Impact Of Elections on Indian Stock Markets

Stock prices are always sensitive to new information. And elections are probably one of the biggest events that a country, its people, economy & society go through. It is a recurring event that will occur on a fixed time schedule and as such there is very little sudden event or announcements that can fundamentally shape how stock markets should behave when election cycles start. Stock markets also become a measure of political sentiment and economic stability, during these election periods. Investors closely monitor the elections as the outcomes can considerably affect market dynamics, and some investors may even be tempted to time the market in such cases.

Political uncertainty based on which party will come in power, who will lead in which states and many other facets of the political landscape are some of the key challenges investors need to think about when looking at how elections impact Indian stock markets. Let’s look at this a little deeper.

How have elections impacted Indian stock markets?

Changes in governments or political parties and ideologies, can cause changes in government policies, economic priorities, and regulations, affecting various sectors and companies. While elections create short-term volatility, the long-term effects are mostly shaped by the economic reforms and policies implemented by the ruling party. However, there has been limited research and insight into how Indian stock markets have been affected by elections. So, let’s dig a little deeper and see what’s happening.

Here’s the quick & short summary – Examining the Sensex returns during the tenures of different Prime Ministers reveals that election politics do not profoundly sway equity returns. The overall trajectory of wealth creation remains consistently positive, maintaining a long-term upward trend irrespective of the political leadership or party in power. But…there are variations, and specific points in time when this hasn’t always been the case.

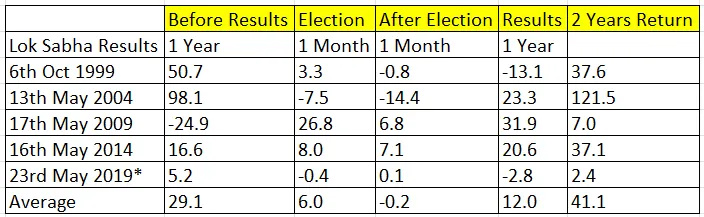

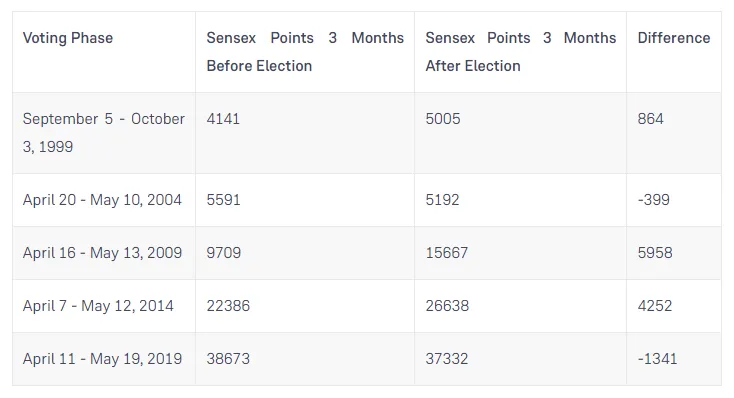

In the periods leading up to general elections, stock markets typically exhibit increased volatility due to uncertainties regarding election outcomes and potential policy shifts. Analyzing past market performance, the average return one year before the elections is 29.1%, and in the one month before elections, the average return is 6%. These statistics indicate strong market performance in pre-election periods. Notable exceptions include 2009, where a pre-year market fall of 24.9% occurred, but was offset by a significant 26.8% market surge in the post-election month. Therefore, despite uncertainties and a tendency for a “wait-and-see” approach amongst investors pre-election, historical data suggests the market has generally performed well during these times.

Looking at Indian elections from 1989 till 2019 & their impact on Indian stock markets

1989: Coalition Era

Political turmoil marked this period, leading to market volatility due to a united opposition forming the National Front coalition. The subsequent reform and anti-corruption measures could not immediately stabilize the economy, reflecting the disruptive impact of elections.

1991: Congress Era

Market instability intensified post-1991 following PM Rajiv Gandhi’s assassination. However, under PM PV Narasimha Rao, economic liberalization policies were introduced, bolstering market confidence and initiating economic recovery and growth.

1996-1998: Unstable Coalition Government

The period between 1996 and 1998 saw political unrest and external economic pressures affecting the market. Frequent changes in leadership and the Asian Financial Crisis led to reduced market confidence and economic downturn.

1999: NDA in Power

Election results were as expected for stock markets. Sensex increased 7% and rose for the next 3 months. NDA’s victory largely brought market stability, witnessing a rally in Sensex and an enhanced GDP growth rate of nearly 6-7%. The government largely focused on sectoral reforms, structural changes, liberalization policies attracting FDIs and boosting the economy. Inflation was within reason and market performance was strong initially. However, global events such as the 9/11 attack on USA and even domestic factors led to a significant market downturn with stock markets falling around 50%. Annual CAGR was around 3% and absolute performance was around 14%.

2004: UPA Era

Following the 2004 elections, the market faced a sharp decline, losing 15% in 2-3 trading sessions due to an unexpected UPA victory. However, this phase was followed by a robust bull market that lasted until 2007, with the GDP growth rate hovering around 8% and FDI reaching a record $34 billion. The global financial crisis of 2008 hampered the bull stock market, but recovery was seen by 2009 before the next election cycle started.

2009: UPA’s Second Term

UPA’s return in 2009 initiated a 17% market gain on a single day. Despite this, the market fluctuated due to prevalent scams during UPA’s second term. Investor confidence waned, affecting both domestic and foreign investments and resulting in reduced capital inflows. Policy uncertainties, along with the government’s struggle to manage fiscal deficits and inflation, characterized this period, even though the Sensex saw a 15.5% increase in the first three years.

2014: NDA’s Return (Modi Wave)

The NDA’s 2014 victory, led by the BJP, brought a resurgence in market optimism, reducing volatility to 9.1% from 17.96%. Expectations of economic reforms underpinned this sentiment. While the market experienced a substantial rally, reaching new highs, a growth rate of around 40% over four years was seen by some as subdued, influenced by factors such as global oil prices and a weakened Indian rupee.

2019: BJP Continues in Power

The 2019 elections underscored the market’s sensitivity to political events. The BJP’s continued governance led to a market upswing, driven by expectations of sustained economic reforms and policy stability. Initiatives like “Make in India” and strategic tax reforms characterized this period. However, growth was constrained by global trade tensions and structural issues within pivotal economic sectors.

Broad Market Insights for Indian Stock Markets During Elections

What is the outlook for the Indian economy going forward?

Between 1980 and 2023, India’s government changed 11 times, with eight being coalitions. Since 2014, the BJP has maintained a clear majority. Since 1980, the average real GDP growth has been 6.2%, and the Sensex has shown compound annual growth of 9.5% in dollar terms and 15.5% in rupee terms up to August 2023. Speculations about the 2024 general elections affecting the market exist due to a unified strategy from the opposition against the BJP.

Coalition governance in India allows for consensus-driven decisions, enabling significant reforms. However, it limits the economy’s potential pace of growth compared to countries like China. India’s long-term real GDP growth potential is projected to be 6.0%-6.5%, implying an 11%-12% nominal GDP growth. This, along with corporate productivity, AI’s impact & continued influences equity markets. Expect double-digit nominal returns to continue for the next two decades. The essential advice for long-term investors is to invest in India.

Liked this story and want to continue receiving interesting content? Watchlist Wright Research’s smallcases to receive exclusive and curated stories!

Explore Alpha Prime smallcase by Wright Research here, use code DIWALI2023 for FLAT 30% Off

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary.

Wryght Research & Capital Pvt Ltd•SEBI Registration No: INA100015717

103, Shagun Vatika Prag Narayan Road, Lucknow, UP 226001 IN

CIN: U67100UP2019PTC123244

Disclosures: Link