From Kiranas to Clicks: How New-age E‑commerce Startups are Outpacing FMCG Giants

Picture this: You wake up to find you’re out of your favourite coffee. Instead of hitting snooze and forcing yourself to get up and go to the store, you grab your smartphone, tap into your go‑to coffee app, and order a fresh brew. In no time, a notification pops up: your cup of liquid motivation is on its way!

This example highlights how the Indian retail landscape is witnessing a seismic shift. New-age e-commerce startups are rapidly outpacing traditional FMCG (Fast-Moving Consumer Goods) giants. The answer is straightforward: a hyper-focused digital-first strategy is redefining retail dynamics.

Meanwhile, established FMCG companies, feeling the heat of this emerging paradigm, are scrambling to catch up. As a result, FMCG behemoths like Hindustan Unilever, Tata Consumer, and ITC are on an acquisition spree, investing heavily in these startups to stay relevant.

Let’s delve deeper.

Era of D2C Brands

In a market where over 55% of India’s population is online and the number of internet users has surged dramatically in recent years, the era of direct-to-consumer (D2C) brands is in full swing. Be it the personal care brand 82° E, the home decor brand Nestasia, or even food and beverage (F&B) brand Storia, these D2C startups are not just selling products, they are building communities with influencer marketing, quick commerce, and data-driven personalisation at their core. No wonder venture capitalists are pumping millions into these startups!

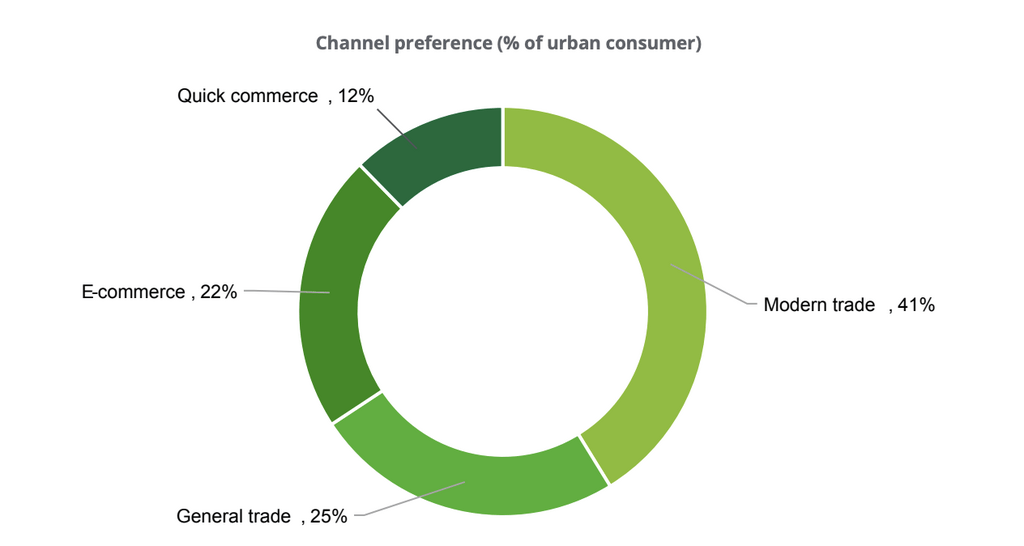

A Deloitte survey highlights that modern trade, which includes hypermarkets and supermarkets, is becoming the most preferred channel by urban consumers. Take a look:

How are They Doing it?

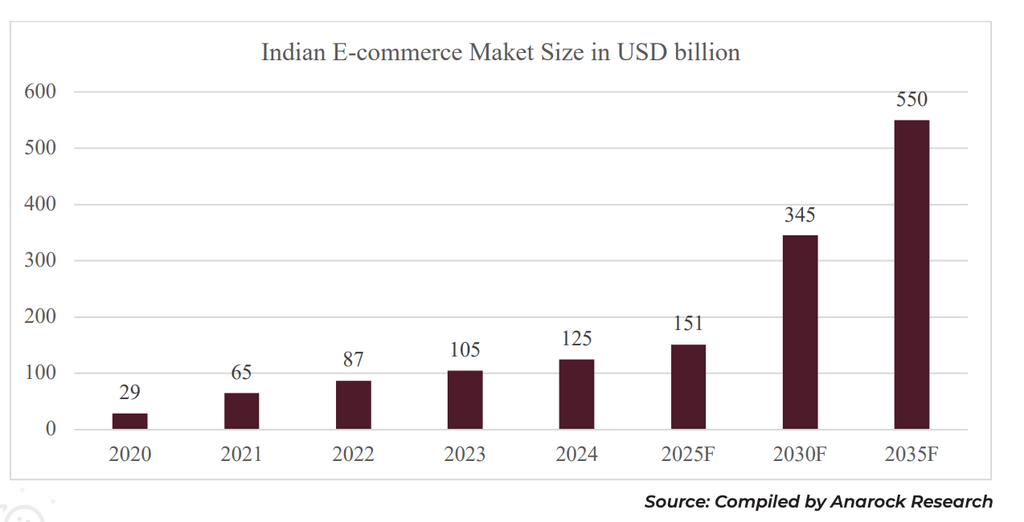

Unlike traditional FMCG brands that often struggle to resonate with younger audiences, these nimble startups are born digital. According to the recent ANAROCK report projections, online retail’s contribution is set to rise from 8% in FY2024 to nearly 18% by FY2030. Here’s how:

Digital-first Approach: Being heavily dependent on tech, new-age startups understand the importance of mobile commerce, given that smartphones are expected to account for 78% of e-commerce traffic by 2035, as per ANAROCK’s report.

Better Marketing: These startups excel in influencer marketing and social media engagement, which resonate well with younger consumers. They focus on storytelling and creating brand awareness through digital channels. Remember when boAt started a new ad campaign, ‘Don’t be a fanboy, be a boAthead’, a strategic move to engage Apple consumers in the Indian market? It created a lot of chatter on social media, leading to a powerful awareness of the product.

Capitalising on Different Distribution Channels: Instead of relying solely on traditional trade channels, the new startups embrace quick commerce and hyperlocal delivery (think Zepto, Swiggy Instamart, Blinkit, and more). This allows them to reach consumers faster and more efficiently.

Tech Savvy: They use advanced technology to improve inventory management and logistics, ensure on-time deliveries, and cut operational costs. AI plays a key role as well. By using AI and machine learning, startups can predict demand, manage stock levels in real time, and minimise waste.

This digital-first approach is not just a matter of technology; it’s a cultural shift. These startups are tuned to speak the language of millennials and Gen Z—offering not just products but experiences, like personalised shopping journeys, AI-powered recommendations too.

The Big Question: What About FMCGs?

The meteoric rise of digital disruptors has not gone unnoticed by traditional FMCG giants. The giants in the retail system realise that “If you can’t beat them, join them” — and they have figured out an effective way out (after lots of hits and misses ). Since the pandemic, FMCGs have embraced aggressive M&A strategies to stay competitive.

For FMCG biggies such as Emami, HUL, Tatas, and others to expand, D2C brands seem to be the right vehicle for reaching out to the emerging Gen Z consumer space and millennial preferences.

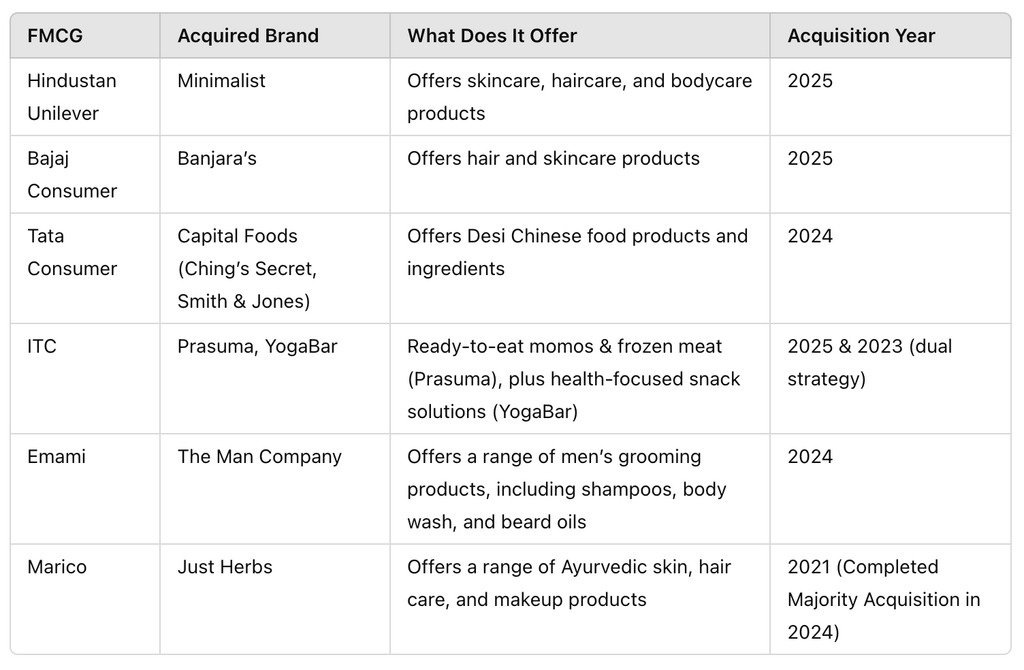

Acquisition Spree

Why Buy Now?

The acquisitions have been a win-win for both FMCG companies and D2C brands. While the deals are opening up uncharted territories for FMCG companies, D2Cs are gaining access to the acquirers’ offline distribution channels and, consequently, catering to a larger segment of consumers.

A brand like Dr Sheth’s, for example, has seen significant growth under the Mamaearth portfolio, mainly due to access to a broader consumer base through offline channels. Similarly, in the food space, a renowned brand like Capital Foods’ acquisition by Tata Consumer shows how acquisitions have enabled these brands to scale quickly.

Data-driven Insights

Recent data from industry reports (such as the ANAROCK Research Report) reveal a promising growth trajectory for digital retail channels in India.

Growing Big, and Bigger

The ANAROCK report further states that India’s online shopping spree is expected to account for nearly 65% by 2030. To put this into context, India currently has 950 million internet users, with an internet penetration of almost 55%.

What’s Driving the Growth?

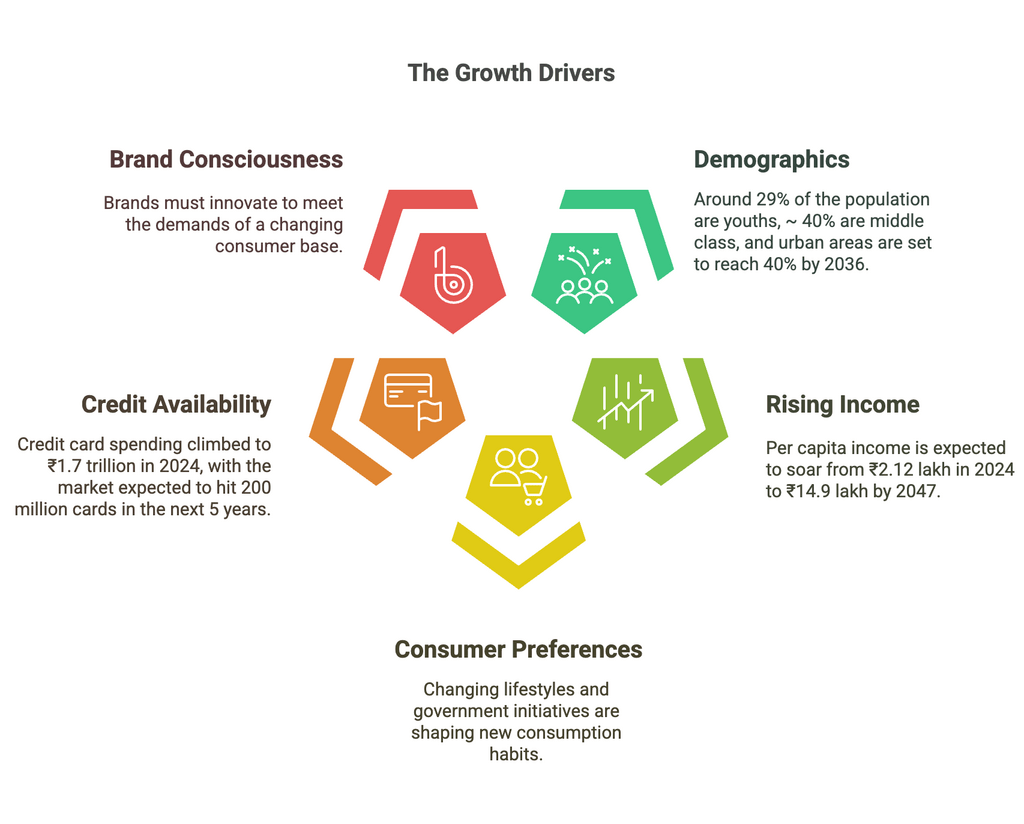

In simple terms, India’s retail space is powered by three key contributors: A cocktail of youthful vibes, booming incomes, and a tech-loving middle class. Here’s an illustration:

Further, the surge in online shopper numbers, fuelled by enhanced digital payment adoption and expanding internet penetration, confirms that the timing is right to capture this market.

Timing is Everything

Some key external factors are amplifying the impact of these new-age startups:

Favourable Regulatory Environment: Recent regulatory tweaks have made digital transactions a breeze and lifted many old restrictions on foreign investments in e‑commerce. For instance, rules allowing 100% FDI on the “marketplace model” of e-commerce, meaning companies can operate an online platform to facilitate transactions between sellers and buyers without directly owning the inventory, have given investors a big thumbs-up and turbocharged growth for these startups.

Demographic Dividend: India’s young, tech-obsessed crowd is the perfect match for digital-first business models. With over 29% of the population buzzing with youthful energy and a steadily growing middle class, there’s a growing market for personalised, tech-savvy shopping experiences.

Funding Availability: Venture capital firms and angel investors actively seek high-growth potential startups, providing significant funding for new businesses to scale rapidly. In 2024, e-commerce startups raised $1.5 billion, registering a 42% year-over-year decline in funding. However, the deal count witnessed a 6% rise in the previous year. According to reports, due to its growing potential, D2C remained the ‘most funded’ e-commerce sub-sector in 2024, accounting for the highest share of deals.

The Road Ahead: Growth, Consolidation, and the Future of Retail

The following 2–3 years are gearing up to be a rollercoaster of robust growth for fresh startups and established players. But as the competition heats up, expect a phase of consolidation where market heavyweights might gobble up smaller brands to boost their market share. Here’s a sneak peek at what might be around the corner:

Expansion of Digital Ecosystems: As more consumers jump online, digital payments, smart logistics, and AI-powered personalisation will evolve, giving digital players even more muscle.

Increased M&A Activity: The current acquisition spree by FMCG titans is set to intensify. This shakeup will not only help traditional companies catch up on the tech front but also let them integrate snazzy, innovative business models that modern shoppers love.

Hybrid Retail Models: Even though digital channels are stealing the spotlight, the blend of online and offline (omnichannel) strategies will still be key. For instance, malls and physical stores, which grew by 4% over the past five years despite strong growth in e-commerce. ANAROCK mentions that apparel and food & beverage sectors consistently contribute nearly 45% of demand, maintaining their position as top drivers.

Investment in Emerging Technologies: Ongoing investments in AI, IoT, blockchain, and advanced analytics are the secret sauce. These tech marvels will ramp up operational efficiencies, trim costs, and personalise the customer journey even more.

Continued Focus on Quick Commerce: With urban lifestyles demanding lightning-fast service, quick commerce is on the rise. Startups specialising in ultra-rapid delivery are leading the charge, nudging traditional retailers to innovate or risk fading into the background.

Final Thoughts: The New Retail Paradigm

Today’s fast-paced retail arena is a playground for new-age e‑commerce startups. As the market becomes more saturated, the ability to innovate and adapt will be key to success. Investors should watch for signs of consolidation and strategic partnerships, as these will likely define the future of the Indian retail sector.

To sum it up in a line: The race is on, and digital Darwinism is rewriting the rules of retail in a big way!