Introducing High Interest Rate Fixed Deposits on smallcase

We are excited to bring to you high interest fixed deposits offered by RBI regulated banks, on the smallcase app. These fixed deposits offer stable and secured returns, thus helping you diversify your investments beyond volatile markets. This blog will walk you through everything you need to know about FDs on smallcase.

Why Fixed Deposits on smallcase?

High Interest Bank FDs

Banks available on smallcase offer some of the best interest rates in the market, ensuring competitive returns on your investments.

Investment up to ₹5 Lac Insured

All FDs on smallcase are RBI regulated and DICGC insured, providing insurance coverage for FD amounts up to ₹5 lakh per bank.

Seamless Digital Process

From booking to withdrawal, every step of the FD transaction is conducted digitally, eliminating the need for any paperwork or physical visits to the bank.

Types of Fixed Deposits Offered on smallcase

Cumulative FDs

- All FDs offered on smallcase have interest compounded quarterly.

- In cumulative FDs, the Interest is added to the principal and reinvested, and paid out at maturity.

Senior Citizen FDs

- Higher interest rates on regular FD schemes for senior citizens.

- Premiums for seniors range from 0.2% to 0.7%, varying across banks and schemes.

Interest Payout and Compounding Frequency

Interest Payout Frequency

The interest payout frequency refers to how often you receive interest payments during the tenure of your FD. For FDs on smallcase, the interest is paid out at maturity.

Compounding Frequency

Compounding frequency refers to how often the interest is calculated and added to the principal amount in a cumulative FD. Banks available on smallcase typically compound interest every three months (quarterly basis) which provides better interest rates than semi-annual or annually compounded FDs. Read more about this here.

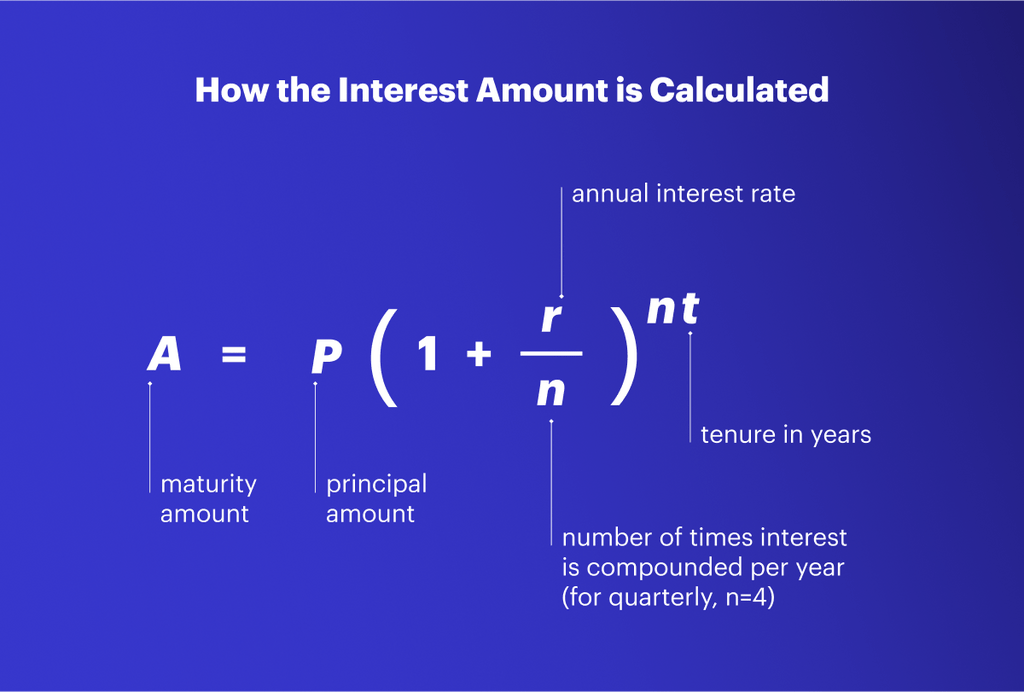

How the Interest Amount is Calculated

Since smallcase has cumulative FDs with quarterly compounding, the Interest is calculated every three months and added to the principal, which then earns interest for the next compounding period.

Available Banks for FDs

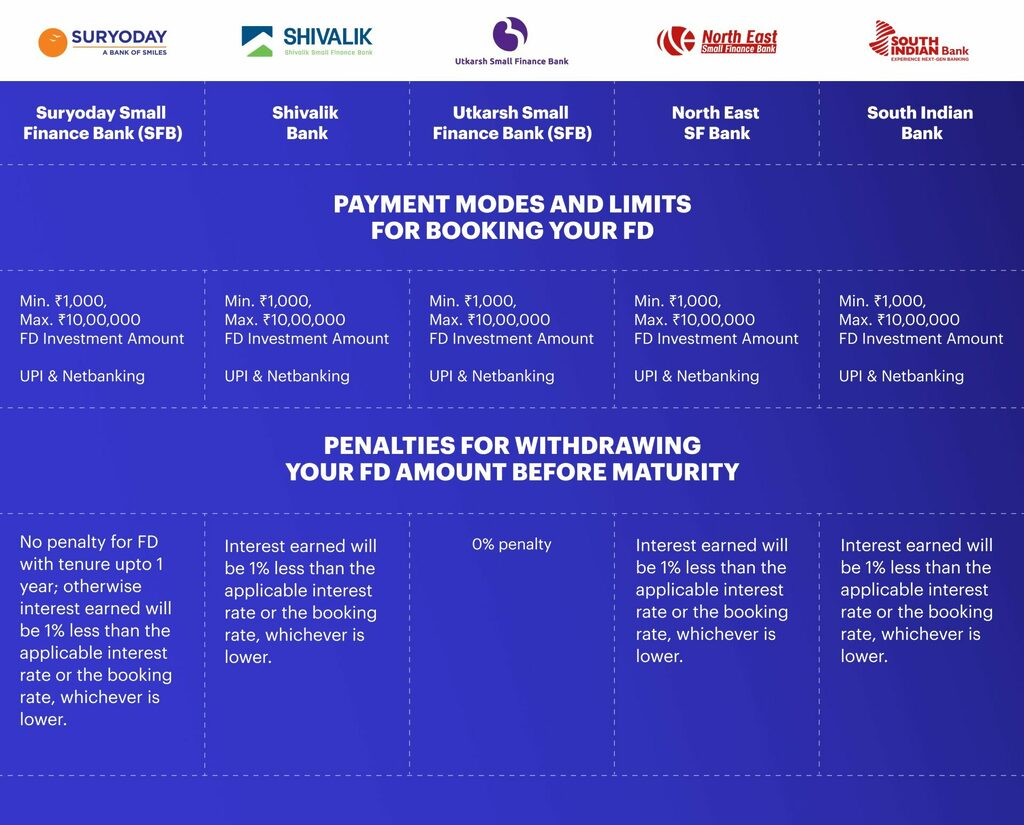

Payment Modes, Investment Amount Limits & Early Withdrawal Penalties

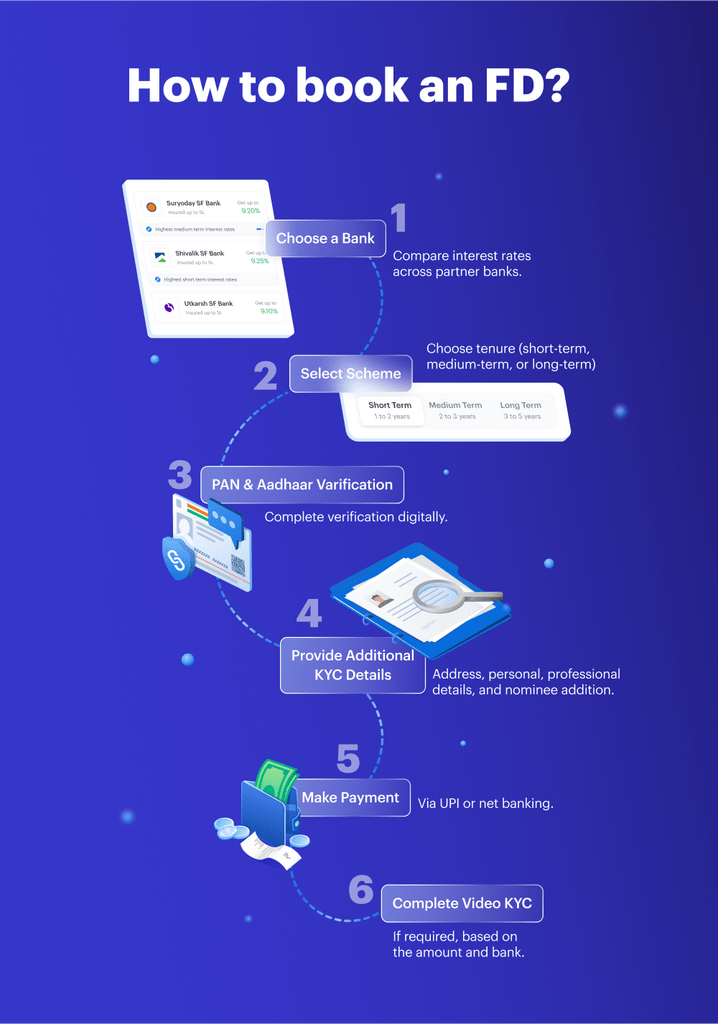

How to book an FD?

Explore Fixed Deposits on smallcase

Frequently Asked Questions (FAQs)

Can I withdraw my money anytime?

Yes, you can withdraw your money after 7 days post booking and FD from the smallcase app.

Is it safe to invest in small finance banks?

Yes, all small finance banks listed on smallcase are RBI registered and DICGC insured for FD amounts up to ₹5 Lac per bank.

Can I invest without opening a bank account?

Yes, you can book an FD on smallcase without opening a bank account. The process is entirely digital and can be completed in less than 10 minutes.

What payment methods are available for booking an FD?

You can book your FD via UPI or Net Banking.

Is Video KYC required for all FDs?

For all the banks listed on the smallcase app, except North East SFB, Video KYC is not required for your first FD booking, if the tenure is 1-year or lower, and if the amount is ₹90,000 or less. For amounts above ₹90,000 or tenures longer than 1 year, Video KYC is mandatory.

In case of North East SFB, Video KYC is required for all schemes.

How can I book an FD for my parents?

To book and FD for your parents via the smallcase app:

- Launch the smallcase app on a device that has your parents’ Aadhaar registered phone number’s SIM in it.

- Login to the smallcase app using the mobile number you are currently using for the app or a different number to create a new profile.

- Start the FD booking process in the app and verify your parents’ Aadhar registered phone number by following the prompts on screen.

- Ensure that the Aadhaar registered number’s SIM is in the device during the entire FD booking process.

- Once the payment is done for the FD, your parents will have to do the video KYC process on the smallcase app.

Why does my mobile number need to be verified?

We verify your mobile number to create a secure FD account for you. By doing this, we are able to create a smooth app experience while ensuring the safety of your account.

Mobile number linked with the bank is different from the one registered with the app. Would I be able to continue?

There is no requirement for using the same mobile number for smallcase app login as well as FD booking. These can be two different mobile numbers too. Do keep in mind however, that the SIM inserted in your device at the time of initiating the FD booking process is the one that will be mapped to your FD account and should match the Aadhaar registered phone number at the time of Aadhar verification step.

I do not have a PAN, can I invest in FDs?

Currently we can only process fixed deposit requests for individuals having a valid PAN.

I am an Indian citizen but not a tax resident of India. Can I invest in FDs?

Currently we can only process fixed deposit requests for users who are tax residents of India.

I already have a running FD with one of the available banks on smallcase, can I book another FD with the same bank via smallcase?

Yes, you can invest in multiple FDs with the same or different banks.

I am a senior citizen, what are the additional benefits I can avail?

Most banks and NBFCs offer an additional interest rate of up to 0.5% – 0.7% over the regular fixed deposit interest rates for senior citizens thus making it even more attractive for senior citizens. What’s more, you can also book an FD via smallcase app for senior citizens in your family.

How are FDs taxed?

Interest earnings from your fixed deposit are taxed as per your tax slab. For e.g. if you are in a 20% tax bracket and you invested in a 6% 1 year FD of amount ₹1 lac, then your total interest for the year is ₹6,000. The tax that you will have to pay while filing will be 20% of ₹6000 = ₹200. Read our blog on taxation of FDs to learn more.

Fixed Deposits on smallcase provide a secure and straightforward investment option, offering high interest rates and convenience of a fully digital process. Whether you’re looking for stable returns or diversifying your investment portfolio, FDs on smallcase are an excellent choice. Start investing today and enjoy the peace of mind that comes with safe and reliable returns.