FY25 Stock Market Recap: A Wild Ride and What’s in Store for FY26

FY25 will likely go down in the pages of history as one of the most dramatic years for investors in the Indian stock market. The year began with a bang – a strong rally that took indices to record highs by September 2024 – and ended with a sigh of relief by the fag end of the financial year.

Despite all the drama, the headline numbers for FY25 don’t look too shabby. According to market data, the benchmark BSE Sensex and Nifty 50 notched annual gains of just over 5% (as of March 28, 2025), marking a second straight year of positive returns – modest, but hard-earned.

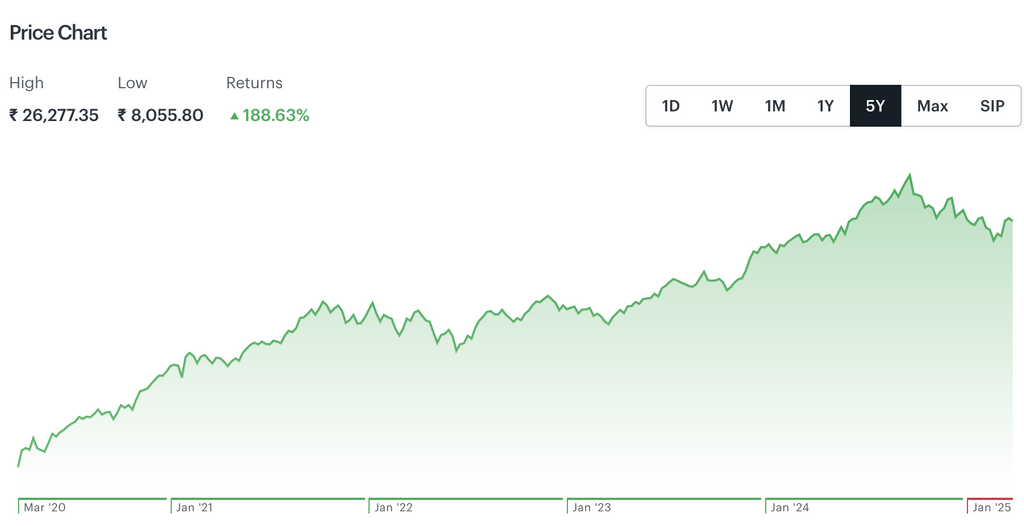

And while the past year saw wild swings, stepping back reveals a different story. Take a look at Nifty 50’s 5-year trajectory:

Despite short-term volatility, the index has delivered a whopping 187% total returns over the last 5 years. This long-term uptrend reflects India’s resilient macroeconomic fundamentals and earnings growth, reinforcing the case for staying invested during dips.

That said, let’s recap the FY25 rollercoaster.

FY25 Scorecard: Major Indices Hit High, Then Humbles

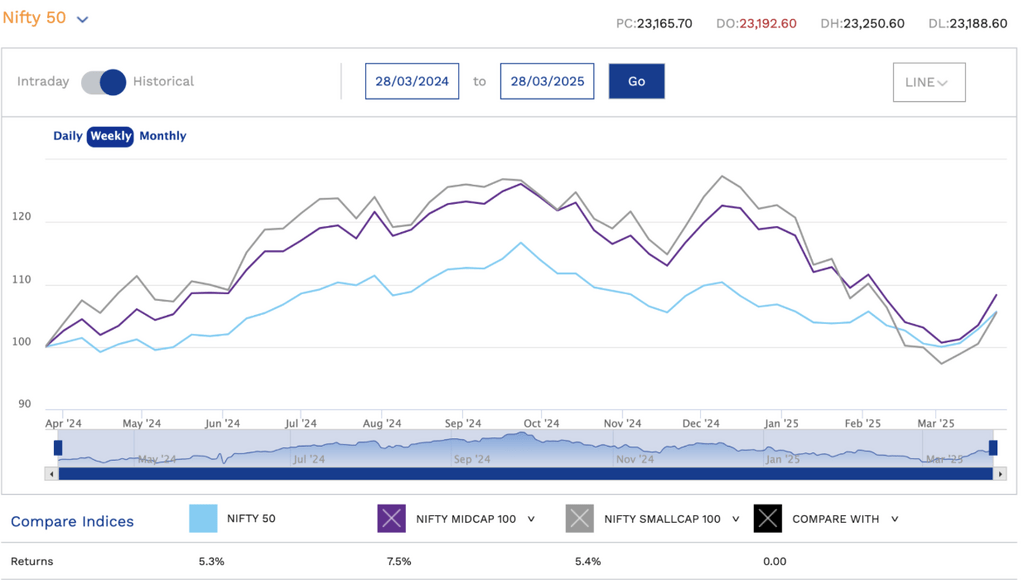

The last financial year (April 1 2024 – March 28, 2025) saw large-cap, mid-cap, and small-cap indices take investors on a bumpy ride.

After a vigorous first-half climb, Sensex and Nifty gained around September 2024 to reach all-time highs of 85,978.25 and 26,277.35, respectively, before sliding downward for five consecutive months, only to bounce back in March 2025.

The chart above shows how Nifty 50’s performed compared to Mid-cap 100 and small-cap 100 segments. Mid-cap and small-cap stocks initially climbed even faster – small-caps were on fire in the early part of the year – but they also felt the sting of the correction. In fact, by early 2025, small-caps had given up their entire gain (and then some) before springing back to end about 5% up. Mid-caps fared better, holding on to roughly 7% gains by year-end.

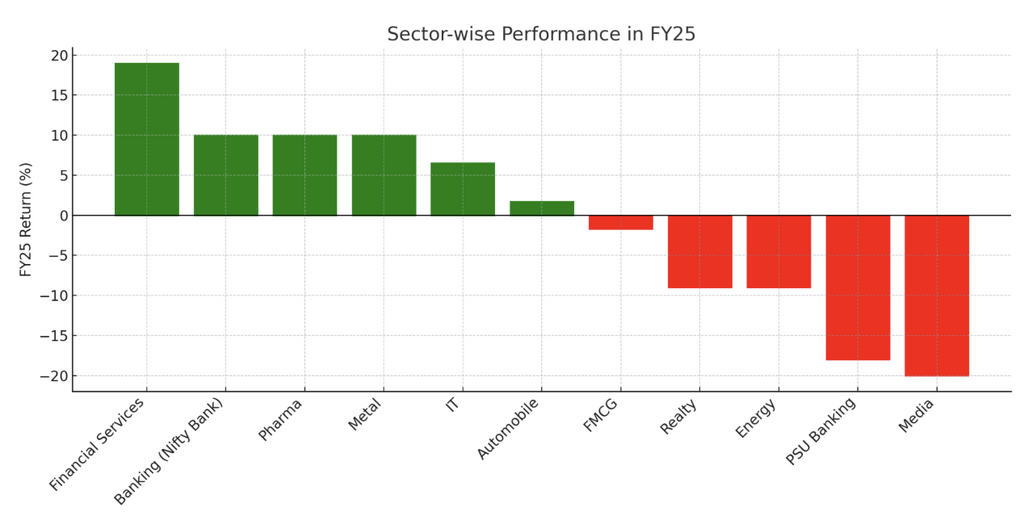

Sector Winners and Losers

Financial services was the top-performing mainstream sector with +19%, while IT and banking delivered mid-single-digit gains. At the other end, consumer goods and auto stocks barely moved, and areas like real estate, PSU banks, energy, and media saw double-digit drops, as per market data and news reports.

Here’s a quick rundown of how key sectors fared in FY25:

Note: This chart is for information and education purposes only. Past performance is not indicative of future results. Before making any investment decisions, investors should conduct their own research.

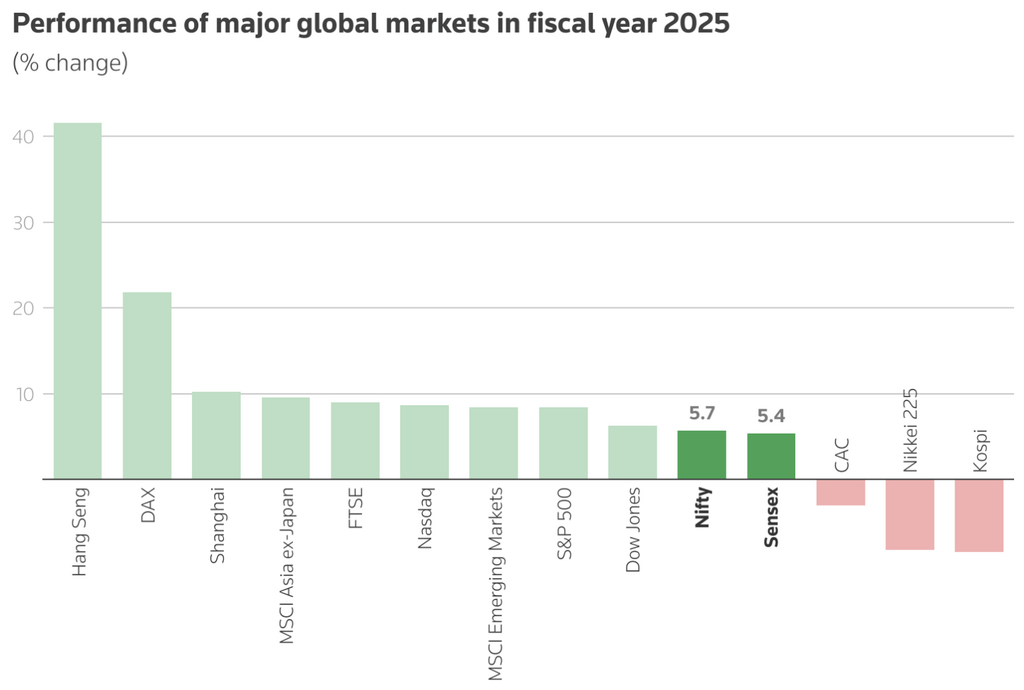

How Did Indian Markets Stack Up Globally?

While India underperformed the US and Japan and other global markets, it remained resilient amid global volatility, especially in contrast to markets like Nikkei.

What Drove the FY25 Market?

From Ballots to Budget, major events were a part of the last fiscal, which not only impacted the stock markets but also laid a ground for FY26.

Politics & Policy: On the domestic front, India’s general elections in April-May 2024 stood out. Political uncertainty following the BJP-led NDA’s failure to secure a full majority in the June 2024 elections initially rattled investors. However, the government quickly reassured markets by reaffirming its commitment to fiscal prudence, infrastructure push, and manufacturing incentives. Still, investor sentiment remained cautious as key economic reforms—especially in land, labor, and privatisation—seemed less likely to move swiftly under a coalition framework.

Trump’s Return to Oval Office: The outcome of the US presidential elections in November 2024 threw a curveball at the Indian stock market. With Donald Trump at the helm of affairs, the new administration quickly rattled markets with talk of fresh tariffs. The mere threat of higher US tariffs on imports hit sentiment in export-focused sectors – Indian pharma and auto exporters, for example, saw stocks wobble.

Budget 2025-2026: By July 2024, markets had shaken off election jitters and even got a booster from Modi 3.0’s Budget. The Union Budget FY26 laid the groundwork for the current fiscal with a clear bet on boosting domestic consumption. This came through reforms in personal income tax slabs, enhanced deductions, and incentives aimed at increasing disposable income in middle-class households, which led to a brief period of resilience in the market.

However, this optimism faded as Q2FY25 GDP growth slumped to a seven-quarter low of 5.4%, capital expenditure fell short by 15%, and corporate earnings remained underwhelming.

Another significant contributor to the market rout was the retreat of the Foreign Institutional Investors (FIIs), who were the net sellers in 7 out of 12 months, selling over Rs 1.35 lakh crore in equities, while Domestic Institutional Investors (DIIs) tried to steady the ship with Rs 5.96 lakh crore in net buying.

Among all this, Nifty logged its longest losing streak since its inception in 1996 (falling for five consecutive months from October to February), before gaining modestly by end of March.

What’s in Store for FY26?

Now that we’ve dissected FY25’s performance, let’s dust off the crystal ball and see what FY26 has to bring.

Budget FY26

The government aim to enhance middle-class spending power through targeted personal income tax reliefs, while also increase allocations for rural schemes and social sector programs can prove to be a major market mover. The underlying goal: spark a broad-based consumption revival from both urban and grassroots levels. These reforms will be closely watched in FY25-26 for their actual impact on consumption-driven sectors like FMCG, autos, and retail.

Global Factors

Global trade tensions persist, particularly with Trump’s reciprocal tariffs potentially rattling India’s export-oriented sectors and overall market sentiment. Sectors like electronics, pharma, auto & auto components and textiles will be in focus till the tariff wars wane.

The Economic Foundation

According to CRISIL projections, India’s GDP is expected to maintain a robust growth rate of 6.5% in FY26 despite geopolitical uncertainties and trade-related issues led by US tariff actions. While this is somewhat lower than previous years, it’s still impressive compared to many major economies.

Inflation is projected to ease further in FY26, which could create a more favourable environment for both businesses and consumers. The current account deficit is expected to remain manageable at 1.3% of GDP, supported by substantial foreign exchange reserves covering 10-11 months of imports.

The ₹120 Lakh Crore Investment Push

India Inc. is gearing up for a massive investment push, but it comes at a cost. ₹120 lakh crore in debt will be needed by FY26 to fuel expansion, according to CRISIL. The drive targets three key areas that investors should watch closely: manufacturing, renewable energy, and infrastructure.

Interest Rate Outlook

In February 2025, RBI slashed its repo rate by 25 basis points (bps) to 6.25% – a first in nearly five years. Recent inflation figures hovering around 3.5% suggest that further monetary easing could be on the horizon, potentially boosting market performance in the coming fiscal year.

Key Sectors to Watch

TI;DR: With anticipated rate cuts, sectors sensitive to interest rates (like real estate, automobiles, and banking) might see interesting movements

That said, here are key sectors to watch out for:

- Information Technology (IT): The IT sector is expected to maintain its robust growth trajectory, fueled by increasing demand for artificial intelligence and emerging tech solutions.

- Electronics Manufacturing: The Government’s $2.7 billion production-linked incentive (PLI) scheme is projected to attract $7 billion in investments and create approximately 91,000 jobs over the next five years, as per news reports.

- Infra & Power: Investments in infrastructure, including power utilities, are anticipated to improve connectivity and boost economic activity. Construction companies, engineering firms, and logistics providers could benefit as well.

- Renewable Energy: With targets to develop 100 GW of nuclear power by 2047, the renewable energy sector is worth the watch. Companies in this sector are also exploring ventures into nuclear power, reflecting the growth potential.

- Financial Services: Anticipated interest rate cuts by the RBI are expected to boost credit growth and attract foreign investments.

- Healthcare and Pharmaceuticals: Within healthcare, hospital stocks are expected to continue their strong performance, driven by bed additions and medical tourism like traveling abroad to access healthcare services that might be unavailable in India.

- Automobile and Auto Components: The domestic automobile industry’s wholesale volumes are expected to grow 3–5% YoY in FY26, according to a report by ICRA. Steady rural demand and an increase in replacement sales due to ageing fleets and government mandates are expected to drive growth.

- ESG-Focused Sectors: Research indicates that stocks with high ESG scores demonstrated better resilience during volatile periods, with investors showing greater confidence in their long-term sustainability. This could become increasingly important as global focus on sustainable investing intensifies.

Conclusion

As FY25 ends with modest but positive returns, FY26 promises to be another eventful year for Indian markets. With robust economic fundamentals but lingering global uncertainties, investors should prepare for volatility while staying focused on long-term opportunities.

To sum up the outlook, cautious optimism is a fair stance. Many ingredients for a positive FY26 are falling into place – a stable government in its stride, potential tailwinds from lower interest rates, and an earnings revival – but the trade war can shake things up.