Cinema vs. OTT: Is the Big Screen Fading in India? 🍿

TL;DR: The magic of cinema in India is at a crossroads, with OTT platforms challenging traditional theaters. Despite increased moviegoers in India since 2019, rising costs and premium offerings by multiplex chains like PVR Inox are making the big screen experience a luxury for many. PVR Inox, facing stiff competition from OTT platforms. A Windmill Capital survey revealed cost-conscious audiences, with many prioritizing cinema experiences but cutting back due to high prices. The future of Indian cinemas will depend on balancing premium and affordable experiences to sustain widespread appeal.

For generations, the darkened cinema hall has been a haven for storytelling in India. From the larger-than-life heroes of Bollywood to the niche dramas of regional cinema, the big screen has served as a window to new worlds and a shared experience for millions. However, the winds of change are blowing, and the question arises: is the magic of the cinema becoming a luxury reserved for the privileged few?

The Rise of OTT and the Challenge of Affordability

The rise of OTT platforms like Netflix and Amazon Prime has undeniably impacted moviegoing habits. With vast libraries of content readily available at home and often at a lower cost, the convenience factor of OTT is undeniable.

However, a report by S&P Global Market Intelligence paints a more complex picture. While cinema attendance hasn’t fully recovered globally, India stands out as a market where frequent moviegoers have actually increased since 2019. This can be attributed to several factors:

Cultural Significance: Cinema holds a unique place in Indian society, offering a social experience and a sense of community.

Limited Alternatives: In smaller towns and rural areas, access to high-speed internet and quality home entertainment setups might be limited, making theaters the primary source of big-screen entertainment.

The Power of Regional Cinema: The growth of regional language films that resonate strongly with local audiences continues to fuel cinema attendance.

The Price of Popcorn and Plush Seating

Despite this continued love for the big screen, a growing concern is the increasing cost associated with the cinematic experience itself. Multiplex chains seem to be prioritizing a more affluent audience, offering premium amenities like plush seating, gourmet food, and advanced projection formats like IMAX. While this caters to a specific segment, it comes at a price. Ticket prices can soar to ₹2,500 with food and beverages adding significantly to the cost.

This trend threatens to alienate budget-conscious moviegoers, particularly those in smaller towns where regular cinemas are already facing closure due to a lack of new releases.

The PVR INOX Story

PVR Cinemas, short for Priya Village Roadshow, is one of India’s largest and most prominent multiplex chains, known for revolutionizing the movie-watching experience in the country. Founded in 1997 as a joint venture between Priya Exhibitors Private Limited and Village Roadshow Limited, PVR has grown to become a significant player in the Indian entertainment industry.

PVR Inox: A Proxy for the Indian Movie Industry

While there are other smaller companies listed in the market from the movie industry, they are just the cogwheels, compared to PVR’s scale & scope of business. PVR’s performance is often seen as a barometer for the health of the Indian movie industry as a whole.

Over the past decade, PVR Inox’s journey can be divided into two phases. From 2015 to 2019, standalone PVR’s revenue doubled and profit increased 14-fold, with an average return on equity of 11% and a low debt-equity ratio. Consequently, its stock price tripled between June 2015 and February 2020.

Then, COVID-19 hit. The pandemic halted revenues entirely while fixed costs like screen rentals persisted. PVR had to negotiate rent waivers and increase its debt significantly. Concurrently, the rise of OTT platforms reduced the appeal of theaters, leading to a 27% drop in PVR’s stock price since February 2020. PVR’s revenue streams include ticket sales, F&B spending, and ad revenue, all dependent on footfall and spending per customer.

Decoding the Numbers – Why Ticket Prices Stagnated

Footfall multiplied by Average Ticket Price (ATP) gives us the total amount that PVR earned via ticket sales. While footfalls fell steeply during COVID-19, they have significantly recovered in the last 2 years, however, ATP is lower than FY18 levels. What could be the reason?

The answer is a combination of the growth of OTT platforms and changing viewer behavior.

During the pandemic, OTT platforms surged in size and preference, with their share in film revenue rising significantly. The digital subscription market grew from ₹1420 cr in 2018 to ₹7600 cr by 2023, and analysts expect continued growth. Well-funded OTT companies are investing heavily in content creation and competitive bidding to expand their subscriber base. The shift to digital platforms and underwhelming responses to Bollywood movies have led many high-profile films to release directly on OTT. These platforms are also investing significantly in original content to enhance their libraries and attract more subscribers.

A study by Motilal Oswal found a low tolerance for subpar content, with collections for movies rated below 5 on IMDb dropping by 90% in FY22. While average ratings for top movies remained stable, overall collections fell by 30%. The number of movies rated 7 or higher decreased from 2018 to 2022, suggesting a decline in quality. Despite this, collections for good movies remained stable due to high ticket prices, and the average collection per movie improved, indicating that high-quality content was well rewarded.

Beyond Popcorn – F&B in Focus

In the face of flat ATP, F&B has become quite a focus point for the multiplexes to sustain revenues. One of the Mint articles puts this aptly:

‘Multiplex chains are seeing revenue from the sale of food and beverages grow faster than earnings from ticket sales, indicating the failure of movies to capture audience attention. And it isn’t just about selling popcorn and cola at the Cineplex. Theater owners are increasing F&B sales through gourmet food created by star chefs, tie-ups with aggregators for home delivery, outdoor catering, kiosks in malls, etc.’

However, the contribution from F&B or Spend Per Head has not been consistently increasing due to lower occupancy percentage.

Merging of the Goliaths

In order to tide over these issues, PVR decided to merge with INOX Leisure Ltd (INOX) in March 2022. The merger was completed in March 2023. This merger has created the largest multiplex chain in India. With more than 1700 screens, the merged entity commands 18% screen share and 30% revenue share in the box office collection.

However, the benefits of the merger are yet to be seen. Over the last 4 quarters, the average occupancy % has been just 25.6%. Lackluster performance in the Bollywood segment, ICC World Cup, IPL, and general elections have all contributed to this poor performance. The company’s business model is highly sensitive to occupancy rates, as a large portion of its costs remain fixed in nature. The business operates on high capex and heavy fixed costs, with rentals making up nearly 20% of costs. Thus, any softening of occupancy has a stronger impact on earnings. The company has declared a loss in 2 of the last 4 quarters. A combination of a high debt burden and volatile content supply resulted in ₹ 3.26 cr loss during FY24.

A Battle for Viewers

Despite offering a superior movie-watching experience and limited recreation alternatives in India, PVR Inox faces significant challenges from the growing OTT ecosystem. Increasing OTT viewership and market size attract top talent and high-quality content, making OTT platforms strong competitors in a price-sensitive market. Major players like Netflix, Amazon, and Disney are investing heavily, which pressures PVR Inox. The multiplex business’s high fixed costs mean that any reduction in occupancy due to OTT competition will adversely impact profitability and growth.

The audience filtration process has also become tighter due to the proliferation of social media, where decision-making is based on word of mouth. In response to these challenges, PVR Inox is shifting to a more capital-light model by partnering with developers for new screen investments. This strategy aims to increase theater footfalls and share risks with mall developers. However, the effects of these initiatives will take time to manifest, as currently, only a few screens in their portfolio are part of this new arrangement.

Windmill Capital’s Survey

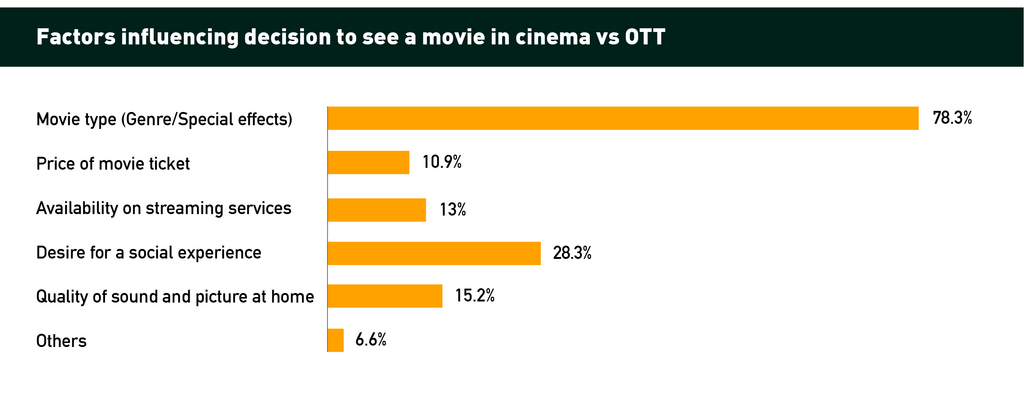

We conducted this survey to gain a deeper understanding of moviegoing trends and consumer preferences amid growing competition from OTT platforms. The survey helped us analyze how often people go to the movies, what influences their decisions, and gauge price sensitivity. Insights on the amenities consumers are willing to forgo for lower ticket prices allow cinemas to tailor their offerings. Understanding demographic and geographic variations aids in targeted marketing strategies, while comparing factors influencing the choice between cinemas and streaming.

Here are the results

This survey revealed a cost-conscious audience. While 80% prioritize big-screen experiences for certain films, especially those heavy on visuals or action, rising ticket prices have led 42% to cut back on moviegoing and 31% to become choosier about their theatrical selections. However, looking at PVR’s average ticket price, we notice that it hasn’t changed much over the years and has remained relatively flat around the 200 rupee mark. What did change is the F&B price, which drives the expense of watching a movie in a cinema hall to 1000 rupee for a family of two, while the same movie can be watched at home at half the price even if the couple plans to order food at home.

Interestingly, the social aspect remains somewhat important, with 29% valuing the shared experience. When it comes to saving money, a majority (65%) would forgo gourmet food options, and over half (51%) wouldn’t mind using self-service kiosks instead of cashiers. These findings highlight the need for theaters to explore tiered pricing models, budget-friendly concessions, and self-service options to address affordability concerns without sacrificing the magic of the big screen.

A Divided Future: Segmentation or Sustainability?

Multiplex chains often advocate for a “segmentation” strategy, believing some viewers seek luxury while others prioritize affordability. However, historical trends suggest more affordable theaters could help multiplexes maintain occupancy and recover lost revenue in a challenging market. Reduced prices for budget-friendly screens, in line with lower urban occupancy rates, could attract a broader audience. Moreover, multiplexes should strategically expand their regional language film offerings to appeal to diverse audiences, especially those beyond Bollywood’s traditional reach. This shift could fill theater seats and reflect India’s evolving film landscape.

In conclusion, the fate of cinemas in India hinges on balance. While catering to premium audiences has its merits, addressing affordability and the broader market’s needs is crucial for sustaining the magic of the big screen. The challenge lies in ensuring that the cinematic experience remains an inclusive, cherished tradition for all.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of a SEBI recognized supervisory body (if any) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital Team: Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.