Maximise Your Mutual Fund Investments: A Comprehensive Guide to LAMF

Financial emergencies can hit us at any time – unexpected medical expenses, impromptu travel plans, or losing a source of income. To meet these needs, there’s a lot of planning around deciding where to invest, how much to invest, lock-in periods, return rates of those assets, and so on. That’s where a loan against mutual funds can emerge as a knight in shining armour

For such planning, we often consider safer options like FDs, debt funds, or savings accounts. But how cool would it be if your existing investments could cater to your emergency needs – without any painful processes of exiting, the tax implications or missing out on returns on mutual funds!

In a world of ever-changing financial landscapes, we at smallcase understand the diverse needs you may have. That’s why we’re thrilled to introduce Loan Against Mutual Funds (LAMF), a financial product designed to cater to your specific requirements, all while ensuring the preservation of your long-term investment goals.

LAMF is a powerful tool that offers you the financial flexibility you deserve, setting itself apart as an exceptional alternative to traditional personal loans.

Let’s delve into some distinctive scenarios where LAMF can unlock a world of financial opportunities, empowering you to create a secure future while addressing your short-term capital needs.

Fulfill Emergency Financial Needs with LAMF

An emergency fund is a crucial safety net that can cushion individuals and families during unforeseen financial crises.

Consider a real-life scenario where you face an unexpected medical emergency that demands immediate financial support. With the ever-rising costs of medical treatments, even health insurance may sometimes either not cover, or meet the financial requirement at the time of the medical emergency.

LAMF can play a pivotal role in such situations. By leveraging your existing mutual fund investments, you can establish an emergency credit line without selling your investments during a time of crisis. All you need to do is use your mutual fund holdings as collateral and get the emergency cash – in under 3 hours on smallcase.

Using LAMF ensures that funds are readily available which you can withdraw anytime, allowing you to navigate through the emergency confidently without compromising your long-term investment strategies or financial health and credit score. It also allows you to retain your mutual fund returns, even if they have been pledged.

Plan Your Next Vacation with a Loan Against Mutual Funds

Many of us dream of embarking on that perfect vacation, but financing it can seem like a distant possibility. Imagine planning a dream vacation with your loved ones, but having to take a personal loan or redeem your investments for it.

In this case, LAMF emerges as an ideal solution. By utilising LAMF as a constant credit line, you can access funds to finance your dream vacation without resorting to high-interest personal loans or prematurely redeeming your investments.

The flexibility offered by LAMF ensures that you have the funds you need when you need them, enabling you to create those sought-after cherished memories without derailing your long-term financial goals.

Use LAMF to Finance Your Dream Home

The living space we inhabit directly impacts our mental state and peace of mind. Upgrading to a newer home can be a tedious financial process even with low-interest home loans. Getting down payments, registration amounts, and the like in place can be difficult on the pocket.

Enter LAMF as the perfect financial ally. Picture yourself planning to buy that house, you’ve been eyeing forever, to create a more comfortable and appealing living environment for your family. LAMF can serve as an instant loan for financing the basics of home-buying like registration and booking amounts; allowing you to undertake the financing of your dream home without disrupting your existing investment portfolio. You can, now, efficiently manage initial expenses, bypassing the need for high-interest loans or premature liquidation of investments.

Thus, you can see how Loan Against Mutual Funds (LAMF) proves to be a versatile financial tool, offering a multitude of benefits to cater to specific financial needs. Explore the vast potential of LAMF for your unique financial needs, as it unlocks a world of opportunities to achieve your aspirations while securing a prosperous financial future.

Eligibility for Loan Against Mutual Funds

Secure a loan against mutual funds with smallcase by meeting the following criteria:

- Eligibility: Self-employed/Salaried Residents (equity and debt funding).

- Entities: Proprietorship concerns, partnership firms, limited liability partnerships, private limited companies, and HUFs (debt securities funding).

- Age: 18 to 70 years.

- Loan Limit: ₹25K to ₹5 Cr.

Documents required for LAMF

Obtaining a Loan Against Mutual Funds (LAMF) on a smallcase is hassle-free and document-free. Experience a smooth process without the need for a detailed document list.

However, in certain cases, users might be requested to provide their Aadhar number for verification.

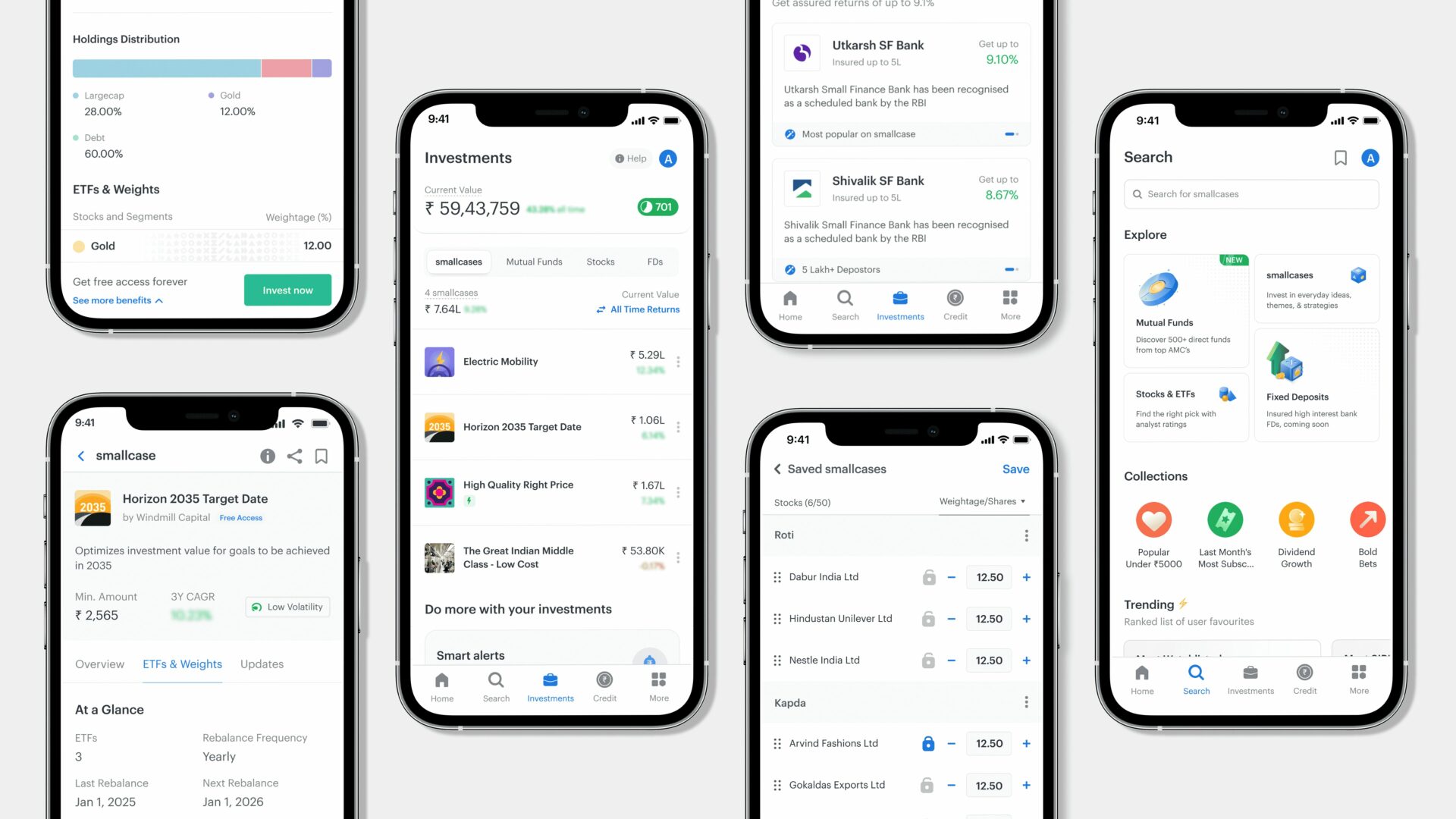

How to Apply for LAMF at smallcase?

Thus, you can see how Loan Against Mutual Funds (LAMF) proves to be a versatile financial tool, offering a multitude of benefits to cater to specific financial needs. Explore the vast potential of LAMF for your unique financial needs, as it unlocks a world of opportunities to achieve your aspirations while securing a prosperous financial future.

Securing a Loan Against Mutual Funds on smallcase is a breeze:

To get a LAMF via smallcase, simply:

- Check your Mutual Fund credit limit

- Confirm your loan amount

- Link bank account

- Use your mutual funds as collateral

- Get money in your bank account in less than 2 working hours

Check your credit limit today

To Wrap It Up…

Embrace digital convenience! Unlock quick funds through Loan Against Mutual Funds (LAMF) on smallcase. Get your desired loan while still investing in mutual funds for future reinvestment or building a corpus.

You can close a loan against mutual funds before the default 36-month tenure without any foreclosure charges at any time with smallcase.

The interest rate on the outstanding principal typically fluctuates between 10% and 20%. Yet, smallcase offers a fixed annual interest rate of 10.5%.

No. At smallcase, no changes are allowed to pledged loans, offering stability and security throughout the loan tenure.

The interest cycle runs from the 7th to the 6th of each month, with interest on the loan becoming due every 7th.

Not paying the interest triggers a bounce charge (₹1200 in smallcase). A monthly penalty is then applied to the outstanding interest until fully paid from the auto-debit failure date.

All About Loan Against Securities & Loan Against Mutual Funds on smallcase –

smallcase offers quick and easy disbursement of loans against securities ( LAMF), all about eligibility, documents, features and benefits of Loan against mutual funds and the process for applying for loan is just one click away –