How the US Credit Rating Downgrade Affects India?

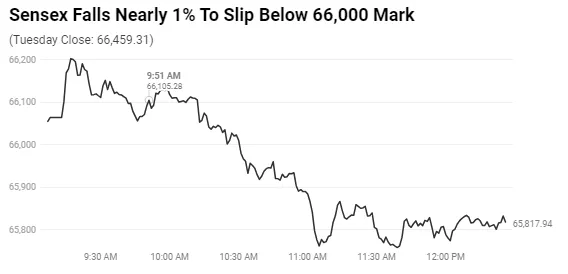

On August 2nd, as a knee-jerk reaction to the US sneezing, the Indian market caught a cold. The Sensex saw a 1,000-point correction. However, analysts and fund managers remain confident in India’s resilience and ability to absorb the impact. The ripple effect was caused by a decline in the US credit rating from AAA to AA+, a move previously seen over a decade ago by S&P Global Ratings. Fitch Ratings was the bearer of this news, citing tax cuts and new spending initiatives that have swelled the US budget deficits as one of the key reasons. Add to this a number of economic shocks and largely unaddressed rising entitlement costs, and we have a clearer picture of the factors leading to this downgrade.

Understanding Credit Ratings

In simple terms, a credit rating downgrade means a lower grade on one’s financial scorecard. Governments and companies are given ratings that show their likelihood of paying back their debts. A downgrade, then, indicates a worsening financial situation and an increased risk when lending money.

Credit rating agencies like Moody’s, Fitch, and Standard and Poor’s evaluate the creditworthiness and risk of default associated with governments and companies. Fitch’s ‘AAA’ rating signifies the best creditworthiness and ‘AA+’ is considered high-quality. The recent downgrade of the US rating to ‘AA+’ with a ‘stable’ outlook implies the US’s creditworthiness remains strong, albeit slightly diminished.

Why did Fitch Downgrade US Credit Rating?

Taking a deeper dive into the downgrade, the six key drivers highlighted by Fitch give us a comprehensive understanding of the reasons for the US rating drop.

Deteriorating Governance

Fitch expresses concern over the decline in US governance standards, including fiscal and debt matters, over the last two decades. Political standoffs and lack of a medium-term fiscal framework have negatively impacted confidence in fiscal management. Economic shocks, tax cuts, and rising social security and Medicare costs have contributed to consecutive debt increases. Addressing these challenges is crucial to ensure fiscal stability and confidence in the US economy.

Rising General Government Deficits

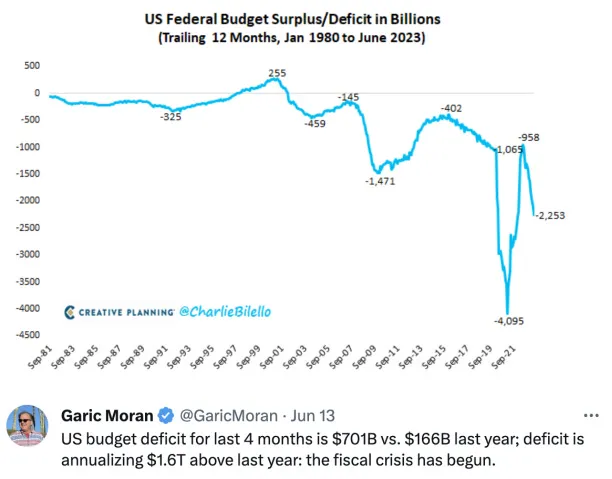

Fitch anticipates the general government (GG) deficit to increase from 3.7% of GDP in 2022 to 6.3% in 2023, a significant jump attributed to weaker federal revenues, new spending initiatives, and a larger interest burden. It’s expected that the GG deficit will reach 6.9% of GDP by 2025 due to slow GDP growth, a heightened interest burden, and wider local government deficits.

General Government Debt Climbing

Fitch highlighted that although lower deficits and high nominal GDP growth reduced the debt-to-GDP ratio from its pandemic peak of 122.3% in 2020, it is still significantly higher than the pre-pandemic level of 100.1% in 2019. Fitch anticipates that the GG debt-to-GDP ratio will increase over the forecast period, reaching 118.4% by 2025. This puts the US at over two-and-a-half times the ‘AAA’ median of 39.3% and the ‘AA’ median of 44.7%.

Unaddressed Medium-Term Fiscal Challenges

Medium-term fiscal challenges like rising debt stock, higher interest rates, and increasing healthcare costs remain largely unaddressed. Fitch underscored that these challenges will increase the interest service burden over the next decade, and an ageing population and rising healthcare costs will elevate spending on the elderly in the absence of fiscal policy reforms.

The Risk of a US Recession

Fitch projections indicate that tighter credit conditions, diminishing business investment, and a slowdown in consumption will push the US economy into a mild recession by the end of 2023. The agency predicts that US annual real GDP growth will slow to 1.2% this year from 2.1% in 2022, with an overall growth of just 0.5% in 2024.

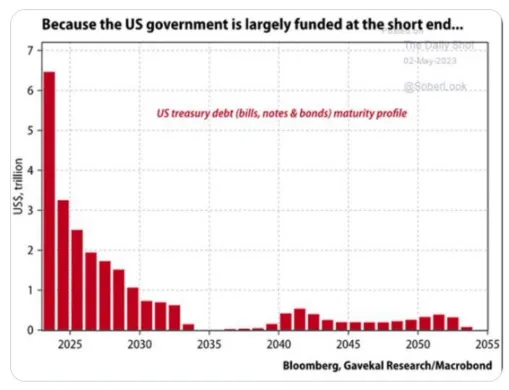

The Federal Reserve’s Monetary Policy

Fitch anticipates a further hike in the Federal Funds Rate by September, as the resilience of the economy and the labor market complicate the Federal Reserve’s goal of bringing inflation towards its 2% target. With the key price index remaining high, it’s unlikely that we’ll see cuts in the Federal Funds Rate until March 2024. Simultaneously, the Federal Reserve continues to reduce its holdings of mortgage-backed securities and US Treasuries, further tightening financial conditions.

The downgrade of the US credit rating and these key driving factors have significant implications for the global market, and it’s crucial to understand the potential impact on economies like India’s.

How did the US Credit Rating Downgrade Impact US Markets?

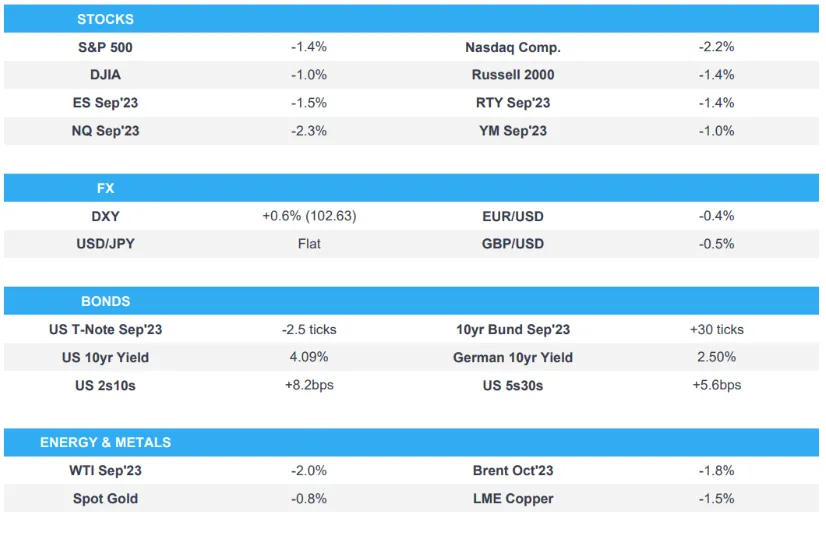

The downgrade caused a sell-off in the US equity markets, reminiscent of a similar downgrade by S&P in 2011. The tremors spread to Asian markets upon their opening and European stocks also followed the trend. This sell-off occurred because a rating downgrade undermines confidence in a nation’s economy and its government. While this may not directly impact company revenues, it influences investor sentiment and affects the cost of capital for companies, impacting their balance sheets. The immediate drop in equities across markets was a reflex reaction.

On August 2nd, Wall Street closed lower for the second consecutive day, prompted by Fitch’s rating cut, resulting in the S&P 500’s largest daily percentage drop since April 25. However, major brokerages believed that the downgrade would not have a long-term negative impact on U.S. financial markets, considering the stronger economy compared to the 2011 rating cut. The sell-off provided investors an opportunity to reassess, despite a resilient labor market indicated by the ADP National Employment report. Corporate America has also remained robust, with a significant majority of S&P 500 companies reporting earnings above analysts’ expectations.

How did the US Credit Rating Downgrade Impact Indian markets?

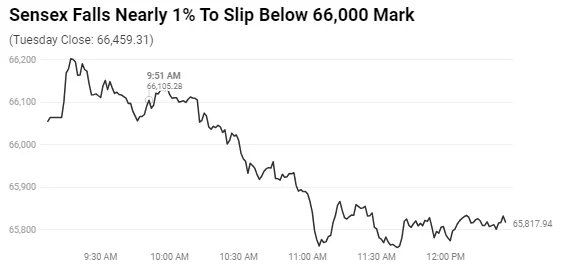

India’s Dalal Street suffered significant losses on August 2nd, with both major domestic equity benchmark indices ending with sharp cuts. Broad-based selling was witnessed with midcap and smallcap indices also falling over a percent each. All sectoral indices closed in the red, with banks, auto, and metals falling the most.

Historically, in 2011, when S&P took similar action, Indian equities, already on a downturn, entered bear market territory, losing about 18% in the following 4-5 months. However, the situation is different this time. The Nifty and other indices are either at their all-time high or close to it.

The Indian market is likely to remain resilient as earnings momentum , especially in midcaps and smallcaps , have been robust. Investors can also find solace in the fact that the buying dip has continued as opportunistic traders jumped to grab stocks at lower levels. This gives confidence that the crisis in the US may not have much negative impact in India.

India: A Promising Destination for Inflows

The US downgrade is not anticipated to significantly impact inflows into emerging markets, as the market had already considered this possibility since Fitch’s hint in May. India has emerged as an attractive destination for inflows among emerging markets due to its favorable inflation trajectory and successful monetary policy management. The country’s effective monetary policy and favorable inflation forecast models suggest a potential further easing of inflation in the future.

Morgan Stanley’s Upgrade for India and Downgrade for China

Morgan Stanley has upgraded India to ‘overweight’, reflecting growing optimism towards the Indian economy. The upgrade is driven by sustained superior dollar EPS growth compared to other emerging markets and a promising demographic profile attracting equity inflows. India’s economy is experiencing a surge in foreign direct investment and leveraging multipolar world dynamics to its advantage. Meanwhile, China has been downgraded to ‘equal-weight’ due to concerns over growth and valuation, highlighting India’s comparative advantage in the global market. India is showing resilience in its economic indicators, with a forecasted 6.2% GDP growth.

A Structural Shift in India’s Economy

In less than a decade, India has seen numerous significant changes that have had a profound impact on its economic landscape. These include supply-side policy reforms, changes in real estate regulations, digitization of social transfers, new bankruptcy laws, and the introduction of a flexible inflation targeting focus on Foreign Direct Investment (FDI).

These reforms, coupled with the declining intensity of oil to GDP and the shifting of the current account funding to more stable FDI flows, have greatly diminished India’s correlation with external factors such as oil, the U.S. Fed’s fund rate, and U.S. growth cycles.

India’s Future Growth Prospects

India’s future growth potential is promising, supported by government incentives for the corporate sector and a transition in the income pyramid. Lower tax rates and production-linked incentives are expected to boost investments in targeted sectors. The introduction of systematic investment plans by domestic households is creating a reliable source of risk capital. However, potential risks from inflation, monetary policies, and disruptions from artificial intelligence in service exports and the labor force will be closely monitored.

Concluding Thoughts

The downgrade of the US credit rating from AAA to AA+ by Fitch Ratings has stirred a wave of response in global markets, but it may well prove to be a catalyst for diversification, especially towards emerging markets like India. As one of the fastest-growing economies in the world, India continues to exhibit resilience and appears to be well-positioned to absorb this shock wave. This scenario does not undermine the strength of the US economy but rather underscores the need for diversified portfolios to hedge against concentrated risks and embrace the upside potentials elsewhere.

The US credit rating downgrade may cause short-term turbulence, but it signals a shift towards diversified portfolios in the medium to longer term. India’s strong fundamentals and growth prospects make it an appealing investment destination. Investors should consider opportunities in emerging markets and prioritize portfolio diversification for risk management and wealth generation in an interconnected global economy.

LIVE AMA – Sonam X Rakesh, Smallcase

To learn more about our thoughts on the recent market movements, wright anniversary, alpha prime, momentum investing and more, ask us questions on our Live AMA with Sonam Srivastava and Rakesh Rathod from Smallcase on Sunday, 6th August at 11AM. Don’t forget to click the bell icon to be notified. See you there!

Submit your questions for the Live AMA here.

Liked this story and want to continue receiving interesting content? Watchlist Wright Research smallcases to receive exclusive and curated stories.

Check out Wright Research smallcases here

SEBI Registration Details: Corporate Registered Investment Advisor | Company Name: Wryght Research & Capital Pvt Ltd Reg No: INA100015717 | CIN: U67100UP2019PTC123244. For more information and disclosures, visit our disclosures page here.