Does India’s IT Sector Need a Reset in the Age of AI?

By 2026, India’s IT industry is projected to cross the landmark $300 billion revenue milestone, with 5.8 million professionals powering this economic engine, highlights Nasscom. Yet despite this impressive trajectory, the sector finds itself at a critical inflection point as artificial intelligence (AI) fundamentally reshapes the game’s rules.

With top IT firms returning 75% of their $20 billion free cash flow to shareholders in FY24 rather than reinvesting in AI capabilities, the question arises: Is India’s IT powerhouse preparing for disruption or heading toward disruption amid the AI revolution?

Let’s dive deeper into it.

India’s IT Sector: A Legacy of Global Dominance

India’s IT outsourcing model has been a cash cow and a case study of global dominance for decades. With years of handling everything from software development to managing servers for overseas clients, the IT and business process management (BPM) industry is estimated to grow by 5.1% to $282.6 billion in FY25, up from 4% in FY24, with projections to surpass the $300 billion milestone in FY26.

Led by behemoths like Tata Consultancy Services (TCS), Infosys, Wipro, HCL Technologies, and Tech Mahindra, the industry has become a cornerstone of India’s economic strength, positioning India as the world’s back office while simultaneously building capabilities in digital transformation.

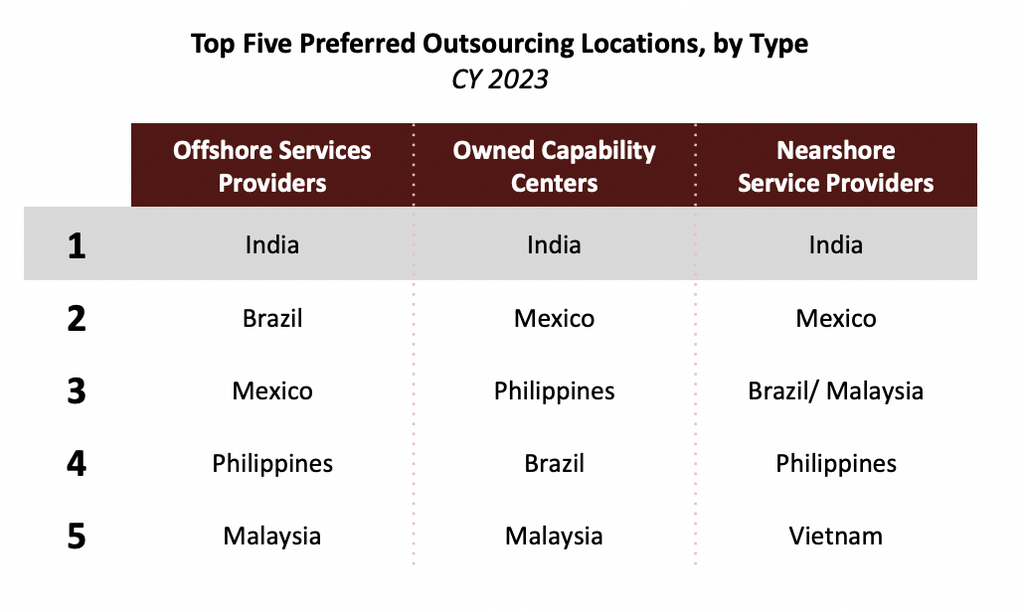

A recent study by Nasscom-Avasant highlighted nearshoring trends, where around 45% of high-tech, travel and transportation companies, along with 41% to 43% of telecom, discrete manufacturing, and construction firms, opted to nearshore to India in 2023.

Nearshoring is a business practice that involves outsourcing tasks to neighbouring or nearby countries rather than distant offshore locations.

This outsourcing boom even birthed the tongue-in-cheek phrase “getting Bangalore-d,” referring to American jobs being offshored to more affordable Indian talent.

Enter AI: A Game-changer

Now, AI has crashed the party in India’s tech scene like a know-it-all intern. From machine learning algorithms in software development to AI-driven automation in business process outsourcing (BPO), this technology is proving to be a game-changer.

In this domain, generative AI is rapidly transforming the fundamental functions that have been the foundation of India’s IT industry. According to an EY report, the AI platform shift is expected to impact 38 million employees but potentially drive a 2.61% boost in productivity by 2030 in the organised sector.

Moreover, as AI costs continue to fall—with OpenAI’s GPT API costs dropping nearly 80% in two years—the technology becomes increasingly accessible to enterprises of all sizes. This democratisation of AI capabilities will likely accelerate its adoption across sectors.

While AI technologies offer opportunities to improve efficiency and reduce costs, they simultaneously threaten to disrupt traditional revenue streams and business models that have sustained the industry for decades.

The Revenue Lens

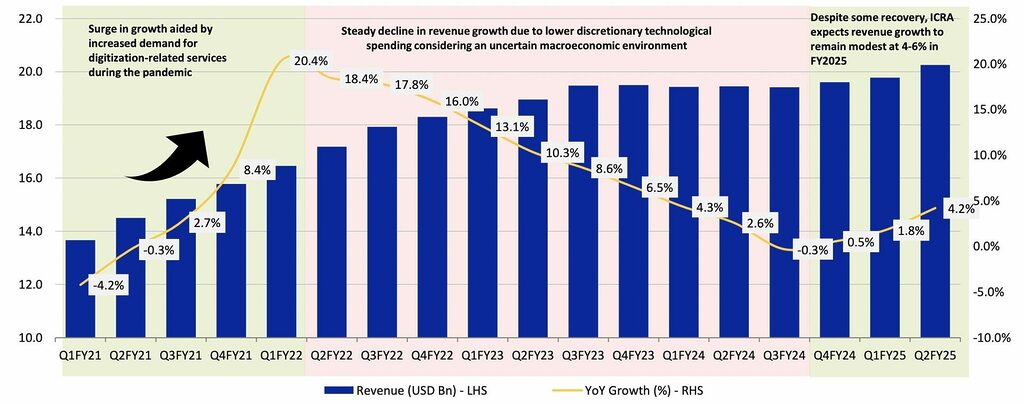

Apart from AI, there are other challenges. ICRA, in its report, highlights that the revenue growth of its sample set of five companies – HCL Technologies, Infosys, TCS, Tech Mahindra, and Wipro – has tapered due to a slowdown in discretionary IT spending in key markets. Higher inflation and interest costs also pressured clients across key industries, resulting in an increasing focus on cost optimisation/critical business projects and the deferment of large discretionary spending.

This is coupled with a key challenge to transform AI from merely a cost-saving mechanism to a revenue-generating opportunity. The transition requires significant investment in AI capabilities, reskilling of the workforce, and the development of new service offerings.

Employment Impact: Job Losses or Role Evolution?

Here’s where the plot thickens. AI’s rise is inevitably linked to jobs – a hot topic on continued mass layoffs or an evolution of roles. Long story short: Layoffs are a reality, but AI technology enables business leaders to restructure and redefine jobs.

For the IT sector, specifically, the challenge is not just about potential job losses, but also the evolution of roles and skills.

Back in 2023-2024, the Indian IT industry added just 60,000 new jobs in the year ending March 2024, which was the lowest annual addition in over a decade. Shockingly, during that same period, the top three IT companies – TCS, Infosys, and Wipro – saw their combined headcount fall by over 60,000, according to a report. Hiring freezes and quiet layoffs had crept in as companies grappled with flattening demand for traditional roles.

But it’s not all doom and gloom. Cut to 2025, the industry is estimated to add 126,000 new jobs in FY25, taking overall employment to 5.8 million.

ICRA also adds that as Gen AI makes rapid inroads, all leading IT services companies are upskilling their employees for tech skills as they explore AI-driven business opportunities. This is likely to lead to an overall moderation in fresh hiring, as compared to pre-Covid levels.

However, the nature of these jobs is evolving rapidly, with calls for AI specialists, data scientists, machine learning engineers, and even “prompt engineers” booming. This demand is expected to rise by 30-35% in 2025.

Infosys, for example, rolled out an AI-first upskilling program for its 300,000+ staff, even using its own AI platform to personalise employee learning paths. Many tech companies have stated that generative AI is improving productivity, and they don’t need to hire as many people per unit of revenue growth anymore.

Yet, optimistic scenarios exist. A recent study by ServiceNow painted a rosy picture, predicting 2.73 million new tech jobs in India by 2028 thanks to AI – suggesting AI could be a net job creator in new areas.

The truth likely lies in between – Specific job categories will diminish (expect fewer routine coders and call centre reps), while new categories we haven’t imagined will emerge.

Furthermore, the government’s Economic Survey 2025 explicitly urged a “moderate” pace of AI adoption in enterprises so that the pursuit of profit doesn’t leave India’s labour force worse off.

There’s even talk of a “tripartite compact” – a three-way partnership between government, industry, and academia – to ensure AI-driven productivity gains are widely shared, not concentrated.

Future of India’s IT Sector in the AI Era

So, what lies ahead for India’s IT sector as it grapples with AI – a decline, a rebirth, or something in between?

Answer: Indian IT is reinventing itself and leading the AI revolution rather than getting run over by it.

TCS’s COO recently said their internal target is to have AI assist in every project, effectively making it an “AI-augmented workforce” company.

Infosys launched “Topaz” (an AI-first service suite) to help clients adopt generative AI at scale.

Thus, for the sector to thrive, companies will need to make strategic pivots in several areas:

- Investment prioritisation: Revisit capital allocation strategy. Companies may need to increase investments in AI research, development, and implementation.

- Business model innovation: IT firms must develop outcome-based pricing models that align with the value delivered through AI-enhanced services.

- Domain specialisation: As general IT services become increasingly commoditised and automated, companies must develop more profound expertise in specific domains or industries.

- Ecosystem development: Building partnerships with AI startups, research institutions, and clients will be crucial to collaborating on solutions.

What’s in Store for Investors?

From an investor standpoint, the AI disruption creates both challenges and opportunities in the Indian IT sector. In the short term, the high shareholder returns from IT companies make them attractive dividend plays. However, the long-term sustainability of these returns depends on how effectively these companies navigate the AI transition.

Investors should monitor some key indicators:

- AI investment trajectory: Companies investing meaningfully in AI capabilities, even at the expense of short-term margins, may be better positioned for long-term growth.

- Workforce metrics: Changes in revenue per employee and the evolution of the skills mix within the organisation can provide insights into how successfully a company is integrating AI into its operations.

- New business models: The emergence of AI-native service offerings and shifts in pricing models may signal a company’s adaptability and innovation capacity.

- Client adoption: The speed at which clients embrace AI-enhanced services will ultimately determine the pace of industry transformation.

Final Thoughts: Navigating the Great Reset

In conclusion, artificial intelligence is undeniably shaking up India’s IT sector – forcing a relook at how revenue is earned and how work is done.

Despite global headwinds, the country has cemented its position as one of the top leaders, contributing 36% of the global IT services brand value—an achievement driven by a 14% surge in brand strength, as per Brand Finance 2025, due to a renewed economic outlook for 2025-2027.

The real question is, will this AI reset be proactive or reactive?