Four Years of Wright Momentum: Mastering the Art of Building a Successful Momentum Strategy

It’s the four year anniversary of Wright Momentum! We launched the Momentum portfolio in December 2020, in a market ripe for Momentum investing. Momentum has been my favourite strategy to work on in the markets and I had been researching quantitative momentum strategy for years before that. I started this strategy with giddy excitement in 2020, and the reception that momentum has received has also been beyond exciting.

So this week, we are celebrating the power of momentum investing with the Wright Research edge. We’ll explore how momentum has looked for the investors, the performance, the multi-baggers, the hits and the misses.

What is Momentum?

Momentum in investing is like a snowball rolling downhill, gaining size and speed. It refers to the rate at which a stock’s price is moving, emphasizing the strength and speed of price changes. Imagine a stock gradually increasing in price – momentum is the force driving it upwards.

To measure momentum, we look at the rate of change in price over a specific period or other technical definitions of momentum. A stock rising 10% in a month versus a week shows different momentum levels.

It’s not just about rapid gains, but also the consistency of these gains. Whether for short-term trading or long-term investing, momentum is about spotting these continuous upward trends and capitalizing on them. It’s a strategy of joining the trend at the right time and exiting before it reverses, leveraging the market’s tendency to persist in a direction.

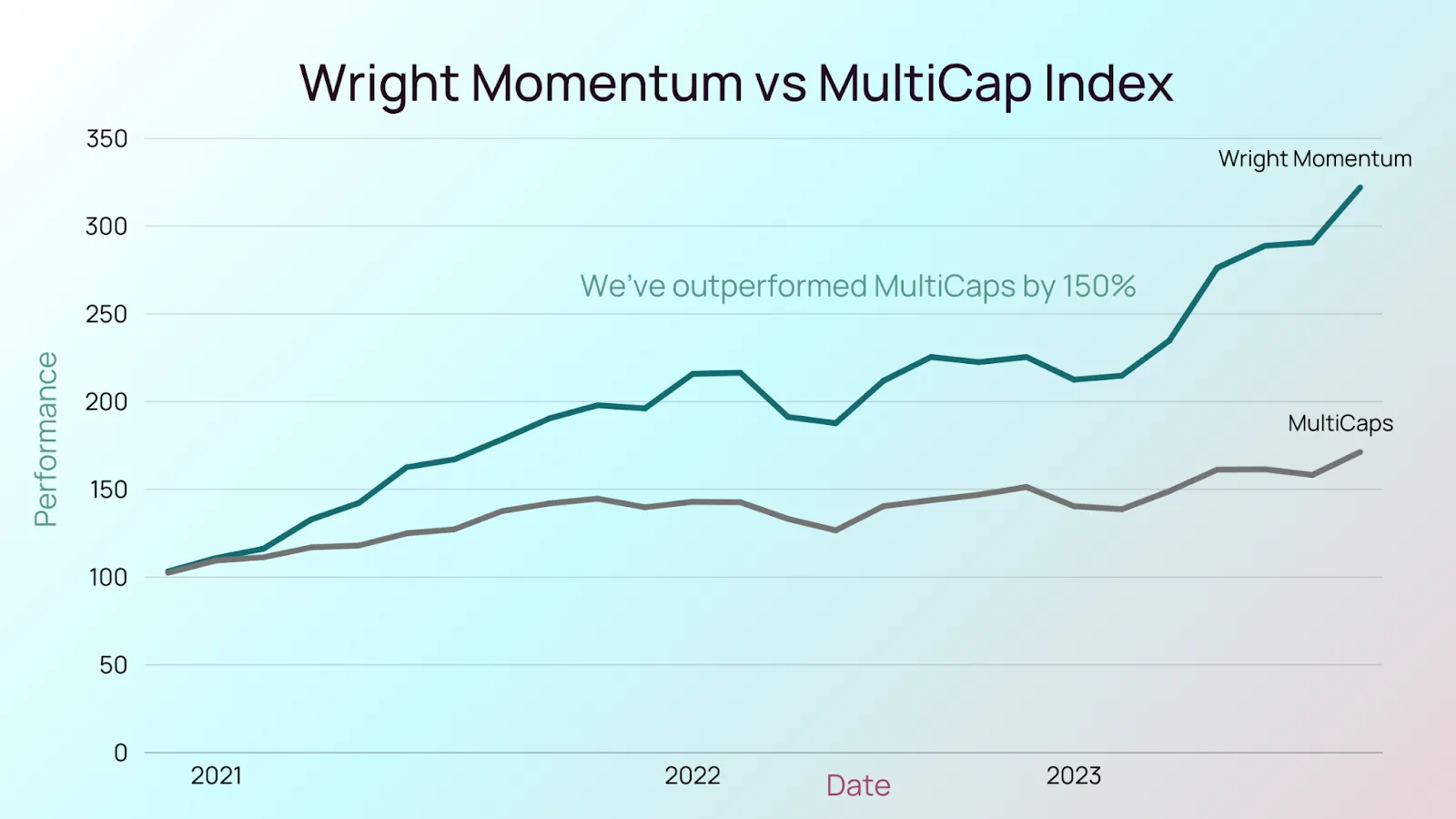

Wright Momentum Performance

Wright Momentum has given a 322% returns in the last 4 years and is a three fold multibagger in itself! What is amazing is that the strategy has performed 150% better than the Multicap Index as well.

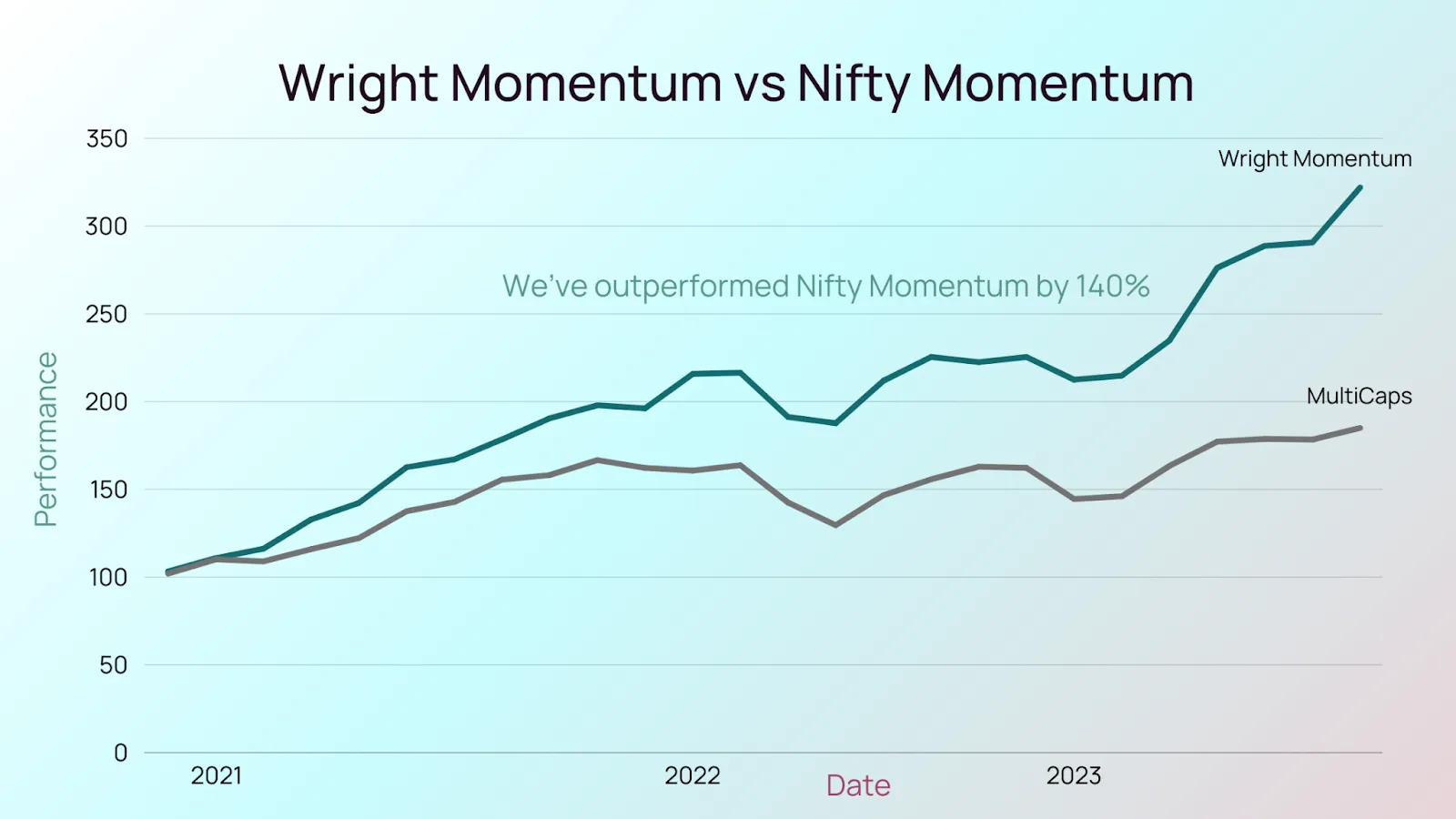

And not just the multicap index, Wright Momentum has infact done better than the Momentum benchmark – Nifty Momentum also by a wide margin.

Momentum has built its performance in the bull markets of 2020-21 and 2023 but it has help on its edge over the market during the sideways market of 2022 as well, speaking a lot about its strong risk management.

The Stocks in Momentum Portfolio

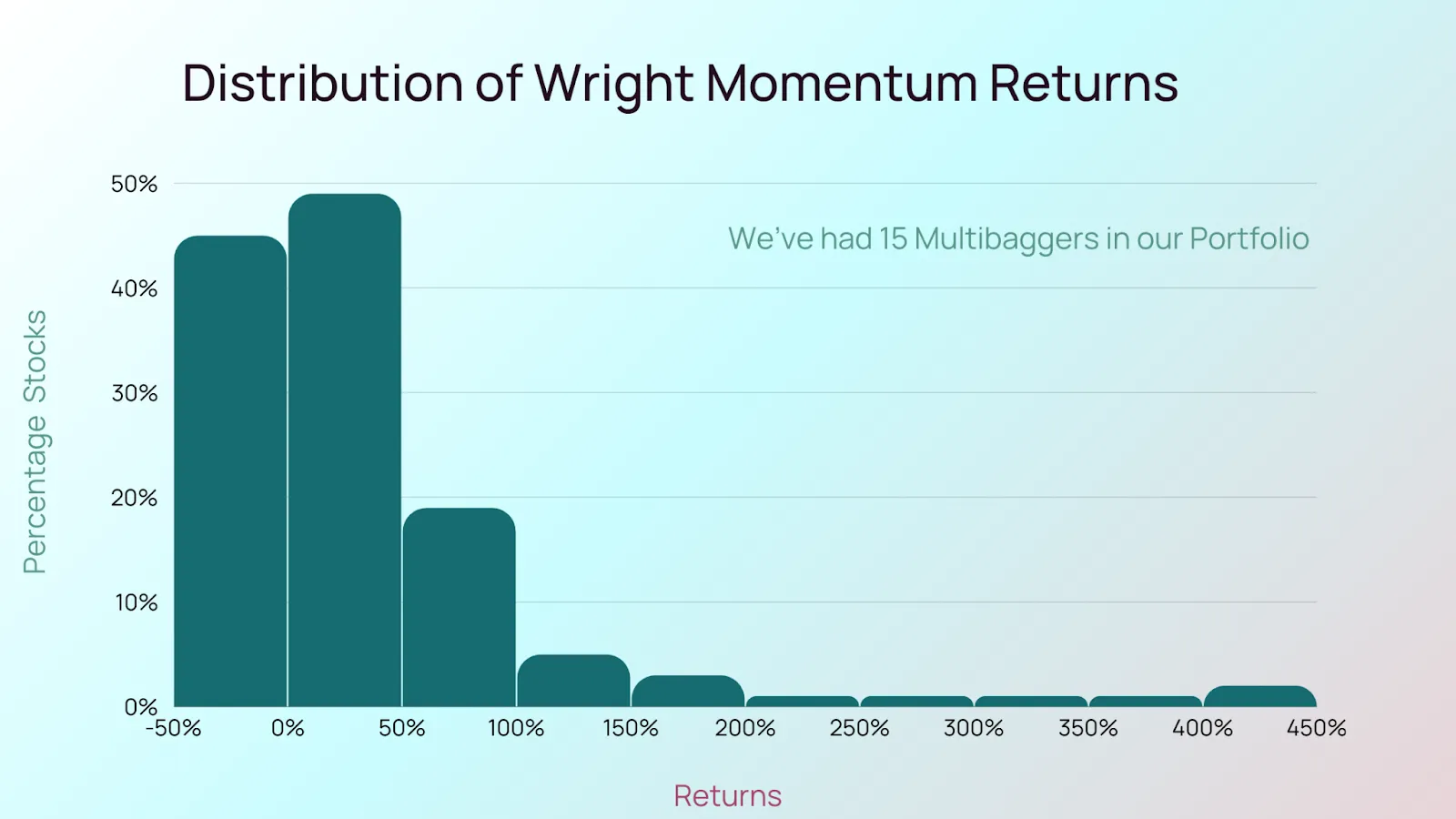

Let’s talk about the stocks in the Momentum Investing portfolio. We’ve held around 130 stocks at various times in the last 4 years with the portfolio being 20-25 stock strong at most times.

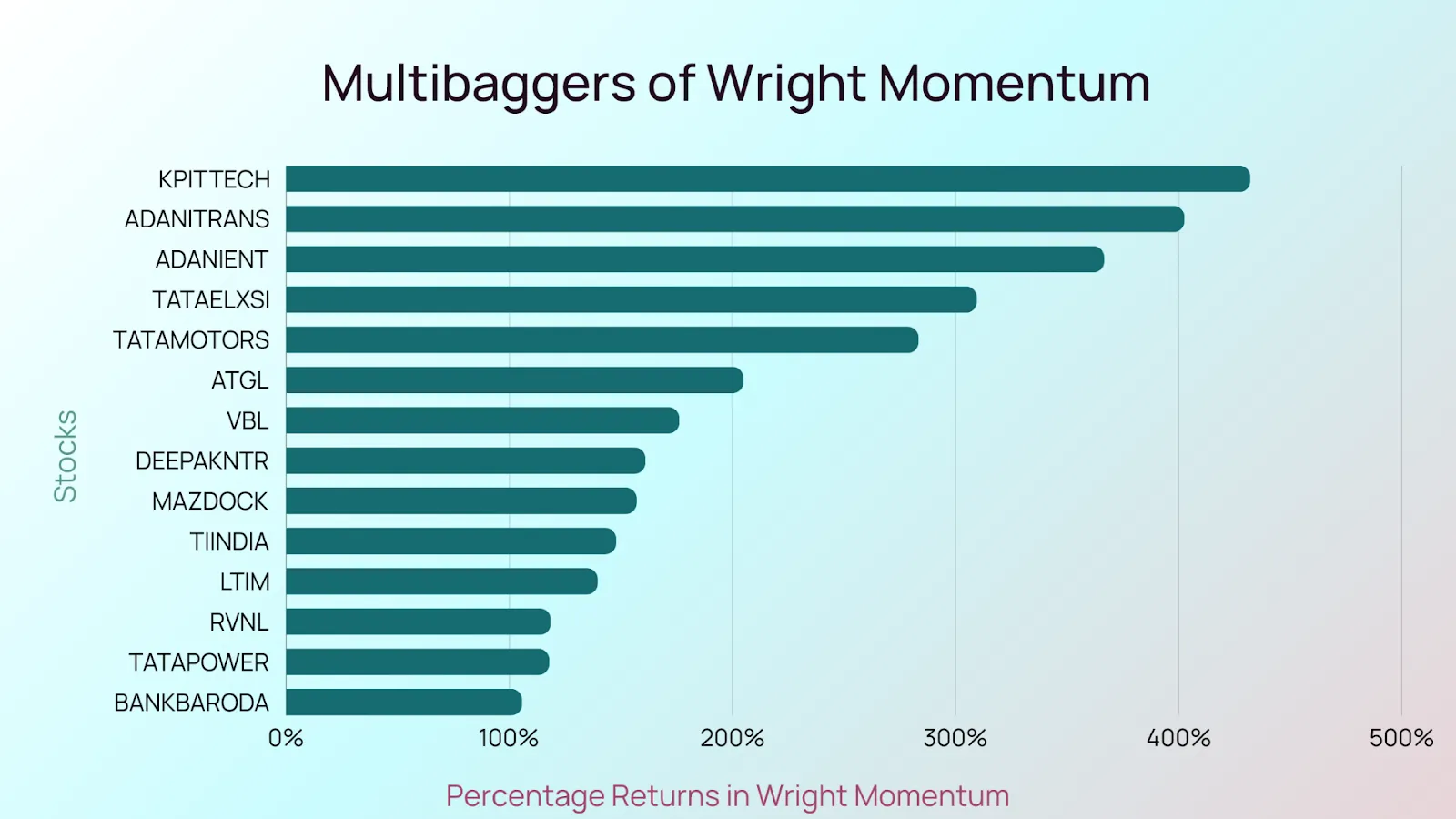

In these 130 stocks 15 have indeed turned multibaggers!

The distribution of returns shows a skew. While most stocks are exited with between 0-50% returns a few of the stocks turn out to be all out winners and skew up the strategy returns.

What is also interesting is that 35% of the stocks are indeed sold at a loss.

The biggest multibaggers of Momentum came in the 20-21 bull market – KPIT Tchnologies, Adani stocks, Tata Elxsi, Tata Motors, Tube India were the best performer at the time. More recently Mazdock, Bank Baroda, RVNL, Tata Power have turned multibaggers in this portfolio.

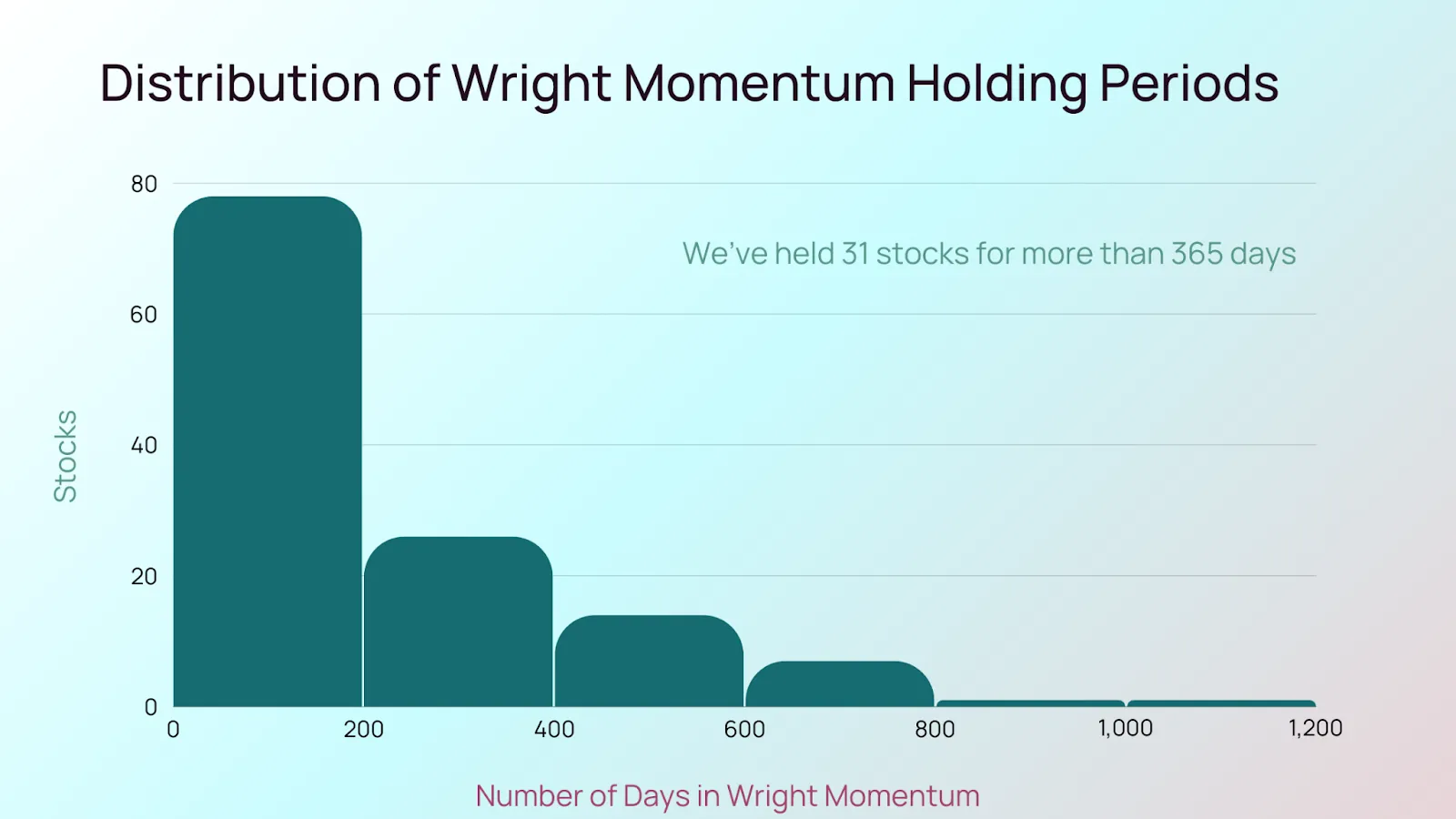

How long do we hold the winners?

We hold on to the winners quite a lot!

In fact we have help 31 out of the 131 stocks for more than a year. But majority of the stocks are offloaded within 200 days of buying.

How we build the Momentum Strategy

Building A Momentum Strategy – Step 1: Define the Universe of Stocks

- We focus on the top 500 stocks on the NSE as our universe.

Building A Momentum Strategy – Step 2: Identify the Momentum indicator

- We look at signals like rate of change, all time highs, trend break out signals, technical analysis, even earnings momentum – based on analyst ratings and analyse a broad set of indicators to pick the best ones.

Building A Momentum Strategy – Step 3: Rank/Normalize Stocks Based on Momentum

- We use various types of nomalization techniques and ranking to assign a final momentum score to stocks in the universe.

Building A Momentum Strategy – Step 4: Build the Momentum Portfolio

- We use portfolio optimization techniques to get the stock weights. The weights are assigned such that the diversification is also high and risk is reduced.

Building A Momentum Strategy – Step 5: Monthly Portfolio Rebalancing

- At the start of each month, re-run the whole model which leads to some stocks coming in and others going out

- This ensures your portfolio always consists of the top momentum stocks and adjusts for any significant changes in stock performance.

🔈 BANGALORE – INVESTOR MEETUP.

Wright Research Team is in Bangalore. Come say hello and ask us your queries live. We would love to meet each of you in this small & cozy get-together.

🗓 Date: Tomorrow, Wednesday – 06.12.2023

⏱ Time: 7pm to 8pm

📍 Location: Sabari Complex, Residency Road Bengaluru

If you are interested, then please fill out this form. And we will get back to you with the meetup details.

Link to fill form

Celebrate 4 Years of outperformance with Momentum. Use discount code MOMENTUM2023 to get 20% off on Wright Momentum smallcase!

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary.

Wryght Research & Capital Pvt Ltd•SEBI Registration No: INA100015717

103, Shagun Vatika Prag Narayan Road, Lucknow, UP 226001 IN

CIN: U67100UP2019PTC123244

Disclosures: Link