Best Quant Funds That Beat The Stock Market

Why have some of the best quant funds earned nearly 40-60% CAGR returns for nearly 20 to 30 years? That is what we will discuss today. We will look at Renaissance & Citadel – the top performing quant funds in the world.

- What is it that sets these 2 apart?

- What are the challenges faced by the top quant funds in their path to success and glory?

- What can you as an investor takeaway from it?

There is limited information about these quant funds that we are looking at. So we are attempting to piece together a puzzle based on publicly available information. But, before we get into the top performing Quant Funds, let’s understand what quant funds are first.

What are Quant Funds?

Quantitative funds, commonly known as quant funds, utilize computer algorithms and quantitative methods to identify and trade stocks. They apply a systematic investing approach, minimizing human emotional influence and enhancing portfolio diversification. In volatile markets, quant funds can offer advantages with their low correlation to other asset classes, strategic flexibility, and potential superior performance. However, they come with risks such as market, liquidity, model, data, human error, and systematic risks.

These funds employ complex mathematical and statistical models, along with algorithmic strategies, for trading opportunity identification and execution. They heavily depend on quantitative analysis for investment decisions, thus eliminating subjective human judgment and emotional factors. These funds analyze vast amounts of data to capitalize on market inefficiencies and trends.

What does a quant team look like typically? Quant teams are typically composed of mathematicians, statisticians, and computer scientists, differing from traditional traders in skillset and approach.

So let’s get into it. Let’s look at the best quant funds that solved the market.

Want to learn more about quantitative investing, read our article on What is Quantitative Trading? and Best Quantitative Investment Strategies 2023 .

Best Quant Funds: Jim Simons & Renaissance Background

Jim Simons’ story is indeed remarkable. Starting a hedge fund at 40 after leaving a career in academia, he went on to become one of the most successful hedge fund managers globally

and one of the richest people in the world.

Born in Newton, Massachusetts, Simons demonstrated his mathematical prowess early on. He achieved significant academic milestone by earning his Ph.D. in mathematics from the University of California, Berkeley, in 1961. His academic career, which included prestigious positions at MIT, Harvard, and Stony Brook University – he made notable contributions to geometry and topology.

In 1978, Simons founded Renaissance Technologies in New York. Here, he revolutionized the industry by leveraging sophisticated mathematical models and algorithms for investment decisions. This approach, radically different from traditional investment strategies, involved analyzing vast quantities of historical data from diverse sources. Renaissance Technologies, especially its Medallion Fund, quickly became renowned for its exceptional financial performance, setting new standards in the hedge fund industry.

Best Quant Funds: Renaissance’s Medallion Fund

The Medallion Fund, the flagship of Renaissance Technologies, stands out for its exceptional performance. It has been known for its secretive and highly effective automated strategies – a testament to Simons’ genius. It’s noteworthy for being exclusive to employees, which is quite unusual in the hedge fund industry. This exclusivity has possibly contributed to its sustained success, as it aligns the interests of the fund managers directly with the performance of the fund. By employing rigorous mathematical and statistical models, the fund consistently delivered outstanding returns, outperforming traditional investment methods and establishing itself as one of the most successful quant funds in history.

Performance numbers for the Medallion Fund are staggering. With an average annual return of 66.1% before fees since 1988, and 39.1% after substantial management and performance fees, the fund’s success is unparalleled. A $1,000 investment in 1988 into Renaissance’s Medallion Fund would have been over $23 million by 2018 – an extraordinary compounding power of these returns. Here’s a detailed breakdown of annual returns, fees, and the size of the fund from 1988 to 2018 showing a consistent pattern of high performance. This consistency is rare in the hedge fund world, where many funds struggle to maintain their edge as they grow in size and their strategies become less effective or revert to mean returns.

| Year | Net Returns | Management Fee | Performance Fee | Return Before Fees | Size of Fund | Medallion Trading Profits | |

| 1988 | 9.00% | 5% | 20% | 16.30% | $20 million | $3 million | |

| 1989 | -4.00% | 5% | 20% | 1.00% | $20 million | $0 | |

| 1990 | 55.00% | 5% | 20% | 77.80% | $30 million | $23 million | |

| 1991 | 39.40% | 5% | 20% | 54.30% | $42 million | $23 million | |

| 1992 | 33.60% | 5% | 20% | 47.00% | $74 million | $35 million | |

| 1993 | 39.10% | 5% | 20% | 53.90% | $122 million | $66 million | |

| 1994 | 70.70% | 5% | 20% | 93.40% | $276 million | $258 million | |

| 1995 | 38.30% | 5% | 20% | 52.90% | $462 million | $244 million | |

| 1996 | 31.50% | 5% | 20% | 44.40% | $637 million | $283 million | |

| 1997 | 21.20% | 5% | 20% | 31.50% | $829 million | $261 million | |

| 1998 | 41.70% | 5% | 20% | 57.10% | $1.1 billion | $628 million | |

| 1999 | 24.50% | 5% | 20% | 35.60% | $1.54 billion | $549 million | |

| 2000 | 98.50% | 5% | 20% | 128.10% | $1.9 billion | $2434 million | |

| 2001 | 33.00% | 5% | 36% | 56.60% | $3.8 billion | $2149 million | |

| 2002 | 25.80% | 5% | 44% | 51.10% | $5.24 billion | $2.676 billion | |

| 2003 | 21.90% | 5% | 44% | 44.10% | $5.09 billion | $2.245 billion | |

| 2004 | 24.90% | 5% | 44% | 49.50% | $5.2 billion | $2.572 billion | |

| 2004 | 24.90% | 5% | 44% | 49.50% | $5.2 billion | $2.572 billion | |

| 2005 | 29.50% | 5% | 44% | 57.70% | $5.2 billion | $2.999 billion | |

| 2006 | 44.30% | 5% | 44% | 84.10% | $5.2 billion | $4.374 billion | |

| 2007 | 73.70% | 5% | 44% | 136.60% | $5.2 billion | $7.104 billion | |

| 2008 | 82.40% | 5% | 44% | 152.10% | $5.2 billion | $7.911 billion | |

| 2009 | 39.00% | 5% | 44% | 74.60% | $5.2 billion | $3.881 billion | |

| 2010 | 29.40% | 5% | 44% | 57.50% | $10 billion | $5.75 billion | |

| 2011 | 37.00% | 5% | 44% | 71.10% | $10 billion | $7.107 billion | |

| 2012 | 29.00% | 5% | 44% | 56.80% | $10 billion | $5.679 billion | |

| 2013 | 46.90% | 5% | 44% | 88.80% | $10 billion | $8.875 billion | |

| 2014 | 39.20% | 5% | 44% | 75.00% | $9.5 billion | $7.125 billion | |

| 2015 | 36.00% | 5% | 44% | 69.30% | $9.5 billion | $6.582 billion | |

| 2016 | 35.60% | 5% | 44% | 68.60% | $9.5 billion | $6.514 billion | |

| 2017 | 45.00% | 5% | 44% | 85.40% | $10 billion | $8.536 billion | |

| 2018 | 40.00% | 5% | 44% | 76.40% | $10 billion | $7.643 billion |

Medallion’s success is often attributed to its sophisticated trading algorithms and the use of advanced mathematics and data analysis, far removed from traditional investment strategies. This focus on quantitative methods, combined with a disciplined approach and a strong emphasis on research, has allowed Medallion to maintain its edge in various market conditions.

So what sets Renaissance apart?

Why is Renaissance the top quant fund?

Renaissance Technologies’ position as a leading quant fund can be attributed to several key factors:

1. 30 years of experience looking at Big Data to find patterns:

Renaissance has over 30 years of experience in analyzing Big Data to discern market patterns. They started with simpler markets like commodities and progressively advanced to stocks and complex derivatives. This extensive experience in building and refining their data pipeline gives them a significant edge.

2. Massive first mover advantage

Renaissance was among the pioneers in applying complex mathematical models to financial markets. This early start allowed them to develop and perfect their methodologies before others entered the field.

While other companies, like Google, have the capability to manage data effectively, they haven’t applied these skills in the hedge fund domain as Renaissance has. The investment world’s complexity means that mastery in one area, like data management, is just a part of the success equation that Renaissance has cracked.

3. Renaissance Technologies also has a culture of academia

Renaissance’s culture is deeply rooted in academic principles. Employees, often with strong backgrounds in mathematics, physics, and computer science, approach financial markets with intellectual rigor and proven research methodologies. This academic mindset fosters a continuous pursuit of knowledge and refinement of their strategies.

4. Jim Simmons is a genius

Jim Simons, a once-in-a-generation talent, successfully combined his academic excellence with strong managerial skills. His leadership was crucial in assembling and guiding a team of exceptional individuals, turning Renaissance into a highly efficient money-printing machine.

5. Retaining smart people with right incentives

The Medallion Fund, Renaissance’s best-performing fund, is exclusively available to its employees. This exclusivity aligns employee interests directly with the fund’s performance. By keeping the fund closed to outside investors, Renaissance ensures that its strategies remain effective and are not diluted by excessive capital inflows, and its proprietary strategies continue to remain exclusive. An inherently great virtuous cycle that the Medallion Fund has managed to capitalize on.

Want to learn more about quantitative investing, read our article on What is Quantitative Trading? and Best Quantitative Investment Strategies 2023 .

Let’s look at another quant fund, Ken Griffin’s Citadel, and see what exactly they did to earn high returns using their quantitative analysis.

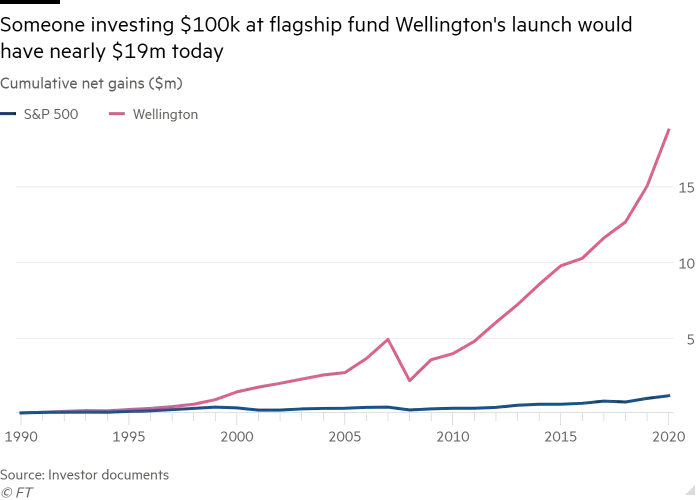

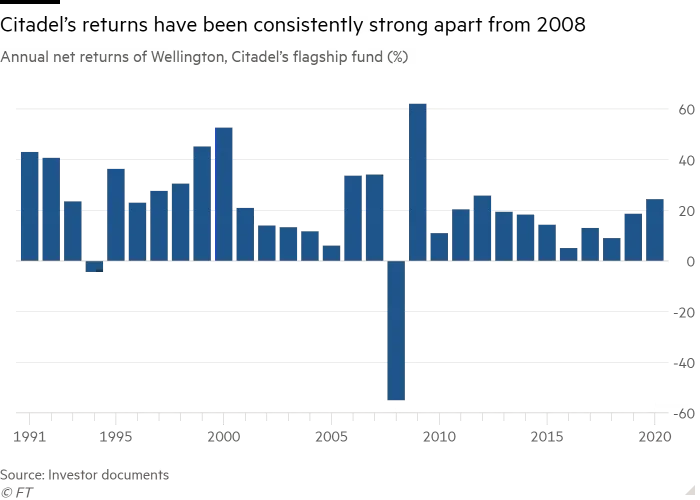

Best Quant Funds: Citadel’s Commodity Play

Ken Griffin’s Citadel is notable for its unique approaches to trading & using quantitative investment strategies . In 2018, Citadel hired a team of scientists and analysts to produce more accurate weather forecasts than most meteorological offices. A particularly strange yet very strategic move, for a hedge fund that relies on quantitative data for trading in various markets. They typically focus on using quantitative data to make trades in stocks, bonds and currencies. Citadel was looking at how weather could impact prices of assets, especially in the commodities sector. A $100,000 investment in 1990 into Citadel’s flagship Wellington Fund would have been over $19 million by 2021 – an extraordinary compounding power of these returns.

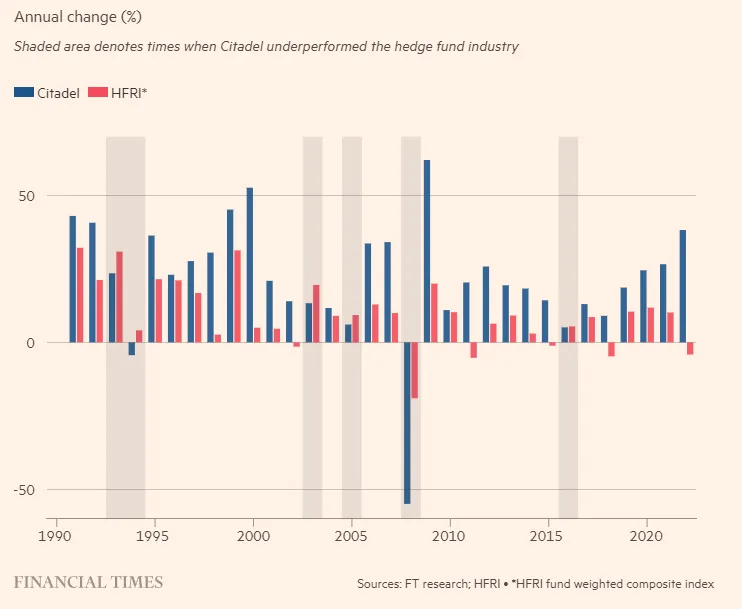

Using this unique skill set and thought-process, Citadel built a commodities business with $54bn-in-assets for both futures and physical trading. Their primary focus was on the gas, energy and power sector. In 2022, Citadel made a record $16 billion, surpassing Bridgewater Associates as the most successful hedge fund of all time. They even beat John Paulson’s $15.6 billion return earned in 2007 – which was well known as the “greatest trade ever” at the time. Here’s a look at how Citadel has performed since inception against the wider hedge fund industry. The shaded parts identify the periods when Citadel had underperformed the hedge fund industry.

In hindsight, the Ukraine & Russia war, volatility in oil prices, the middle-east tensions as a result of the Israel-Hamas war , US & European energy issues – has all helped pay off on their big commodity bet. The commodity play produced returns of $8 billion last year – which is approximately 50% of Citadel’s overall profits for 2022.

And the funny thing is that Citadel started working on its commodities book, data & pipeline at a time when other hedge funds had scaled down their commodities play or were holding low single digits of these assets in their commodities book.

How did Citadel capitalize on the gas & energy play?

Citadel’s success in capitalizing on the gas and energy sector can be attributed to a comprehensive approach that combines in-depth supply analysis with advanced demand forecasting from some of the smartest minds in the quant world.

Supply Side Gas & Energy Analysis:

- Citadel’s large teams of researchers meticulously map and analyze the supply side of the gas market.

- Existence of numerous gas hubs across the U.S. and other regions provides a variety of pricing points that can be exploited for trading opportunities.

- Ability to comprehend and quickly anticipate changes in supply side factors—whether due to geopolitical events, changes in production levels, or other factors—allows Citadel to position trades & bets in the market advantageously.

Demand Side Weather Forecasting:

- Demand forecasting, on the other hand, is notably more complex, primarily because it is heavily influenced by weather patterns, consumption changes, impact of ocean, moon etc on weather conditions etc. There are a lot of data points and it can be difficult to manage & understand what is happening

- Energy usage spikes during extreme temperatures—hot summers increase the demand for air conditioning, while cold winters raise heating needs.

- Citadel’s edge in this aspect comes from its formidable weather team, which as we discussed earlier isn’t a common feature among hedge funds.

- This team uses supercomputers to generate accurate forecasts and includes experts in specific meteorological phenomena like thunderstorms and tropical cyclones.

The Citadel Advantage:

- Citadel traders are provided with information from this dedicated weather team, which is capable of running sophisticated models to predict weather up to two months in advance.

- The weather forecasting team was also working on sub-seasonal forecasts. Basically, beyond just predicting and forecasting how the weather would look like tomorrow, day after or this week – the team was looking at how to predict weather up to 2 months ahead.

- These sub-seasonal forecasts are particularly challenging to predict, but they can be extremely valuable. Accurate long-term forecasts can provide insights into future energy demand trends, allowing Citadel to make informed trading decisions before these changes are reflected in market prices.

A combination of smart hiring choices by the management team at Citadel to prop up its commodity book that helped develop its rigorous supply side analysis and cutting-edge demand forecasting, particularly in the realm of weather prediction, has given Citadel a distinct competitive advantage. The firm’s capacity to integrate and analyze complex data sets has played a significant role in achieving a remarkable 38.2% performance in the last year. This performance has contributed to an impressive annualized return of 19.7% since the firm’s inception in 1990.

Liked this story and want to continue receiving interesting content? Watchlist Wright Research’s smallcases to receive exclusive and curated stories!

Explore Wright Momentum smallcase by Wright Research, use code MOMENTUM2023 for 20% off, Valid till 10th December

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary.

Wryght Research & Capital Pvt Ltd•SEBI Registration No: INA100015717

103, Shagun Vatika Prag Narayan Road, Lucknow, UP 226001 IN

CIN: U67100UP2019PTC123244

Disclosures: Link