations, and slowly moves the allocation towards more conservative instruments. A glide path can be thought of as an investment layout or weighing scheme that an investor witnesses over the course of their goal-based investment journey. It is a mapping of the weightage of the asset allocation scheme based on the target date.

At the beginning of the goal-based investment journey, when the target year is far and the investor has substantial risk-taking ability, greater weight is allocated to equity & gold assets to capture growth – but this comes with increased volatility. Gradually the portfolio is rebalanced to accommodate a greater percentage of fixed income than equity & gold as the investor turns midway in their investment journey and their risk appetite also decreases. Eventually, everything is moved to cash equivalents at the target date as the investor has retired and no longer has the ability to take any risk at this point. Ergo, aligning this mix of equity, gold, fixed income & cash equivalents along the journey with the investor’s risk appetite and mapping out the different mix of various assets at the end of each year is what is called a glide path.

An important reason why a dynamic glide path is required is because, say the investor is very close to the target date and the portfolio has allocation to equities. An equity market crash will result in severe losses and all the wealth that has been amassed over the previous years will be lost. Hence, this glide path of aggressive investments in the early years and safer investment in the later years provides an optimal framework to balance wealth creation and wealth protection.

Below is the graph of the glide path of someone whose target date is 2055. As you can see, as time passes and the target date is coming closer, the allocation to equity is reduced more weightage is given to fixed income and then even cash.

That was all about glidepath investing. Take care, and happy investing! 🙂