Budget ’22 – Decoded for you

Budget ‘22 was quite the event and the country didn’t expect any less. This year the focus was on inclusive development, productivity enhancement, energy transition and climate action – “this gives a blueprint of the economy from India at 75 to India at 100”, our Finance Minister, Nirmala Sitharaman said.

With speculations flying around about the future of various markets, cut out the extra information. Here are some of the key themes and sectors that are likely to be impacted after Budget ‘22 – hear it from India’s top professionals.

Already made up your mind about investment opportunities from Budget ‘22? Check out this exclusive collection made for you.

Capex-driven Budget –

“It’s a capex-boosting budget” – Wright Research

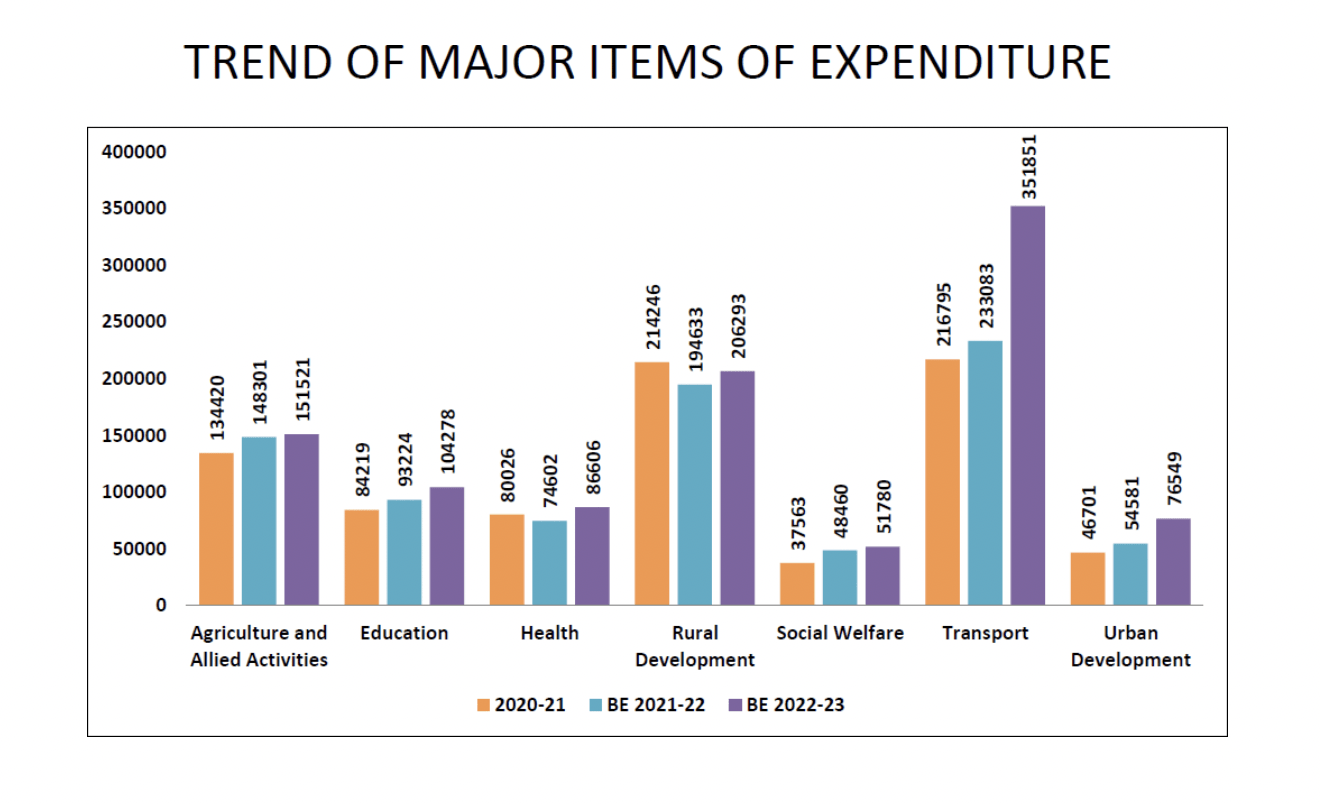

The Indian economy is expected to grow at 9.2 per cent in FY22. The priority in the budget was to sustain the high growth. The major thrust was on reviving the capital expenditure cycle in the country. The rise in capital expenditure helps to crowd in private investment. The virtuous cycle of investments begins in the economy.

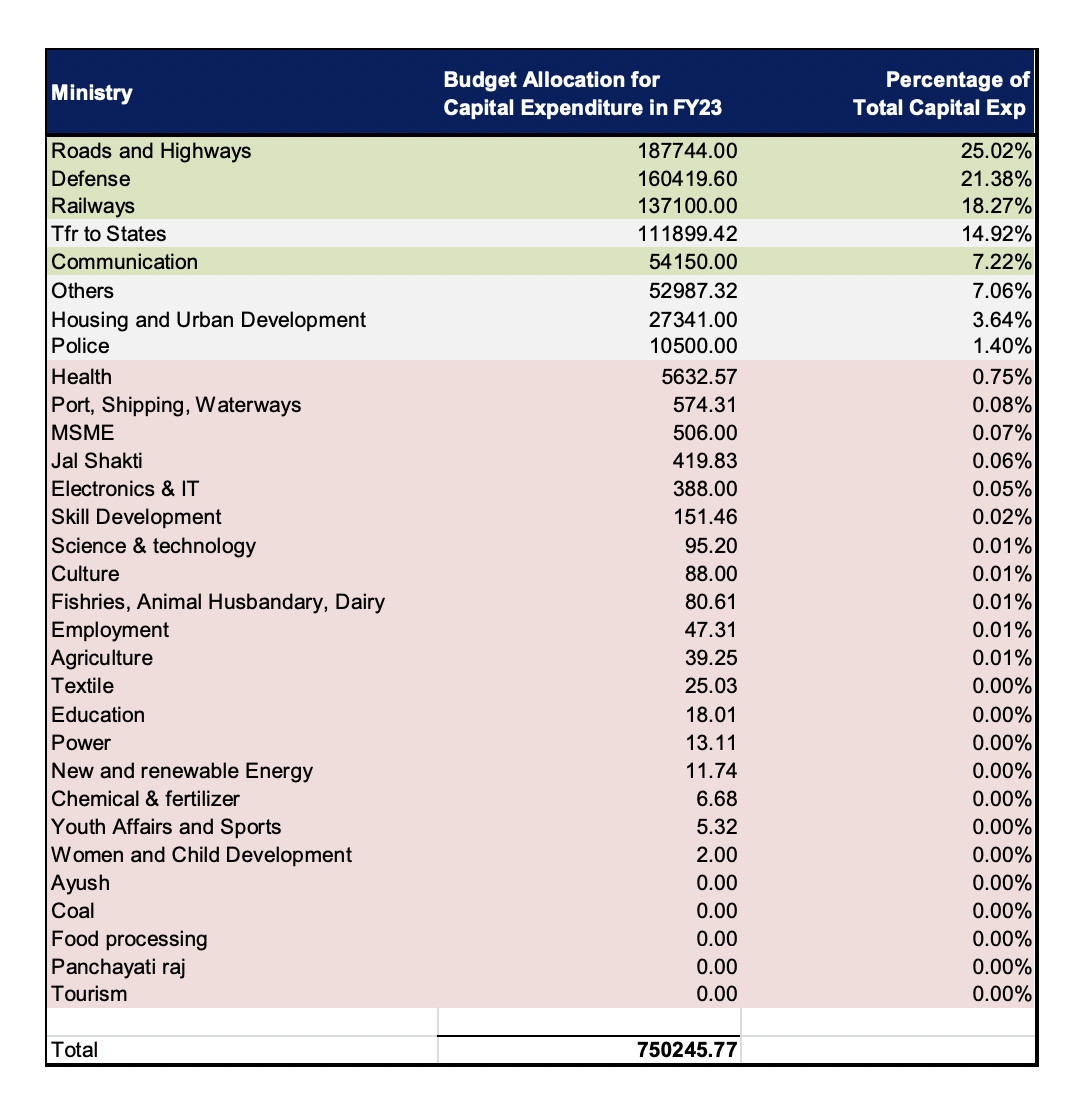

This is a Capex boosting budget which is prudent in other expenditures as the FM looks to contain the fiscal spending while enhancing growth. Therefore, the FM has increased the Capex investment target by 35% to 7.5 lac crore and announced critical investments and policies for infrastructure development via railways, metro systems, highways primarily through the PM Gati Shakti initiative. Railway and Logistics linked stocks, Capital Goods, Cement, and Real Estate will gain with this.

Capex has a higher multiplier effect on economic output over revenue spending. The capital spending push will also induce demand for services and manufactured inputs from large industries and micro, small and medium enterprises (MSMEs), while helping farmers through better infrastructure.

Infrastructure –

“Remember the growth China had post the Asian and Global financial crises? That’s the growth that this infrastructure impetus will bring to India over the next two decades” – Green Portfolio

The outlay for capital expenditure in the Union Budget is once again being stepped up sharply by 35.4% from Rs.5.54 lakh crore in the current year to Rs.7.50 lakh crore in 2022-23. This has increased to more than 2.2 times the expenditure of 2019-20. This outlay in 2022-23 will be 2.9% of GDP.

With this investment taken together with the provision made for creation of capital assets through Grants-in-Aid to States, the ‘Effective Capital Expenditure’ of the Central Government is estimated at Rs.10.68 lakh crore in 2022-23, which will be about 4.1% of GDP.

For financing the infrastructure needs, the stepping-up of public investment will need to be complemented by private capital at a significant scale. Measures will be taken to enhance financial viability of projects including PPP, with technical and knowledge assistance from multilateral agencies.

“Enhancing financial viability shall also be obtained by adopting global best practices, innovative ways of financing, and balanced risk allocation” – Windmill Capital

The outlay for ‘Scheme for Financial Assistance to States for Capital Investment’ is being enhanced from Rs.10,000 crore in the Budget Estimates to Rs.15,000 crore in the Revised Estimates for the current year. For 2022-23, the allocation is Rs.1 lakh crore to assist the states in catalysing overall investments in the economy. These fifty-year interest free loans are over and above the normal borrowings allowed to the states. This allocation will be used for PM GatiShakti related and other productive capital investment of the states.

Digital India –

“The government is now in a hurry to catch the digital train it has been missing for the past more than a decade” – Adroit Financial Services

The FM, Nirmala Sitharaman, has focused on fintech instead of banking, EVs instead of transport, and edtech instead of education. This has brought back focus to the new-age innovative sectors.

In recent years, digital banking, digital payments and fintech innovations have grown at a rapid pace in the country. Government is continuously encouraging these sectors to ensure that the benefits of digital banking reach every nook and corner of the country in a consumer-friendly manner. Taking forward this agenda, and to mark 75 years of our independence, it is proposed to set up 75 Digital Banking Units (DBUs) in 75 districts of the country by Scheduled Commercial Banks.

The government appears willing to be a part of the global digital transition. Initiative to increase the use of digital technologies in key sectors like education, health, logistics, agriculture is a good omen. Infrastructure status to data centers is a step in the right direction.

“Recognition of animation, visual effects, gaming, and comic (AVGC) sector as a high potential employment opportunity for youth; introduction of digital currency; and recognition of virtual digital assets (VDAs) like cryptocurrencies and NFTs, as legitimate assets, demonstrate the change in bureaucratic mindset” – Adroit Financial Services

The financial support for the digital payment ecosystem announced in the previous Budget will continue in 2022-23. This will encourage further adoption of digital payments. There will also be a focus to promote use of payment platforms that are economical and user friendly.

Required spectrum auctions will be conducted in 2022 to facilitate rollout of 5G mobile services within 2022-23 by private telecom providers.

A scheme for design-led manufacturing will be launched to build a strong ecosystem for 5G as part of the Production Linked Incentive Scheme.

To enable affordable broadband and mobile service proliferation in rural and remote areas, five per cent of annual collections under the Universal Service Obligation Fund will be allocated. This will promote R&D and commercialization of technologies and solutions.

The contracts for laying optical fibre in all villages, including remote areas, will be awarded under the Bharatnet project through PPP in 2022-23. Completion is expected in 2025. Measures will be taken to enable better and more efficient use of the optical fibre.

“Introduction of Central Bank Digital Currency (CBDC) will give a big boost to digital economy” – Windmill Capital

Digital currency will also lead to a more efficient and cheaper currency management system. It is, therefore, proposed to introduce Digital Rupee, using blockchain and other technologies, to be issued by the Reserve Bank of India starting 2022-23.

Transport and logistics –

“Logistic parks, use of technology, reduction in documentation under PM Gatishakti is a huge positive for the logistics companies” – Green Portfolio

PM GatiShakti’s approach is driven by seven engines – Roads, Railways, Airports, Ports, Mass Transport, Waterways, and Logistics Infrastructure. It will also include the infrastructure developed by the state governments as per the GatiShakti Master Plan. The focus will be on planning, financing including through innovative ways, use of technology, and speedier implementation.

The touchstone of the Master Plan will be world-class modern infrastructure and logistics synergy among different modes of movement – both of people and goods – and location of projects. This will help raise productivity, and accelerate economic growth and development.

The National Highways network will be expanded by 25,000 km in 2022-23. Rs.20,000 crore will be mobilized through innovative ways of financing to complement the public resources.

The data exchange among all mode operators will be brought on Unified Logistics Interface Platform (ULIP), designed for Application Programming Interface (API). This will provide for efficient movement of goods through different modes, reducing logistics cost and time, assisting just-in-time inventory management, and in eliminating tedious documentation.

Contracts for implementation of Multimodal Logistics Parks at four locations through PPP mode will be awarded in 2022-23. One hundred PM GatiShakti Cargo Terminals for multimodal logistics facilities will be developed during the next three years.

Clean Energy –

“Energy transition, energy efficiency, electric mobility, and supporting renewable energy infrastructure was the key theme of the budget 2022-23. Promoting energy transition and climate action was one of the key focus areas” – Niveshaay

280 GW solar capacity target by 2030 – Under PLI Scheme, the government approved the proposal of an additional allocation of Rs. 19,500 crores. Earlier allocation was Rs 4,500 cr. The government will give priority to fully integrated manufacturing units from polysilicon to solar PV modules.

25% and 40% BCD (Basic customs duty) on Solar cells and Solar Modules to promote domestic manufacturing of solar modules. This is a big step. And, we believe it will help India to become a leading player in the solar equipment manufacturing industry.

Focus on ESG Investing – Sovereign Green Bonds will be issued for mobilizing resources for green infrastructure. The proceeds will be deployed in public sector projects which help in reducing the carbon intensity of the economy.

Blending of fuel is a priority of this Government. An additional Basic Excise Duty of Rs. 2 per litre on unblended Petrol and Diesel, would be levied. The government will promote a shift to the use of public transport in urban areas. This will be complemented by clean tech and governance solutions, special mobility zones with zero fossil-fuel policy, and EVs.

Affordable Housing –

“In 2022-23 80 lakh houses will be completed for the identified eligible beneficiaries of PM Awas Yojana, both rural and urban Rs.48,000 crore is allocated for this purpose” – Windmill Capital

The Central Government will work with the state governments for reduction of time required for all land and construction related approvals for promoting affordable housing for middle class and Economically Weaker Sections in urban areas. We shall also work with the financial sector regulators to expand access to capital along with reduction in cost of intermediation.

The allocation of 48000 crores for housing is a huge thrust on Infra as well, and is a positive for steel, cement and infra developers. Cement and Steel sectors are already in the capex mode. This focus will also ensure a higher GDP multiplier and job creation.

“Digitization of land records is a step towards standardization of the registration process” – Green Portfolio

This can impact the benami properties and cash economy.

In conclusion –

We would rate this budget a 3.5 as it was very much in line with market expectations and ensured a delicate balance between growth and fiscal prudence by pushing Capex investments – Wright Research

This budget will go a long way in boosting growth if the infrastructure spending delivers, but might also trigger inflation. There were no surprises – positive or negative, but the focus on digitization, upskilling, education, fintech, and inclusivity was a good call by the FM.

The Budget 2022 is clearly focussed on long term growth of Indian economy with thrust on capex, infrastructure, sustainability, clean energy, technology, skill development and job creation – Green Portfolio

Reducing the current account deficit and attracting capex and investments will be a huge positive for the Indian economy which is positioning itself as a contender for China plus one. FM has struck all the right cords considering inflation and lack of fiscal room for the Government in this budget. This budget is a huge positive for the markets as there were no negative surprises and is going to ensure continuity of attractiveness of the Indian economy for the FPI investors.

Overall, the budget can be described as a pro-growth budget with a more stable tax regime – Niveshaay

As an equity investor, we will find our pockets of growth from the budget. It aimed to reduce duty on imports on certain raw materials to ease on the higher prices like chemicals, stainless steel etc. It is always said that any individual should focus on their strengths. The key idea of the budget was to focus on India’s strengths from both domestic and export perspectives and be set towards growth.