Investing in the biggest US and Indian companies!

In his book called ‘The Little Book That Beats the Market’, Joel Greenblatt — a distinguished value investor — puts out his thoughts on how he thinks about equity investing and what has helped him generate market-beating returns. The reason we are talking about his philosophy here is to highlight the way Joel, and other celebrated investors like him, think about stock investing.

When Joel invests in stocks, he thinks of them, not as mere shares of a company that he owns, but as business ownership — because that’s what it truly is. Like your neighbourhood businessman who owns a medical store thinks of his shop as a business unit and not as an investment that he entered at one point and is looking to exit at another time, stock investing is synonymous with owning an actual part of a business. Joel argues that during economic downturns, do small business owners — like a bakery owner, a real estate developer, etc end up selling their businesses? Or do they stick to their business and ride out the economic cycle? More often than not, the answer will be the latter. So he says, “ Then why do we look to sell our shares when the markets go down? Why can’t we think of the shares that we own as actual business ownership in the company that we invested in? And hence why are we so impacted by the share price when we can actually ride the economic cycle?”

These questions help long-term investors think about equity ownership. Joel says that since stock ownership is like actual business ownership, one should concentrate on owning good quality stocks with strong business fundamentals.

That’s where we thought of bringing in the Global Opportunities smallcase. This smallcase helps investors track and invest in the largest and most formidable businesses in India and the US. It’s like owning a part of the largest US and Indian firms like Reliance, HDFC, TCS, Google, Facebook, Apple, Amazon, Tesla, etc. Pretty cool, right?

Okay, without further ado, let’s dive into the minutiae of this smallcase…

The Global Opportunities smallcase invests in the 100 largest companies in India and the US. It does so by way of 3 ETFs. For the first 50 largest companies in India, it invests in the Nifty50 ETF also called the Nippon India ETF Nifty Bees. For the next 50 largest companies in India, it invests in the NIfty Next 50 ETF also called the Nippon India ETF Junior Bees. Finally, for the largest 100 US companies, the smallcase invests in the ETF that tracks the NASDAQ 100, also called the Motilal Oswal NASDAQ 100 ETF. These combined, allows investors to invest systematically into the 100 largest US and Indian companies.

Why invest in the Global Opportunities smallcase?

- Large-cap investing is safe yet rewarding: Large-cap investing entails owning stocks of businesses that are highly reputed. These are generally companies that have proven to be dominant in their respective business sectors and thus offer investors a safe way of being exposed to good quality stocks.

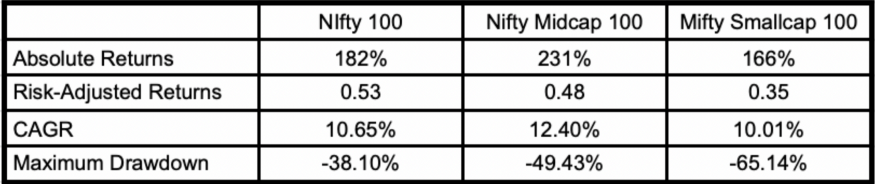

As can be seen below, large-cap stocks (represented by Nifty100 in the table below) in India over the last 10 years have given impressive returns, especially on a risk-adjusted basis.

Maximum drawdown showcases a portfolio’s downside risk. As can be seen, Nifty100’s max drawdown is Significantly lower than that of small-cap and mid-cap indices.

- The benefits of diversification: Portfolio diversification is one of the most widely accepted best practices of investing. Taking exposure to stocks that belong to a foreign country is considered a prudent diversification strategy. However, due to a variety of reasons, the biggest being transaction costs, international equity investing was not widely done. However, the Motilal Oswal NASDAQ 100 ETF offers a low-cost way of investing in companies in the US. Thus, we thought this would be a great way to invest in the US markets and offer our investors a way to diversify their portfolios into international equities.

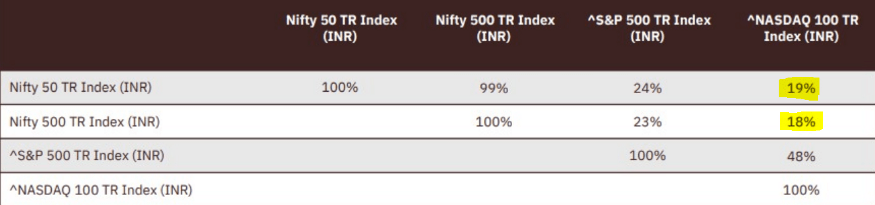

One can gauge the extent to which diversification will work by looking at the correlation of the returns between Indian and US stocks. The lower the correlation, the higher the diversification benefits.

- Exposure to global technology giants: Remember what we spoke about at the beginning of this write-up about how you should think of owning shares as owning actual businesses? Well, imagine owning the world’s largest and most dominant firms of the modern era — the technology giants like Google, Facebook, Apple, Amazon, etc. So much is their might that NASDAQ 100 is often touted to be the technology index — because tech stocks form a majority of the index.

For the longest time, we wanted to figure out a way to give our investors an opportunity to invest in international equities while also acknowledging the positive impact of prudent portfolio diversification. The Global Opportunities smallcase was the answer to that and we’re as excited as you to offer this product to you…

Take care, and happy investing! 🙂

Shoot your queries to us on Twitter — Windmill Capital and feel free to let us know any other thoughts you might have!