Introducing Personal Loans on smallcase

Navigating urgent cash needs can be cumbersome. However, the situation can become even more challenging when faced with the additional overhead of lengthy paperwork and long wait times associated with traditional loan processes. To help our customers manage such financial situations in the most efficient way, we are glad to announce the launch of Personal Loans on smallcase.

With a personal loan, borrowers can get the funds they need within 45 minutes and without the hassles of paperwork. Be it a surprise medical expense, loan down payments, home renovation, sudden travel plans, or paying off high-interest debts, a personal loan can help you take care of your needs with confidence.

Additionally, every step of the borrowing process is seamless and tailored to offer you the flexibility you need to manage your loan. Building on the success of Loans Against Mutual Funds, Personal Loans are now here to make accessing the funds you need simpler and quicker than ever!

Understanding personal loans

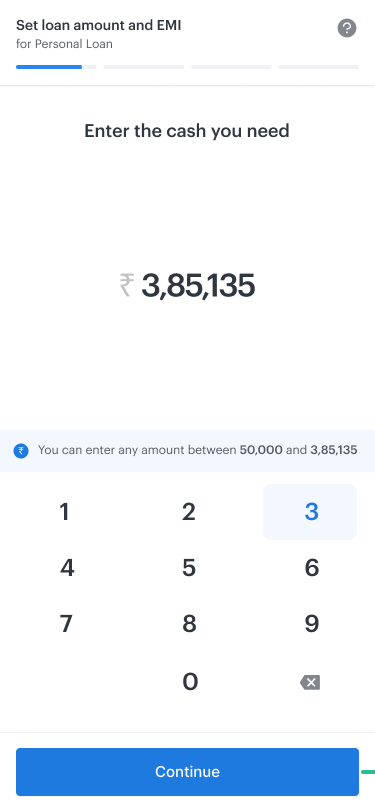

Personal loans are collateral-free loans that provide quick access to funds and can be used for any purpose. Currently, users can take a personal loan ranging from INR 50,000 to INR 5,00,000.

Your personal loan amount is determined by the lender based on several factors including your credit score, credit history, debt-to-income ratio, employment status, and overall financial stability.

Features of personal loans

- 100% digital application – You can apply for a loan from the comfort of your home without any paperwork hassles.

- Loan insurance – For added security, you can opt for loan insurance at an additional charge to cover your EMIs in case of any unfortunate circumstances.

- Auto EMI repayments – Your EMI, including both interest and principal, is automatically deducted from your linked bank account monthly. This helps to avoid late payment penalties and keeps your credit score intact. We recommend ensuring you have an adequate account balance to avoid any late payment fees.

Benefits of personal loans

- 5-minute application process – The application process is designed to be quick and simple, allowing you to get the funds you need without unnecessary delays. If you’re already a smallcase investor, some details will be pre-filled for you, which you can review and edit, making the process even faster. Regardless, every application takes less than 5 minutes to complete!

- No foreclosure charges – Got some extra funds? You can repay the entire loan early without any foreclosure charges and settle your debt whenever it suits you best.

- Quick disbursal – Once your loan is approved, the funds will be credited to your linked bank account within 45 minutes or less so you can address your financial needs as soon as possible.

Who can make the most of a personal loan?

Personal loans can be ideal for both self-employed individuals and salaried employees with a decent credit history and regular income. They can be used for various purposes, including:

- Business expenses

- Medical emergencies

- Home renovation

- Existing loan repayment

- Any unexpected expenses

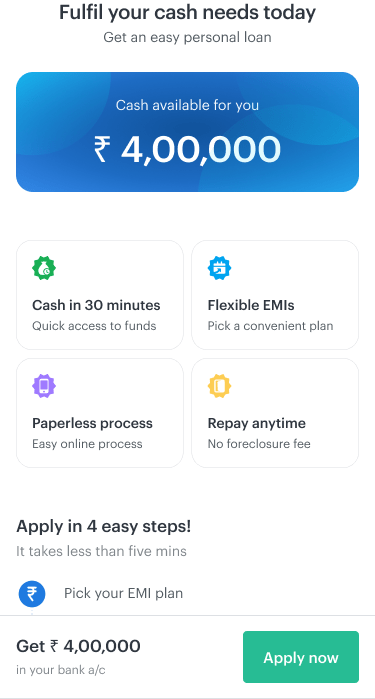

Apply in 5 minutes for a Personal Loan on smallcase

We are currently in the process of gradually introducing loan offers to ensure the best possible experience. Rest assured, we’ll notify you as soon as you get a personal loan offer from the lender. Once an offer is available, you can check it on the ‘Credit’ tab on the smallcase app and start your application by clicking the ‘Apply Now’ button.

- Pick your EMI plan – Choose an EMI plan that suits your financial needs and repayment capacity

- Instant KYC verification – Complete the KYC (Know Your Customer) verification process with your Aadhar and upload a selfie

- Link your bank account – Link your bank account for seamless disbursal and EMI payments

- Sign documents – Review & digitally sign the documents from the lender to complete your application

And that’s all – cash will be credited in 45 minutes to your bank account!

Start nowApply for a personal loan