Investing in Multibagger Stocks in India: A Guide for 2024

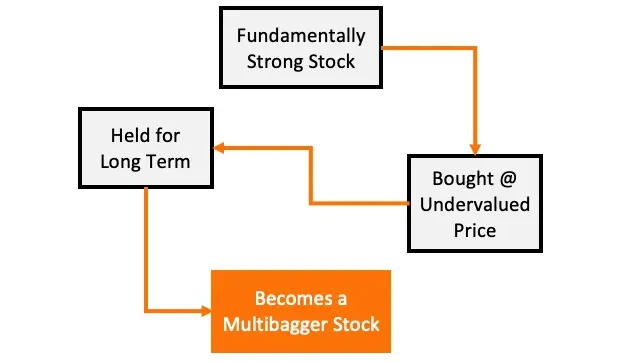

We all want multibagger stocks in our investment portfolio – these exponentially high returns can be mouth watering. Investing in multibaggers stocks is not merely a gamble on future growth but a calculated decision based on a comprehensive analysis of the company’s financial health, management efficiency, and future growth prospects. This multiplication of value, quantified as two-baggers, ten-baggers, or even beyond, is what makes these stocks a coveted asset in an investor’s portfolio. The search for these gems involves sifting through the market to find stocks that not only are undervalued but also have the intrinsic growth potential to achieve multifold returns.

But finding the multibagger stock is the hard part. And not all stocks with strong fundamentals will qualify as multibaggers. Identifying a multibagger stock requires a keen eye for companies that are undervalued yet possess solid fundamentals—a combination that suggests a significant upside potential for value appreciation over time. Let’s look at these multibagger stocks in detail.

What are Multibagger stocks?

The term “multibagger” stems from the stock’s ability to “bag” multiple times the returns on the initial capital invested. There isn’t a strict definition for multibagger stocks; instead, they are categorized by the fold increase they offer – two-fold increases lead to two-baggers, ten-fold to ten-baggers, and so forth. These stocks are predominantly undervalued despite having solid fundamentals, suggesting a potential for significant value appreciation in the future.

But is there a minimum return to be classified as a multibagger stock?

Well, Multibagger stocks are renowned for their potential to deliver returns significantly over 100%, marking a considerable increase in their initial value over years. When a stock’s price escalates from, say, ₹50 to ₹ 500 per share, it earns the title of a “10-bagger.” This classification extends to stocks that can achieve status as 20-baggers, 50-baggers, or even more ambitious, 100-baggers, based on the multiple times they increase in value relative to the initial investment. The essence of multibagger stocks lies in their ability to multiply an investor’s capital to an extent that far exceeds the initial investment.

Characteristics of Companies Behind Multibagger Stocks In India

As investors, we are looking for these stocks to help us exponentially increase the returns of our investment portfolio. But investing in multibagger stocks requires diligent research and a strategic approach. By focusing on companies with the right mix of innovation, market potential, financial health, and effective management, investors can significantly enhance their chances of securing investments that deliver manifold returns.

Let’s start by looking at the characteristics of companies that become multibagger stocks.

1. Disruptive Innovation Powerhouse

- Top-notch research and development are crucial for creating high-quality, in-demand products that keep customers coming back for more. This fuels massive sales and propels a company towards multibagger status.

- Companies & startups with groundbreaking products that fill a unique market gap have immense potential. Their high demand can lead to multibagger stock issuance as they raise capital.

- Monopolies and duopolies also have significant pricing power and limited competition, allowing for higher profits and potentially multibagger returns for investors.

2. Strong Fundamentals with a Growth Engine

- Multibagger companies demonstrate consistent high profits, indicating strong financial health and growth potential.

- They typically have low debt-to-equity ratios, showcasing responsible financial management. Their high earnings per share translate to significant dividend income for investors.

- A high price-to-earnings growth ratio (PEG) reflects the potential for returns exceeding the initial investment by several times.

3. Experienced Management With Strong Promoter Holding

- Multibagger companies are steered by skilled and experienced leaders who ensure smooth operations and efficient coordination between production and sales.

- Effective management teams make wise decisions that drive profitability and expansion, ultimately leading to multibagger stock performance.

- Transparency & effective corporate governance are equally important. Assess the company’s commitment to ethical practices, independent board oversight, and responsible financial management.

Six Factors to Analyze the potential of a stock turning into a Multibagger stock

You have now figured out the universe of stocks to look at. But how do you analyse and determine whether your identified stocks have the potential to become multibagger stocks? Let’s look at 6 factors you can look at to determine this –

1. Company Size Matters:

- Target companies with relatively low market capitalization for higher growth opportunities, as they are less likely to have reached their market saturation point and have more room for explosive growth.

2. Strong Promoter Holding:

- Significant promoter holding reflects their commitment to the company’s success and aligns their interests with yours as an investor.

- Evaluate the promoter’s business acumen and past performance in managing the company.

2. Market and Product Differentiation:

- The company’s offerings should stand out in a crowded market, either through unique products or by addressing unsolved problems, creating new market opportunities.

- You can also look for companies with differentiated products or solutions to emerging problems.

3. Revenue Sources and Growth Potential:

- Investigate the diversity and sustainability of the company’s revenue streams and whether its business model is scalable in the long-term.

- The prospects for macroeconomic growth in the primary revenue segments and scalability of operations are critical factors in identifying potential multibaggers.

4. Quarterly & Year on Year Performance Analysis:

- Dive deep into the company’s fundamentals and how they’ve navigated challenging periods. Pay attention to annual reports for any major shifts that could impact the company’s trajectory.

- Keep an eye on a company’s quarterly revenue multiples. Low valuation multiples coupled with strong operational performance hint at a stock’s potential upside.

5. Low Debt, High Returns:

- Multibagger stocks typically have low debt-to-equity ratios. Opt for companies with manageable levels of debt. Ideally, debt should not exceed 20-30% of the equity value, though this can vary across sectors such as infrastructure companies may have higher debt to equity % due to higher capital expenditure early on.

- High profit margins are indicative of effective financial management and innovative or competitive advantages within the industry.

- A high price-to-earnings growth ratio reflects the potential for returns exceeding the initial investment by several times.

6. Earnings and Price Multiples:

- A faster-growing PE ratio compared to the stock price can indicate a stock’s potential to become a multibagger.

- Seek out undervalued stocks by comparing PE and PB ratios with industry averages to find hidden gems.

Risks of Investing in Multibagger Stocks in India

Investing in multibagger stocks offers lucrative returns, but it is a risky proposition. It is important for us to understand these risks if you want to invest in potential multibagger stocks.

1. Bulk Purchases and Potential for Substantial Losses

Multibagger stocks typically require investors to purchase shares in bulk to realize significant wealth creation. This approach amplifies the risk, as substantial losses can occur if the investor is caught in a market downturn. The higher the investment in these stocks, the greater the potential loss during adverse market conditions.

2. Economic Bubbles and Value Traps

Investors in multibagger stocks are susceptible to economic bubbles and value traps, two phenomena that can severely impact investment returns.

- Economic Bubbles: A surge in asset prices driven by market conditions can lead to the formation of bubbles. Investors buying into these bubbles risk incurring massive losses when the bubble bursts, and asset values plummet.

- Value Traps: Stocks that appear to be profitable investments due to anticipated future price rises can turn out to be value traps. These investments may seem appealing but could lead to losses in the long term if the assets lack intrinsic value.

3. High Volatility

- Multibagger stocks usually start out by being midcaps, smallcaps or microcaps. As such price volatility can be quite large especially in bear market conditions & when the markets are moving sideways

- These smallcap companies often may also be less diversified in terms of their business operations & revenue sources, which means minor macroeconomic or industry specific shifts may hamper their business models. All of this can lead to prices can swing widely over short periods, making these investments particularly risky in the early growth stages of a company.

4. Limited Liquidity

- Many multibagger prospects are found among small-cap and mid-cap companies, which often suffer from limited liquidity.

- This limitation can make it challenging to execute trades at favorable prices, potentially impacting the overall investment return.

5. Risk of Failure

- Not every company poised for rapid growth achieves its potential. The risk of failure is a significant concern with multibagger stocks.

- Factors such as competition, market changes, or internal challenges can derail a company’s growth trajectory, leading to underperformance or even failure.

Few Examples of Multibagger Stocks In India

Multibagger Stocks #1: Varun Beverages (VBL)

Varun Beverages (VBL), India’s largest PepsiCo bottler, has defied the FMCG sector slowdown & private consumption challenge with a strong 14% volume growth in 2023, driven by strategic investments and expansion. Varun Beverages is well-positioned for continued growth with normalized operations, strong execution, and focus on expanding its product portfolio and distribution network. The BevCo acquisition and capacity expansion further support its growth trajectory. Varun Beverages’ share price has increased by 134% in the last 1 year and 1162% in the last 5 years.

Varun Beverages has increased its penetration in new territories, capacity expansion, wider distribution reach, and acceptance of new products like Sting Energy drink. With heavy capital expenditure in 2023 (Rs 2,100 crore), Varun Beverages plans to spend Rs 3,600 crore in 2024 for increasing its capacity expansion, adding 45% to its peak month capacity.

- Debt and financials: Net debt increased to Rs 4,730 crore but debt-to-equity ratio improved to 0.67x. Varun Beverages’ expects to maintain this ratio despite further investments.

- Future growth: Varun Beverages’ sees potential for further growth in energy drinks, sports drinks (Gatorade), juices, and value-added dairy products. Aims to add 4-5 lakh outlets per year and expand reach significantly.

- South Africa acquisition: Varun Beverages’ acquisition of The Beverage Co. in South Africa expands its market and offers significant growth potential.

Multibagger Stocks #2: Jindal Stainless Steel (JSL)

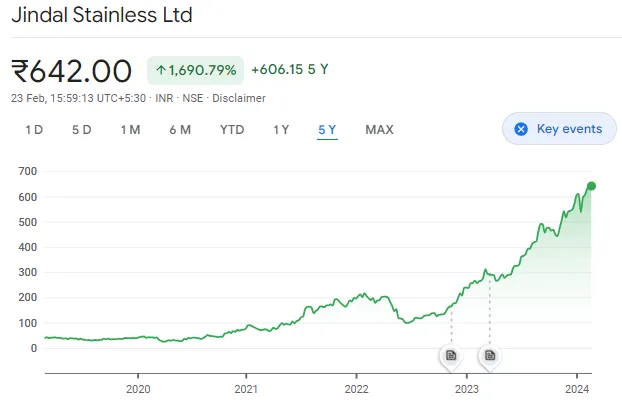

JSL is a leading Indian manufacturer of stainless steel products. They’ve seen impressive growth recently due to high demand, increased capacity, and cost optimization. JSL’s share price has increased 1690% in the last 5 years and 142% in the last 1 year.

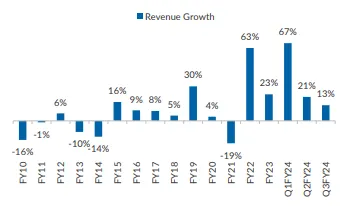

The Indian stainless steel industry is expected to see continued growth in the coming years, driven by factors like urbanization, rising disposable incomes, and government initiatives in infrastructure and construction. JSL has a proven track record under experienced management. JSL has delivered strong financial performance in recent quarters, with significant revenue and profit growth with a strong balance sheet with low debt and healthy cash flow, which provides financial flexibility for future growth investments. This was driven by factors like:

- High demand for stainless steel due to economic recovery and infrastructure projects.

- Increased capacity utilization with expansions and mergers.

- Improved product mix and realization.

- Cost optimization measures.

Multibagger Stocks #3: Voltamp Transformers

Voltamp Transformers is an Indian company that manufactures and exports oil-filled power and distribution transformers since 1963. Voltamp’s transformers are used in a variety of industries, including power generation, transmission, and distribution, as well as in industrial and commercial applications. The company has a strong track record of growth, and has been expanding its product portfolio and geographical reach in recent years. In the last 1 year, Voltamp’s share price has increased from Rs. 2,724 to Rs. 8,308, a 205% increase. Over a 5 year horizon, the price has increased by 702%.

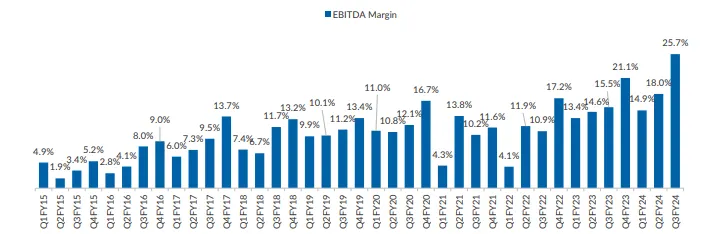

- Exceptional margin performance: Voltamp’s current gross and EBITDA margins are at record highs, significantly exceeding industry averages. This translates to higher profitability and potential for future growth.Gross and EBITDA margins reached record highs in Q3 FY24, with EBITDA margin expanding 1000bps YoY to 25.7%. This was primarily due to strong realization growth exceeding volume growth and selective order selection.

- Strong order book: The company has a healthy order inflow, indicating continued demand for its products. Voltamp also beat expectations most recently with revenue in line and significant growth in EBITDA and PAT, driven by a surge in gross margin (33.4%) despite only moderate revenue growth (14% YoY).

- Capacity expansion: Planned capacity increase suggests confidence in future growth and potential for market share gain. With capacity expansion, realization growth may normalize in FY26 due to increased competition and capacity coming online.

- Low-cost structure: Voltamp’s efficient operations and lower expenses contribute to its profitability and competitiveness.

Multibagger Stocks #4: Tata Motors

Let’s look at a different multibagger stock – a large cap stock that fell and has rebounded with strong growth. As of 2024, Tata Motors’ stock has returned over 420% in the last five years and 118% in the last 12 months. In 2023, Tata Motors’ share price doubled, making it the only stock in the Nifty 50 index to do so. In the last 20 years, Tata Motors’ has given multibagger returns of 1370%, meaning that an investor who had invested Rs 10,000 in the stock would have turned into lakhs.

Tata Motors reported strong Q3 FY24 results, exceeding market expectations with a robust EBITDA beat and higher adjusted profit. This impressive performance was driven by improved margins across segments, lower taxes, and healthy cash flow generation. Both domestic and JLR businesses generated healthy free cash flow – there is also a positive demand outlook for JLR in North America, with stable demand in Europe. Here are the results from the latest Q3 numbers –

- EBITDA: Beat expectations by 10.9%, reaching Rs 153.3 billion (up 59% YoY and 11.7% QoQ). Consolidated Ebitda margin also improved significantly to 13.9% (up 300 bps YoY and 80 bps QoQ).

- Adjusted Profit After Tax: Surpassed forecasts, coming in at Rs 73.6 billion (compared to expected Rs 44.4 billion/Rs 47.1 billion).

- Net Auto Debt: Reduced further to Rs 292 billion (down from Rs 387 billion in Q2 and Rs 437 billion in FY23).

Explore Wright Research smallcases here

Wryght Research & Capital Pvt Ltd•SEBI Registration No: INA100015717

103, Shagun Vatika Prag Narayan Road, Lucknow, UP 226001 IN

CIN: U67100UP2019PTC123244

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary.