Digging deep into India’s metal sector

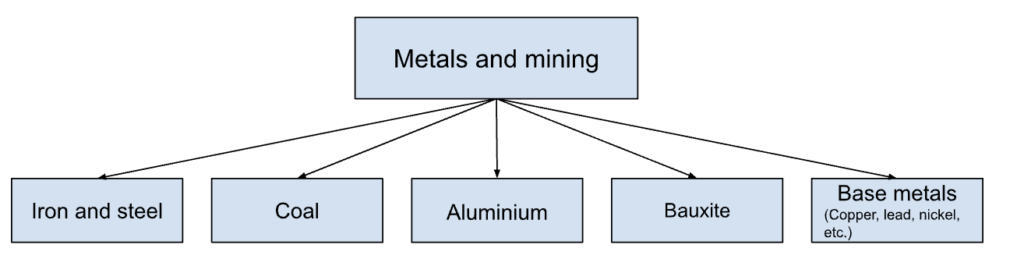

The metals and mining sector serves as the backbone of India’s industrial and infrastructural growth. The sector provides essential raw materials to various industries – from cement in the construction sector to steel in the automobile sector. Therefore, the growth of the metals industry is crucial for the overall industrial development of any nation. Fortunately, India is blessed with vast reserves of both metallic and non-metallic minerals, providing a solid foundation for the growth of the metals and mining sector. India has the world’s seventh-largest reserve base of bauxite, fourth-largest reserve base of iron ore, and fifth-largest reserve base of coal. The availability of such diverse minerals enhances India’s self-sufficiency and reduces dependence on imports. A sufficient supply of these materials also reduces the overall costs of infrastructural projects and also ensures the timely execution of such projects.

In this article, we will explore the metal sector’s contribution to various industries, highlight key government initiatives, and identify growth drivers for the sector.

Major segments of the industry

Growth drivers

Infrastructure development – The infrastructure sector in India is expected to grow at a CAGR of 8.2% by 2027, thanks to government initiatives such as the PM Gati Shakti, Housing for All, National Infrastructure Pipeline, etc. These initiatives are bound to increase the construction of homes, roads, airports, and railways – the process of which requires substantial amounts of steel and construction materials.

The surge in infrastructure development directly translates into increased demand for metals and minerals, driving the growth of the metal and mining sector in India. As a result steel consumption is expected to reach 230 million tonnes by 2030 from a current 119 million tonnes in 2023. Additionally, projections indicate that aluminium consumption in India will more than triple from 2.6 million tonnes in 2021 to reach an impressive 9.5 million tonnes by 2030.

Growth in power demand – India is currently the third largest consumer of electricity in the world, after China and the United States. India is expected to surpass the United States by 2030 and become the second-largest consumer of electricity in the world. The demand for electricity is witnessing a steady rise due to the electrification of rural areas, coupled with rapid urbanisation and industrial growth. The surge in power demand will also increase the demand for coal as it is the primary source of electricity generation in India, accounting for 60% of total power generated.

In addition to this, metals like copper are used in electrical wiring, transformers, power cables, and conductors. Hence, India’s per capita copper consumption is also projected to reach around 1 kg in coming years from the current 0.6 kg, driven by increased demand for power.

Favourable government policies – The government has created several favourable policies such as The Mines and Minerals Development & Regulation Act (MMDR) 2021, along with the National Mineral Policy, 2019 to facilitate the growth of the metals and mining sector. The policies help to streamline mining operations, enhance transparency, and promote sustainable practices. Additionally, the government has allowed FDI of up to 100% in exploration, mining, minerals processing, metallurgy, and exploration of metal and non-metal ores under the automatic route. Moreover, the removal of export duties for certain metals like steel can significantly enhance the global competitiveness of the Indian metals sector.

As the nation continues to evolve, the metals and mining sector will continue to be the backbone of progress, driving infrastructural development, creating employment opportunities, and contributing to overall economic progress.

Explore Windmill Capital’s Metal Tracker smallcase

Liked this story and want to continue receiving interesting content? Watchlist Windmill Capital smallcases you’d like to read more stories about!

Windmill Capital Private Limited is a SEBI registered (SEBI Registration No. INH200007645) Research Analyst

Address: No 51, 3rd Floor, Le Parc Richmonde,

Richmond Road, Shanthala Nagar, Bangalore – 560025

Phone: +918041279566 CIN – U74999KA2020PTC1323

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Visit bit.ly/sc-wc for more disclosures.

The content in this article is purely the author’s personal opinion and is for informational and educational purposes only. It should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy / sell any security or financial products. The views and opinions stated in the content belong to the author. Smallcase Technologies Private Limited does not uphold nor promote any of the views / opinions.