Expert Analysis of the Global Macro Events & News affecting the Indian Markets – 7 Nov 2023

The most awaited festival of the season is here. Everyone is ready for Diwali with their traditions and so are we. Every Diwali, we give our investors Samvat Portfolios, and following our tradition of three years, we are proud to give you our Samvat smallcases 2080. Samvat smallcases are designed specifically for new investors to give you confidence in the markets and a sneak peek into the experience of investing with Green Portfolio. Here are a few things about our Samvat Smallcases:

- Two portfolios: Samvat 2080: Smallcap Picks and Samvat 2080: Midcap Picks.

- Invest in small and mid-cap stocks with rapid growth potential.

- Consolidated portfolios with only 7 or 8 stocks.

- Diversification along with focus across 6-7 key sectors to manage risk.

- Subscribe at less than Rs.275 per month.

The Samvat 2080 smallcases have the best picks as per current valuations. Considering the recent market correction, this is a good time to add these stocks at current valuations.

P.S: Subscriptions to the Samvat smallcases at a 30% discount are only open till November 15 with code DIWALI2023. So hurry and visit the link in our bio to know more!

Festive Demand Keeping Indian Economy’s Spirits Up

We know you must be busy shopping, traveling, or attending celebrations. Before the festivities begin in full swing, let’s take a quick break to learn about interesting spending patterns emerging through this issue. Brew a cup of chai and let’s decode the numbers together!

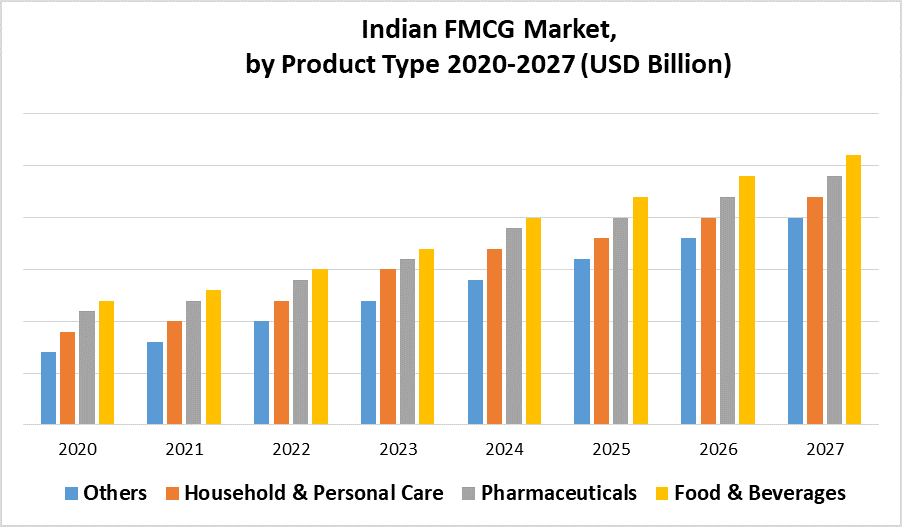

FMCG & Consumption

The festive season brought good cheer for FMCG and auto sectors as sales saw a strong uptick. In the second quarter of 2023, India’s fast-moving consumer goods (FMCG) industry saw a 7.5% consumption growth. This was the highest growth in the last eight quarters and surpassed the country’s price growth. Demand for both food and non-food products increased, with sales of snacks, beverages, and home care products rising 4-5% sequentially. Rural spending power was on the rise too, with core categories in villages witnessing improved trends of 5-7% growth.

Bumper monsoon rains boosted Kharif crop prospects and future rural spending potential considerably. FMCG majors reported a 10% increase in stocking for packaged foods, snacks, and home care products to meet the expected surge in demand of 8-10% during the upcoming festive period. With consumers optimistic and open to splurging, FMCG industries were set for a bumper holiday sales season.

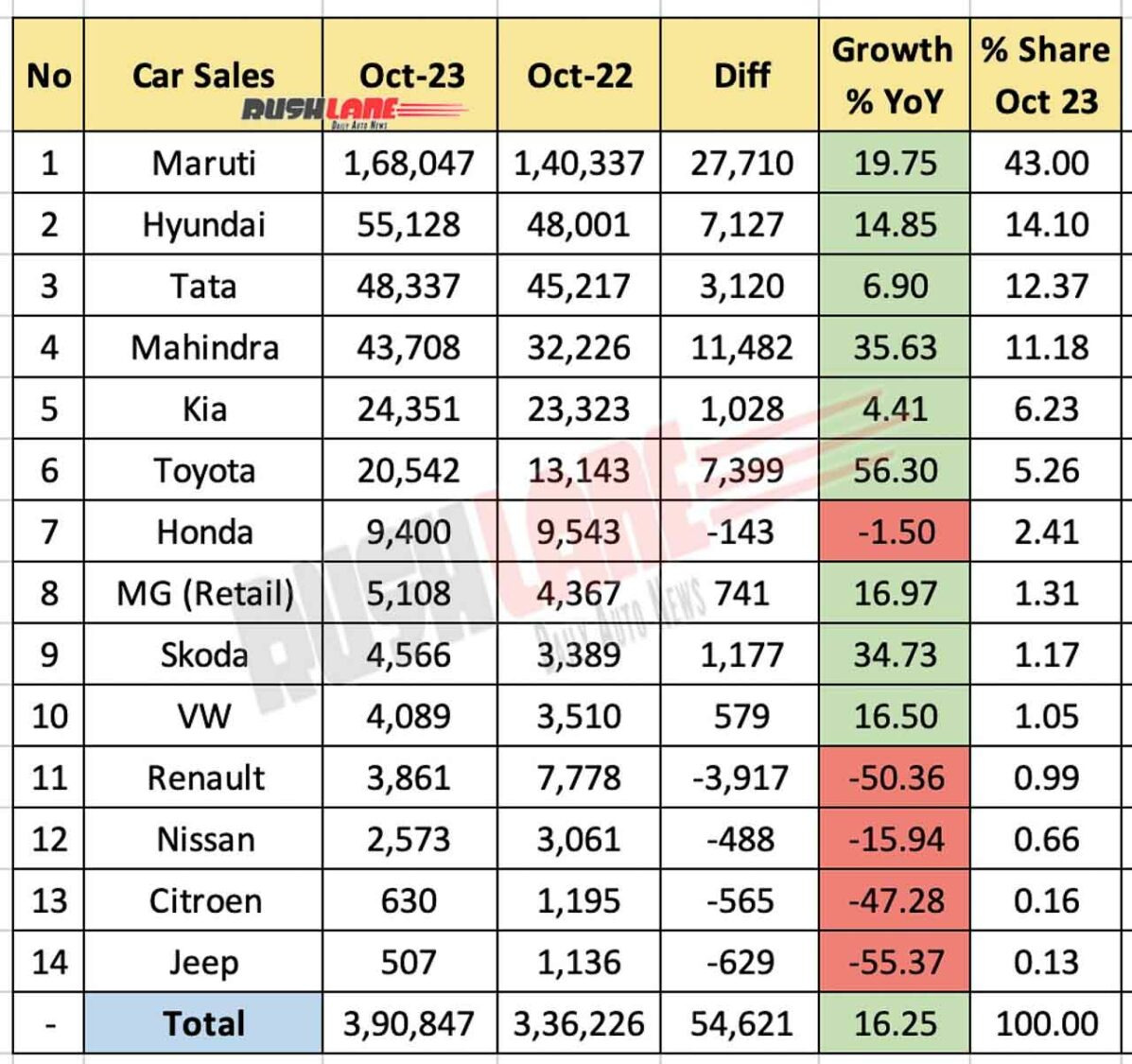

Automobile Sales

The festive season is looking very promising for the automobile industry in India. The passenger vehicle segment continued its strong performance as dispatches to dealerships reached a record high of 391,472 units in October 2023. This was driven by robust demand, easing supply issues, and inventory build-up ahead of the festive season. Every month of 2023 has witnessed record PV wholesale volumes, highlighting sustained growth. SUVs accounted for 50.7% of sales while hatchbacks were at 29%. However, the sedan segment continued declining to just 8.1% share.

Wholesale volumes in November will depend on retail sales in the first half as inventory levels are quite high at present. Dealerships currently hold around 335,000 units of stock, which is the highest in five years. Many families see vehicle purchases during Dussehra and Diwali as an auspicious investment. The high inventory levels at dealerships of around 335,000 units have been built up purposefully to cater to this robust festive demand. The first fifteen days of November are auspicious in North and Central India and could witness a spike in auto sales numbers because of the ongoing festive season.

With many new model launches capturing consumer interest, especially in the popular SUV segment, automakers are confident of a very busy sales season. The high stockpiles are expected to normalize quickly if the festive period sees similar retail success as in previous months. Industry experts believe the coming weeks will likely surpass last year’s sales and see the auto sector ended 2023 on a high note. With economic indicators remaining positive and financing offers attractive, the outlook for passenger vehicle sales remains optimistic.

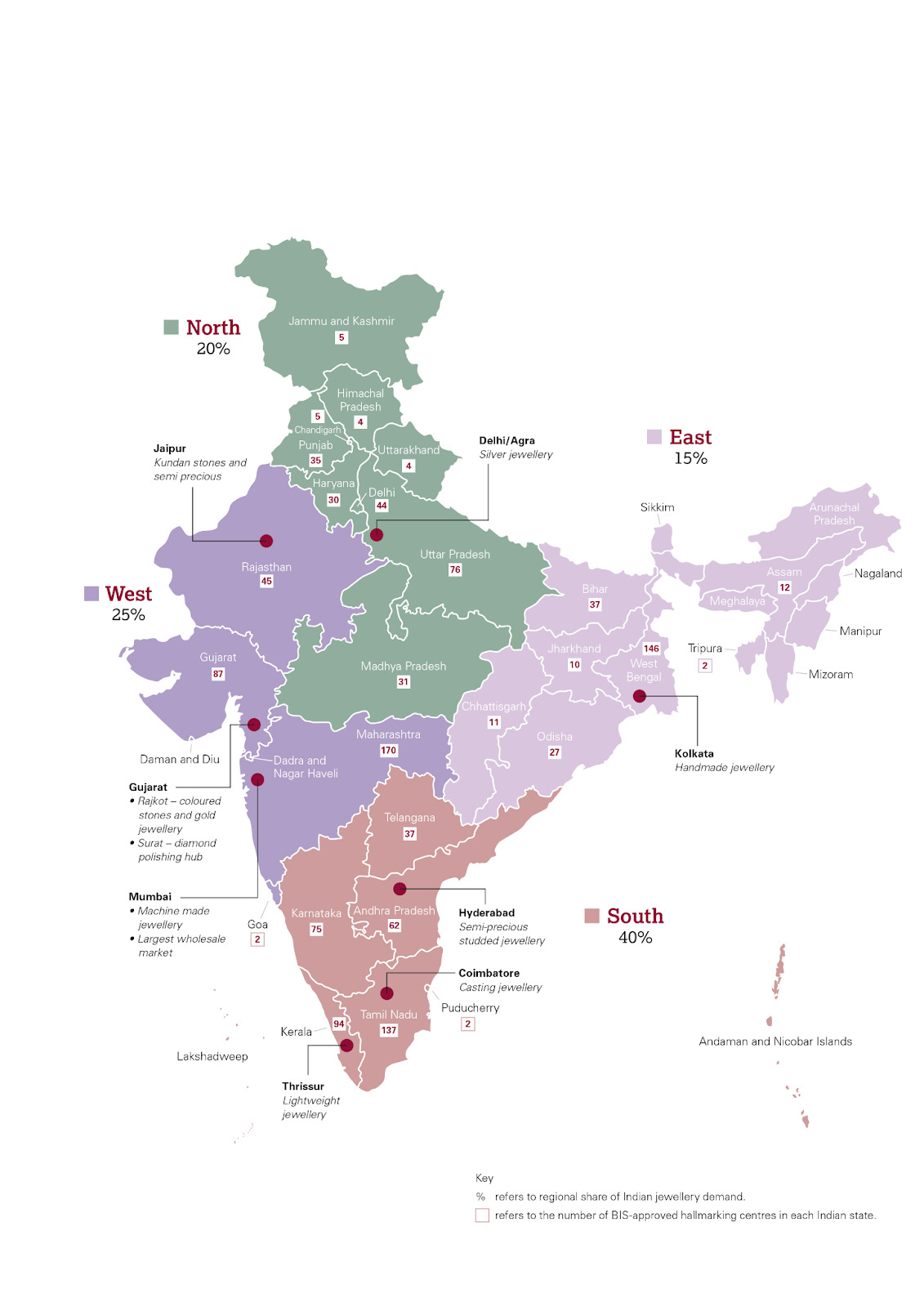

Jewellery Demand

The onset of the festive season with festivals like Raksha Bandhan, Janmashtami, and Ganesh Chaturthi, coupled with a decline in gold prices, has led to increased demand for gold and gold jewellery in India. Gold imports to Gujarat in September rose 52% as prices fell over 10 days. Lower prices have made gold attractive for investing and gifting during the upcoming festivities. Jewellers are leveraging the opportunity to stock up ahead of Diwali and the wedding season. People are taking advantage of discounted gold rates and many are buying coins according to their budgets.

Jewellery companies see a large spike in sales and profits during the festive season in India as lower gold prices and traditions of gifting gold and jewellery result in significantly higher ornament demand across the country. Jewellers are using innovative strategies to attract customers and capitalize on the rising demand before the festive season peaks. Falling silver prices are also boosting purchases of silver jewellery. Analysts expect robust growth in jewellery sales to continue on the back of strong consumer sentiment during the festive period.

Source: https://www.gold.org/goldhub/research/jewellery-market-structure-india-gold-market-series

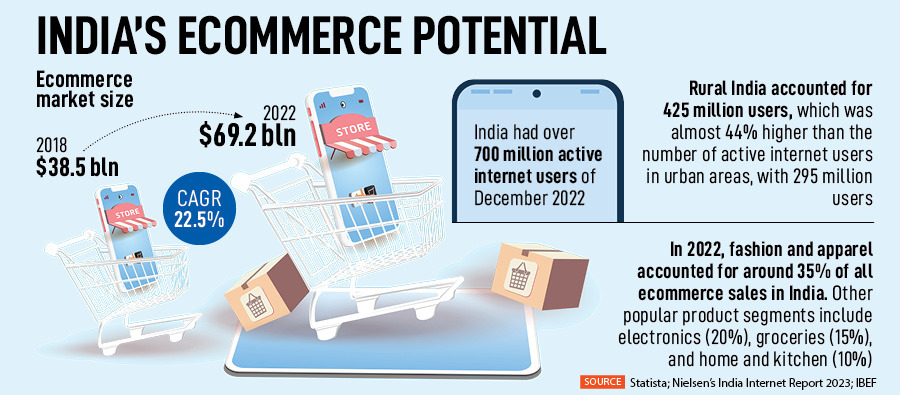

E-Commerce

Smartphones, electronics & appliances contributed 67% to online festive sales of $15 billion. Categories such as smartphones, laptops, televisions, and large domestic appliances accounted for a massive 67% of the total $15 billion worth of sales recorded by major online retailers such as Amazon and Flipkart during the festive sale period in October 2023. Smartphones alone contributed over $6 billion in sales, up by 25% from last year, indicating their growing importance.

Meanwhile, television sales surged by 30% to $3 billion compared to 2022 levels. Clearly, consumers were willing to spend significantly higher amounts on consumer electronics, with smartphones and TVs becoming the top two categories attracting sales of over $9 billion in total. Smartphone purchases saw a significant surge, with sales amounting to $6 billion – an increase of 25% over the previous year’s figures. This indicated rising discretionary spending on such items. Televisions emerged as another strongly sold product, with Indian consumers spending $3 billion – 30% more than the previous year during the festive period alone.

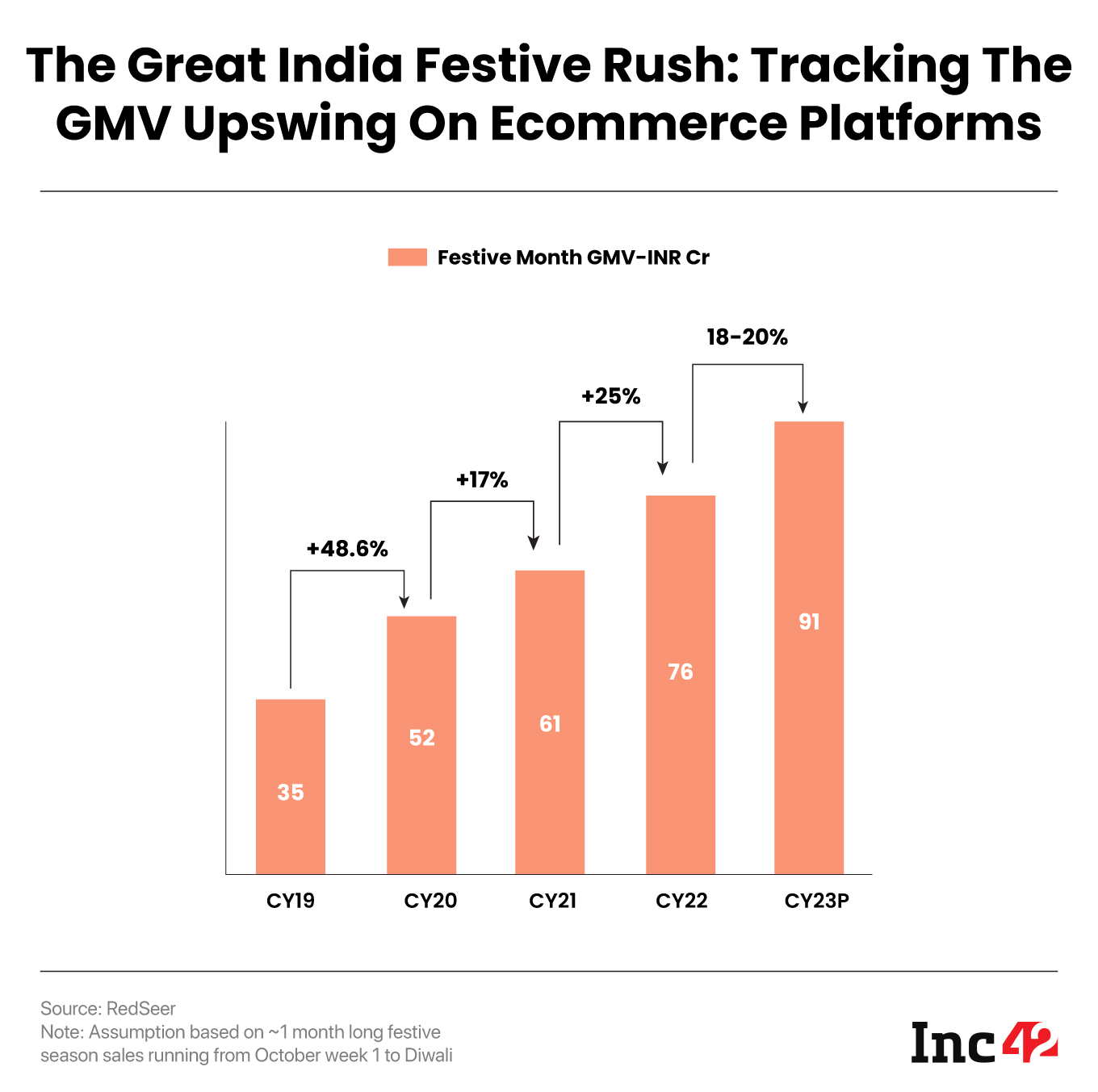

E-commerce platforms in India have been witnessing strong growth in GMV (gross merchandise value), especially during the festive season sales as more customers shift online. Based on last year’s figures, the recent Amazon Great Indian Festival sale clocked an unprecedented $5 billion in sales over a month-long event, marking its highest GMV ever during its signature festive sale. Flipkart’s Big Billion Days also achieved record GMV with $3.2 billion in sales across a 6-day period last year. This increasing online shopping trend witnessed last year is expected to continue on the back of rising smartphone and internet penetration in India.

The Indian Wedding Season

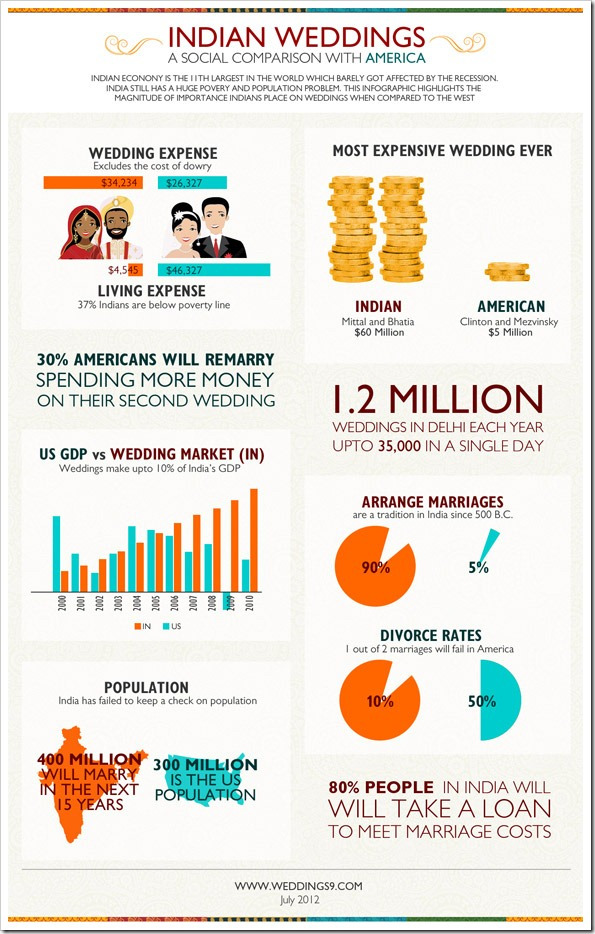

The peak wedding season in India between November 23rd to December 15th was projected to result in approximately 3.5 million bookings for wedding banquet halls and hotels across the country, as people made arrangements for marriage functions during this auspicious period. Market reports indicated around 50,000 high-budget weddings with expenses over Rs. 1 crore each.

Meanwhile, another 1 million weddings would cost around Rs.6.5 lakhs per function. The massive demand during this period is concentrated in tier 1 and tier 2 cities, with states like Rajasthan, Delhi, Mumbai, Bengaluru, and Hyderabad accounting for over 60% of total weddings. These cities see large banquet halls and hotels operating at over 80% capacity to cater to the wedding rush. The overall economic impact of the entire 23-day wedding season stretching from November 23rd to December 15th is estimated to inject a substantial $50 billion into the Indian wedding industry through spending on venues, catering, decor, outfits, jewellery, meals, and other wedding services.

Travel & Tourism

Domestic flight bookings in India saw a sizable 20% Year-on-Year jump during the first week of October 2023, with approximately 12 million citizens estimated to be traveling within the country on domestic routes. The major airports in metros like Delhi, Mumbai, Bengaluru, and Chennai witnessed significant passenger footfall of over 500,000 daily during this period. This surge in domestic air passenger traffic, at a time when the festive season and long holiday weekends were coinciding, clearly indicated the positive impact that cultural festivals had on boosting local and regional tourism.

We believe this trend is likely to continue in the coming years as well with more Indians choosing to travel domestically during festive breaks instead of venturing overseas. This is a positive sign for the tourism industry in India which saw some impact on occupancy levels and revenues during the pandemic. The festive season travel has provided a much-needed boost to hotels, restaurants, tourist attractions, and transportation sectors across the country.

Use ‘DIWALI2023‘ to unlock a 30% discount on the SAMVAT smallcases by Green Portfolio

Explore the Samvat 2080: Mahurat Smallcap Picks! smallcase

Liked this story and want to continue receiving interesting content? Watchlist Green Portfolio’s smallcases to receive exclusive and curated stories!

And for all you Green Portfolio subscribers, we’re rolling out Exclusive Perks!

Use Promocode SCMINT30 on Mint Premium’s 1 Year or 2 Year plan to get 30% OFF on your purchase! Offer Valid until 31st December, 2023.

Green Portfolio is a SEBI Registered (SEBI Registration No. INH100008513) Research Analyst Firm. The research and reports express our opinions which we have based upon generally available public information, field research, inferences and deductions through are due diligence and analytical process. To the best our ability and belief, all information contained here is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable. We make no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results obtained from its use.