Investing in India’s New Age Sectors: A Public Stock Market Perspective for 2023

The Indian stock market is a bustling hub of activity, teeming with opportunities for investors both domestic and international. In recent years, the market has seen a surge in interest in new age sectors. These sectors are characterized by their innovative use of technology to disrupt traditional industries. In this blog, we’ll delve into some of the most promising new age sectors in India for 2023, from a public stock market perspective.

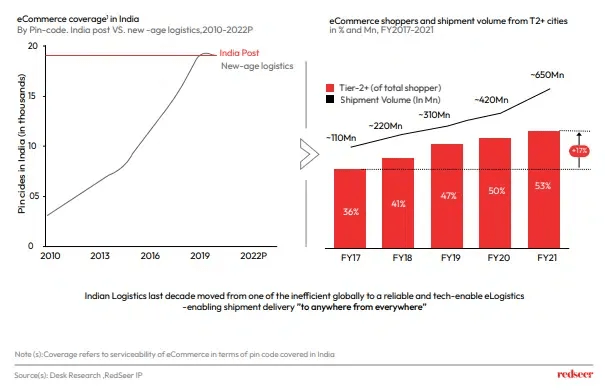

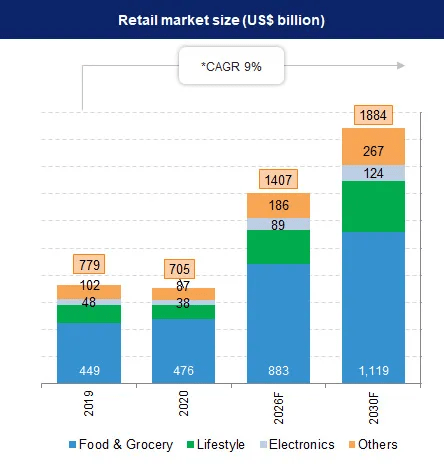

E-commerce: The Digital Marketplace

The e-commerce sector in India is booming, expected to grow at a Compound Annual Growth Rate (CAGR) of 30% over the next five years. This growth is fueled by increasing internet penetration, the widespread use of smartphones, and rising disposable incomes among the Indian populace. Companies in this sector have seen their stock prices skyrocket, making it a lucrative investment opportunity.

Why Invest?

High Growth Rate: With a CAGR of 30%, the sector promises robust returns.

Technological Advancements: The sector is at the forefront of adopting new technologies, making it future-proof.

Top stocks in E-commerce sector in India

- Nykaa: Nykaa is an online beauty and personal care retailer that generates revenue through product sales, advertising, and affiliate marketing. The company’s recent financial performance has been strong, with revenue and net profit growing by 54% and 40% year-on-year, respectively.

- Zomato: Zomato is an online food delivery platform that generates revenue through food delivery commissions, advertising, and subscription fees. The company’s recent financial performance has been strong, with revenue and net loss narrowing by 84% and 459 crore (~$57 million), respectively.

- Indiamart: Indiamart is an online B2B marketplace that generates revenue through product sales, advertising, and lead generation. The company’s recent financial performance has been strong, with revenue and net profit growing by 22% and 15% year-on-year, respectively.

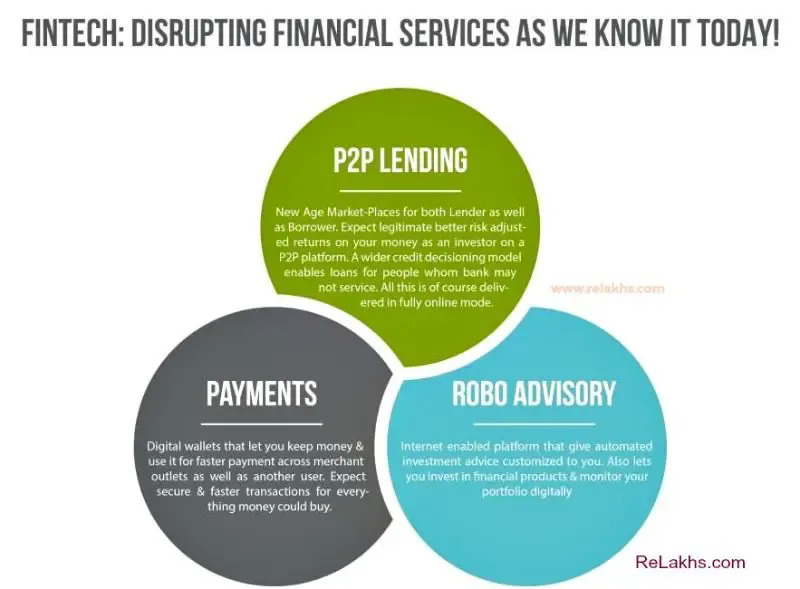

Fintech: The Future of Finance

The fintech sector in India is another rapidly growing industry. With an increasing demand for digital financial services like mobile payments, online lending, and insurance, fintech companies have become hot stocks.

Why Invest?

Digital Transformation: The move towards digital financial services makes this sector resilient.

Consumer Demand: With a young and tech-savvy population, the demand for fintech services is high.

Top Fintech Stocks in India

- Paytm: Paytm is a digital payments and financial services company that generates revenue through payment processing fees, merchant discount rates, and financial services commissions. The company’s recent financial performance has been mixed, with revenue growing by 35% year-on-year but net loss widening by 83%.

- Policybazaar: Policybazaar is an online insurance marketplace that generates revenue through lead generation fees, policy sales commissions, and renewal premiums. The company’s recent financial performance has been strong, with revenue and net profit growing by 49% and 12% year-on-year, respectively.

- Bajaj Finance: Bajaj Finance is a non-banking financial company that generates revenue through loan interest, fees, and commissions. The company’s recent financial performance has been strong, with revenue and net profit growing by 26% and 21% year-on-year, respectively.

Electronic Manufacturing: Make in India

India is already a significant player in the global electronic manufacturing sector. The government’s ‘Make in India’ initiative has given a further boost to this industry.

Why Invest?

Government Support: The ‘Make in India’ initiative provides incentives for manufacturing.

Export Potential: India’s manufacturing capabilities make it a key player in the global market.

Top Electronic Manufacturing stocks in India

- Havells: Havells is an Indian multinational electrical and electronics company that generates revenue through the manufacture and sale of electrical equipment, home appliances, and lighting solutions. The company’s recent financial performance has been strong, with revenue and net profit growing by 18% and 22% year-on-year, respectively.

- Dixon Technologies: Dixon Technologies is an Indian electronics contract manufacturer that generates revenue through the manufacture of consumer electronics, mobile phones, and LED TVs. The company’s recent financial performance has been strong, with revenue and net profit growing by 32% and 25% year-on-year, respectively.

- Polycab: Polycab is an Indian electrical and electronics company that generates revenue through the manufacture and sale of cables, wires, and electrical accessories. The company’s recent financial performance has been strong, with revenue and net profit growing by 14% and 20% year-on-year, respectively.

Explore Wright New India Smallcase where we find companies building for Atmanirbhar Bharat vision.

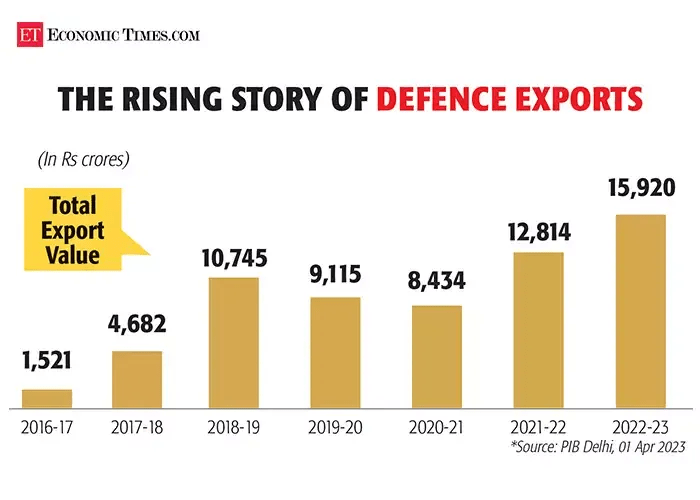

Defence Manufacturing: Securing the Nation

The defence manufacturing sector is also on the rise, thanks to increasing demand from the Indian armed forces and the government’s focus on indigenization.

Why Invest?

National Importance: The sector is crucial for national security, ensuring sustained investment.

Indigenization: Government policies favor domestic manufacturers, providing a competitive edge.

Top Defence Manufacturing Stocks in India

- Bharat Electronics Limited (BEL): BEL is a public sector undertaking that manufactures a wide range of electronic and telecommunications products for the Indian armed forces and other government agencies. The company’s recent financial performance has been strong, with revenue and net profit growing by 12% and 10% year-on-year, respectively.

- Bharat Dynamics Limited (BDL): BDL is a public sector undertaking that manufactures a wide range of missiles and missile systems for the Indian armed forces. The company’s recent financial performance has been strong, with revenue and net profit growing by 30% and 20% year-on-year, respectively.

- Mazagon Dock Shipbuilders (MDL): MDL is a public sector undertaking that builds and repairs warships, submarines, and other naval vessels for the Indian Navy. The company’s recent financial performance has been strong, with revenue and net profit growing by 15% and 10% year-on-year, respectively.

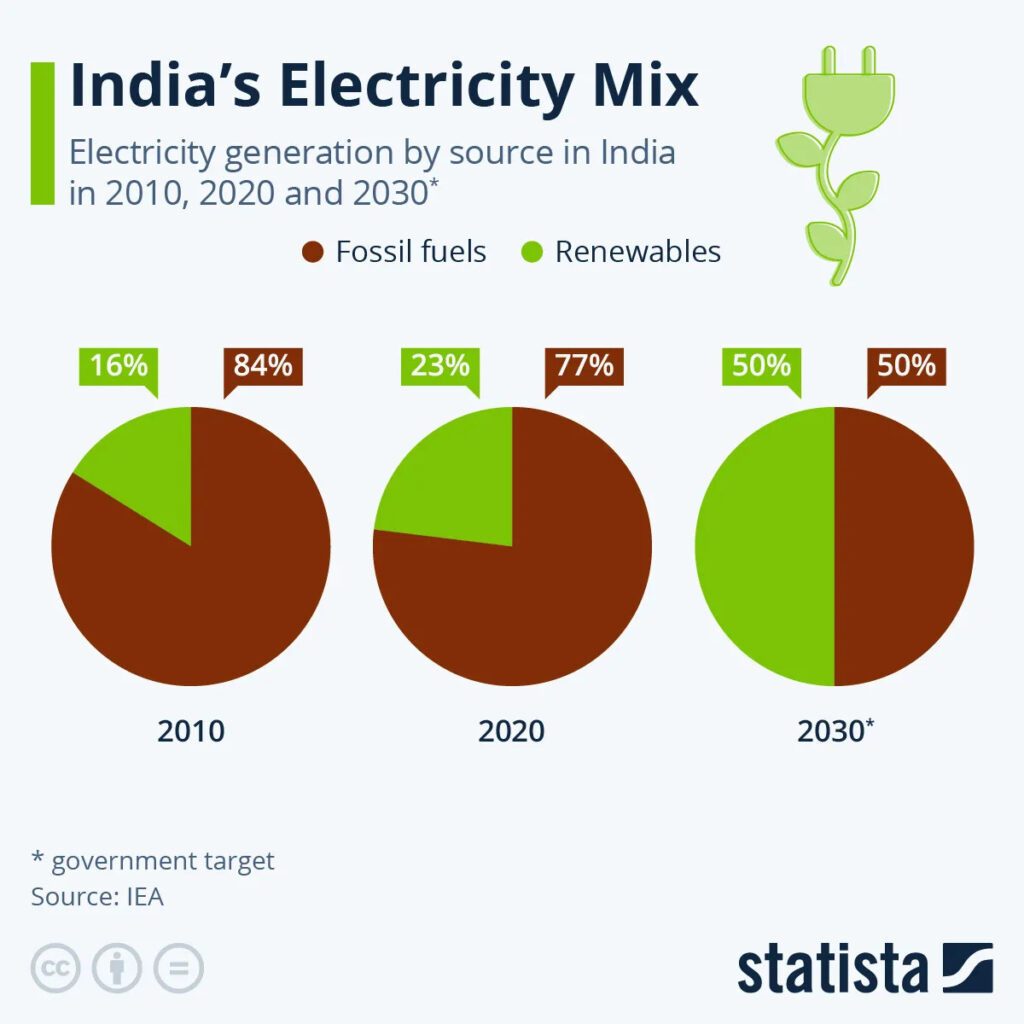

Green Energy: The Sustainable Choice

With a focus on renewable energy and increasing demand for clean energy solutions, the green energy sector is another promising avenue for investment.

Why Invest?

Sustainability: Investing in green energy is not just profitable but also sustainable.

Government Support: Various incentives and policies make this sector more attractive for investors.

Top Green Energy Stocks in India

- Olectra: Olectra is an Indian electric bus manufacturer that generates revenue through the manufacture and sale of electric buses. The company’s recent financial performance has been strong, with revenue and net profit growing by 60% and 10% year-on-year, respectively.

- Inox Energy: Inox Energy is an Indian renewable energy company that generates revenue through the generation and sale of solar and wind power. The company’s recent financial performance has been strong, with revenue and net profit growing by 50% and 20% year-on-year, respectively.

- Adani Green: Adani Green is an Indian renewable energy company that generates revenue through the generation and sale of solar and wind power. The company’s recent financial performance has been strong, with revenue and net profit growing by 80% and 30% year-on-year, respectively.

Space Tech: The Final Frontier

The space tech sector in India is a relatively new but rapidly growing field. The government’s focus on space exploration and the increasing demand for space-based services make this an exciting sector for investment. Several promising space tech companies in India are poised for significant growth in the coming years.

Why Invest?

Government Focus: The Indian government is heavily invested in space exploration, providing a stable foundation for growth.

Innovation: The sector is ripe for technological advancements, making it a hotbed for innovation.

Global Market: Space tech has a global market, offering opportunities for international collaborations and exports.

Top Space Tech Stocks in India

- MTAR Tech: MTAR Tech is an Indian defense company that manufactures a range of defense products, including rocket launchers, ammunition, and electronic warfare systems. The company’s recent financial performance has been strong, with revenue and net profit growing by 30% and 20% year-on-year, respectively.

- HAL: HAL is a public sector undertaking that manufactures a wide range of aircraft, helicopters, and other defense products for the Indian armed forces. The company’s recent financial performance has been strong, with revenue and net profit growing by 15% and 10% year-on-year, respectively.

- Paras Defence: Paras Defence is an Indian defense company that manufactures a range of defense products, including armored vehicles, weapons, and ammunition. The company’s recent financial performance has been strong, with revenue and net profit growing by 20% and 15% year-on-year, respectively.

Conclusion

India’s new age sectors offer a plethora of opportunities for investors looking for high-growth potential – and we are bullish on India . From e-commerce and fintech to electronic and defence manufacturing, green energy, and now space tech, these sectors are set to define the future of the Indian economy. Investing in these sectors is not just a financial decision but a step towards participating in India’s growth story.

So, if you’re looking to invest in the future of India, these are the sectors to watch in 2023. Happy investing!

Explore Wright Research smallcases

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Visit bit.ly/sc-wc for more disclosures.