Expert Analysis of the Global Macro Events & News affecting the Indian Markets

WEEKLY MARKET SYNOPSIS

| Index | 1 week | 1 month | 1 year | 5 years |

| Nifty 50 | 2.67% | 3.9% | 22% | 79.33% |

| BSE Midcap | 2.33% | 5.61% | 31.18% | 87.82% |

| S&P 500 | 2.79% | 4.13% | 16.16% | 61.26% |

| Nasdaq | 3.41% | 4.22% | 21.78% | 79.33% |

Before I talk about this week’s news, I have another big news to share. Green Portfolio is celebrating its five-year anniversary on 12th of July and our founders will be talking about our journey in a webinar this Sunday. We also have a surprise to thank you all, so tune in on Sunday and if you’ve been having any doubts about investments, smallcases or anything else, ask us anything here!

To set a reminder for the webinar – click here

To submit your questions – click here

Byju’s – The Edtech Giant or a Marketing Scam?

Byju’s, one of the world’s largest Edtech companies, is under the government’s scrutiny. I wish I could tell you the reason, but there’s not one; there are plenty, and I will get to them in a while. Let’s first understand the scale and scope of the company. Byju’s, founded in 2011 by two teachers, Byju and Divya, with the mission to make quality education accessible to students anywhere, became India’s most valuable startup in just ten years.

In 2021, Byju’s was valued at a whopping $22 billion. Cut to June 2023, the company stands at a valuation of $5.1 billion. That is a decrease of $17 billion in less than two years!!! Byju’s has spent nearly three billion dollars on acquisitions. Over the years, it has acquired about a dozen companies to expand its base across the world and stay competitive. Yet, the company sits on a bad reputation of late for several reasons. This made us look into where it all started. So this week, we are discussing the signs and shortcomings that led to Byju’s becoming the falling giant that it is today.

The Red Flags

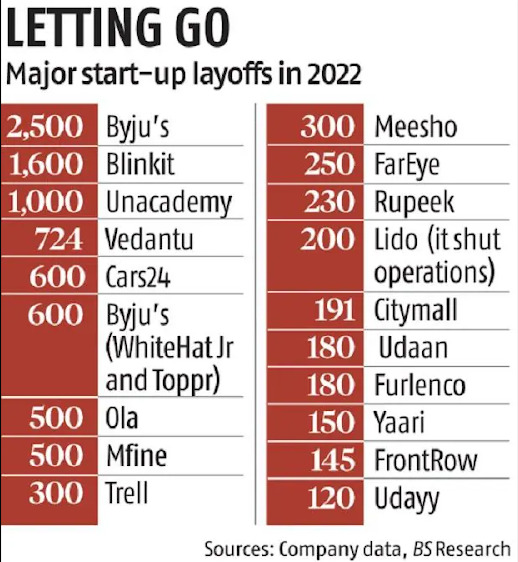

Employee Layoffs

Last year, in October, Byju’s announced that it would lay off 2500 employees in order to cut costs and become profitable. At the beginning of this year, it laid off another thousand employees, citing the same reasons. And this is not even the real red flag here. While on one side the company laid off its employees, on the other hand it sponsored the FIFA World Cup for $30–40 million and signed a deal with the footballer Lionel Messi to be its global brand ambassador. This deal is said to cost Byju’s about $5–7 million per year. Employees were aggravated as the company laid them off but spent heavily on marketing. Byju’s is further planning on laying off another 500–1000 employees.

Defaulting Loan and Interest Payments

Ever heard of a borrower suing its lender? Basically Ulta Chor Kotwal Ko Daatein! Well, as funny as it may seem at first, Byju’s actually did it. At the end of 2021, Byju’s took a Term Loan B of $1.2 billion to fund its operations in the US. Well, the company missed the interest payment of $40 million due on June 5 this year, and the very next day, it announced the filing of a case against its lenders. Byju’s sued the lenders in the New York Supreme Court citing that the lenders have been predatory and have tried to control Byju’s Alpha’s operations in the US, and have deprived them of contractual rights. Thus, it has denied making any payments towards the loan or the interest until the case is resolved.

Resignation of Statutory Auditors

Deloitte, the company that had been auditing Byju’s account since 2016 resigned last month on June 22 as its auditors. The reasons being lack of communication from management’s end and an excessive delay in furnishing the financial statements for FY22, which were due last year. But immediately after Deloitte’s resignation, Byju’s announced the appointment of BDO-member firm MSKA & Associates as its statutory auditor for the next five years. Let’s see what BDO will do differently for the company.

Resignation of Board Members

Right after Deloitte resigned as Byju’s auditors, several members of the board of directors at Byju’s also resigned putting the company into a turmoil. The non-executive investor board members gave the reason of having differences with the CEO Byju Raveendran for their resignation. This leaves only three members on the board now: the founders, Divya and Byju, and Byju’s brother. From what I see, the board’s resignation is indicative of something fishy going on in the company.

Valuation cuts

As of December 2022, US asset manager BlackRock reduced the start-up’s valuation to $11.5 billion as compared to its valuation of $22 billion valuation in April that year. In March ‘23, they further cut down Byju’s valuation to $8.1 billion.

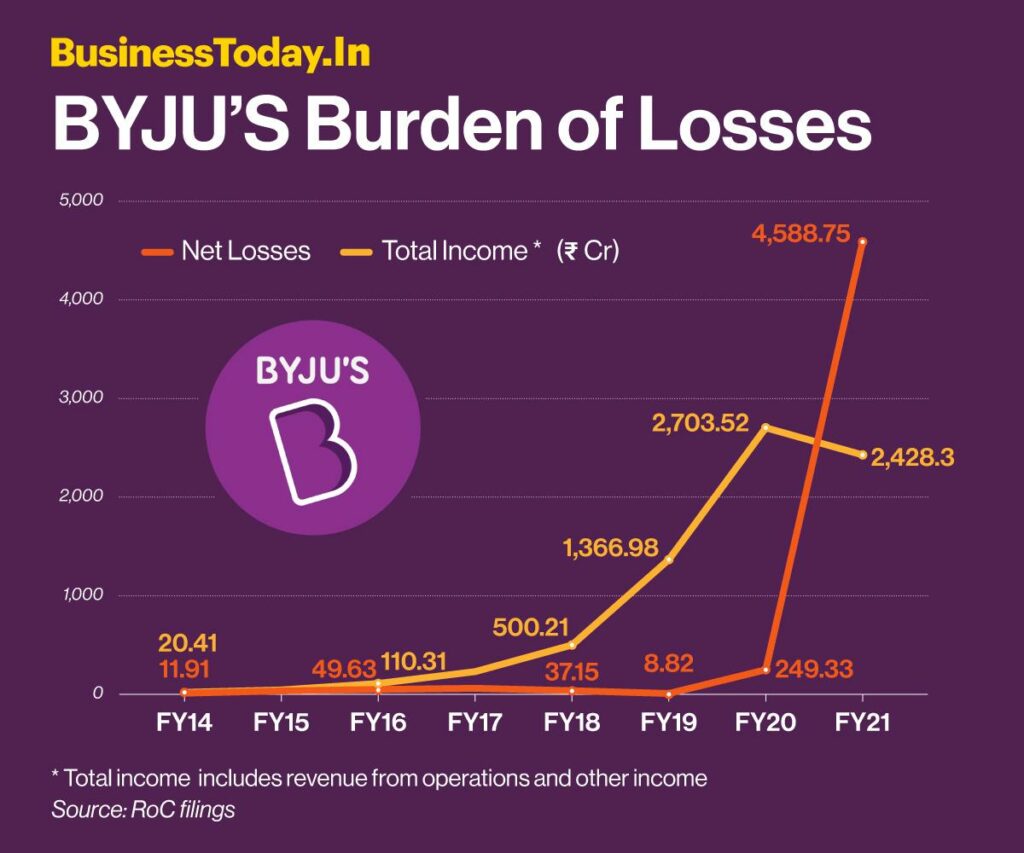

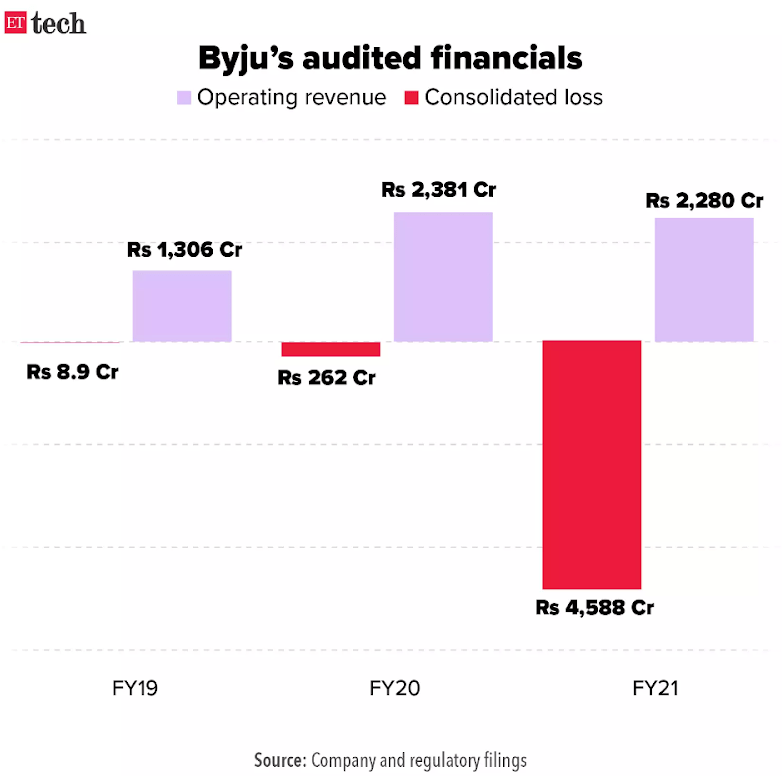

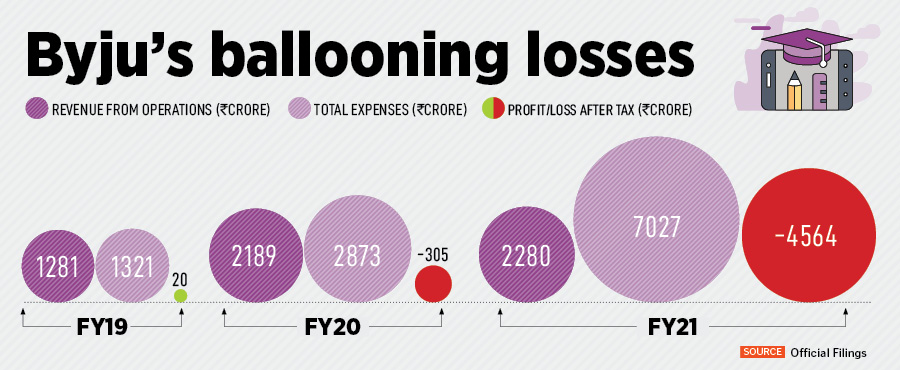

That’s not it, one of Byju’s largest investors, Procus cut their share in the company and also slashed its valuation to just $5.1 billion. This is a fall of over 75% in the valuation. But this may be justified as Byju’s of late has been running in losses.

Byju’s is clearly struggling right now. This situation has come as a result of multiple problems going on in the company, all of which have now come to the surface. The CEO is still positive and has assured his stakeholders that this is just a speedbreaker, but I am not convinced by it at all.

What does this indicate about India’s startup and Edtech space?

India is one of the most startup-friendly countries in the world. This means that several startups flourish in India, but most of them end up dissolving or getting acquired. India’s startup space is quite complex. Edtech in India today is just tuition, coaching, and online courses but it severely lacks innovation. The space has become cluttered with similar startups doing the same things.

With so many startups and so many VCs and angel investors, it’s a deadly competition. Most startups in India have the mindset that they’ll work out because of the country’s population and ever so often, VCs buy into it trying to be adventurous or out of FOMO, which gives a good push to these companies but they’re not able to keep up with it. Bad corporate governance and rampant acquisitions are two reasons why startups don’t work out so often. Look at other startups like BharatPe and GoMechanic, they have had discourses.

The Byju’s turmoil has now made investors more cautious of startups and their operations, but I am sure we still believe in our startups. So, let’s see how it pans out!

Stock Specifics: Precision Camshafts Ltd. – PCL

Your last ride on any vehicle be it a bike, a car or even a truck, the engine of your vehicle had a component called camshaft and there is a 70% chance that the said camshaft was manufactured by Precision Camshafts Ltd. Okay, think about this – all engines necessarily need camshafts to operate, some need one and some as much as four and 70% of camshafts in India are made by PCL. So, am I saying that in a country having more than 300 million motor vehicles, 210 mn of them would have a camshaft made by PCL? Yes! And that is why we’ll be talking about this company today.

Precision Camshafts manufactures and supplies camshafts, balancer shafts, injector components and other automotive and non-automotive components. PCL has also entered the electric mobility market by supplying end-to-end electric drivelines for heavy equipment and vehicles. Over the last few years, PCL acquired companies and expanded its base both in India and abroad.

The stock that gave us almost 300% returns in 2 years!!!

Well, here’s the real reason I am talking about PCL. We started investing in the company in March 2021 in our PMS & Smallcap Compounders smallcase and have just booked profits with 300% returns. This makes the stock special for us.

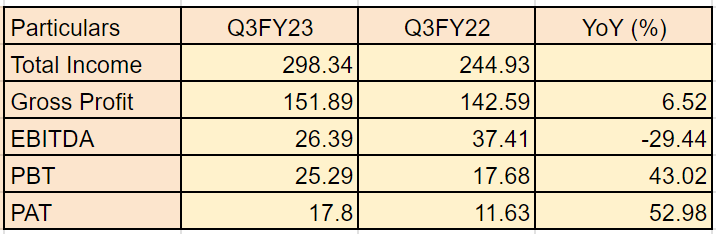

Here are some pointers on the company’s financials:

- PCL crossed a turnover of INR1,000 crores in FY23 with a consolidated turnover of INR 1,103 crores.

- With 14 plants in 3 countries, the company serves over 50 marquee global customers and manufactures over 15 different products.

- PCL is currently setting up its first EV plant in Solapur and will be starting with retrofit, i.e, the conversion of petrol and diesel based vehicles to electric vehicles.

So, what makes Precision Camshafts special?

- PCL has developed new engine components for commercial vehicle braking systems, marking their first foray into non-camshaft parts.

- PCL has been expanding by acquiring companies. It acquired MEMCO of Nashik, a precision machining company in 2017.

- It then formed PCL international based in the Netherlands and acquired MFT of Germany, manufacturers of vehicle components and EMOSS, which offers solutions for electric mobility. This was done in order to get the technical knowledge required for entering the EV sector.

Having a strong hold on the camshaft business, PCL is now looking at the EV sector. We recently had a chat with PCL’s director, Mr. Karan Shah and had a discussion about what’s coming up for the company. We’ll soon be releasing that in Episode 4 of Green Sharks by GP, stay tuned for that!

CURRENT ECONOMIC EVENTS

| EVENT | DATE | SIGNIFICANCE |

U.S. Crude Oil Inventories | July 6 | The Energy Information Administration’s (EIA) Crude Oil Inventories measures the weekly change in the number of barrels of commercial crude oil held by US firms. The level of inventories influences the price of petroleum products, which can have an impact on inflation. |

U.S. Unemployment Rate for June | July 7 | The unemployment rate is the measure of the number of people unemployed and seeking work in the workforce. A higher rate is negative for the USD while a lower rate is positive for it. |

Explore Green Portfolio’s smallcases

Liked this story and want to continue receiving interesting content? Watchlist Green Portfolio’s smallcases to receive exclusive and curated stories!

And for all you Green Portfolio subscribers, we’re rolling out Exclusive Perks!

Use Promocode SCMINT30 on Mint Premium’s 1 Year or 2 Year plan to get 30% OFF on your purchase! Offer Valid until 31st December, 2023.

Green Portfolio is a SEBI Registered (SEBI Registration No. INH100008513) Research Analyst Firm. The research and reports express our opinions which we have based upon generally available public information, field research, inferences and deductions through are due diligence and analytical process. To the best our ability and belief, all information contained here is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable. We make no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results obtained from its use.