Anatomy of the Indian Pharma Industry

The Indian pharma industry is the world’s 3rd largest by volume. It is also the world’s largest supplier of generic drugs and a leading producer of vaccines catering to about 50% of global vaccine demands.

Segments in the Indian pharma industry

Active Pharmaceutical Ingredients (API)

- All pharma drugs are made up of the API, which is the central ingredient, and the excipient the substance that helps deliver the medication to the user’s system. It is the API that produces the intended curing effect whereas excipient is a chemically inactive substance.

- India is the 3rd largest producer of API accounting for an 8% share of the global API Industry.

Formulations

- A pharma formulation is a process of combining different chemical substances with the active drug to create an end medicinal product. The formulation can be solid, semi-solid or liquid.

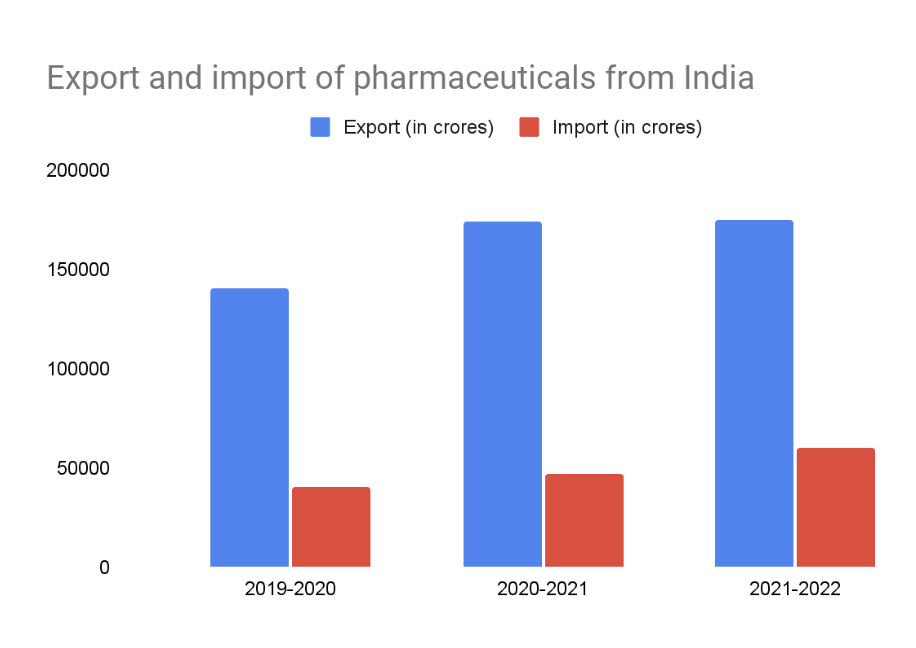

- India is the largest exporter of formulations in terms of volume, with a 14% market share and 12th in terms of export value.

Biosimilars

- A biosimilar is a biological product that is developed to be similar to an already regulator-approved biologic, known as the reference product. Biosimilar is usually marketed as cheaper versions of costly name-brand drugs.

- The domestic market for biosimilar is expected to reach $12 bn by 2030, growing at a CAGR of 22%.

Contract research and manufacturing services (CRAMS)

- CRAMS involves outsourcing research services or product manufacturing activity to companies that can provide the service at a low cost. CRAMS activities include contract research and contract manufacturing.

- The domestic CRAMS market is expected to reach $20 bn by 2024.

So what has been fuelling this growth of the pharma industry?

Low cost of resources has facilitated low cost of production providing Indian pharma companies with a significant cost advantage. It’s speculated that India’s cost of production is 33% lower than in the USA & half of that of Europe.

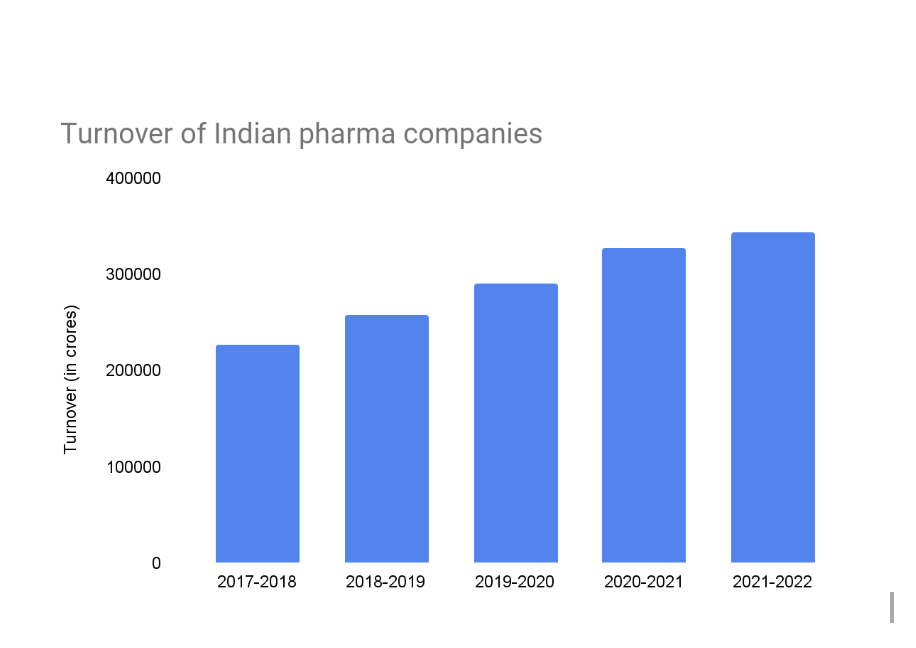

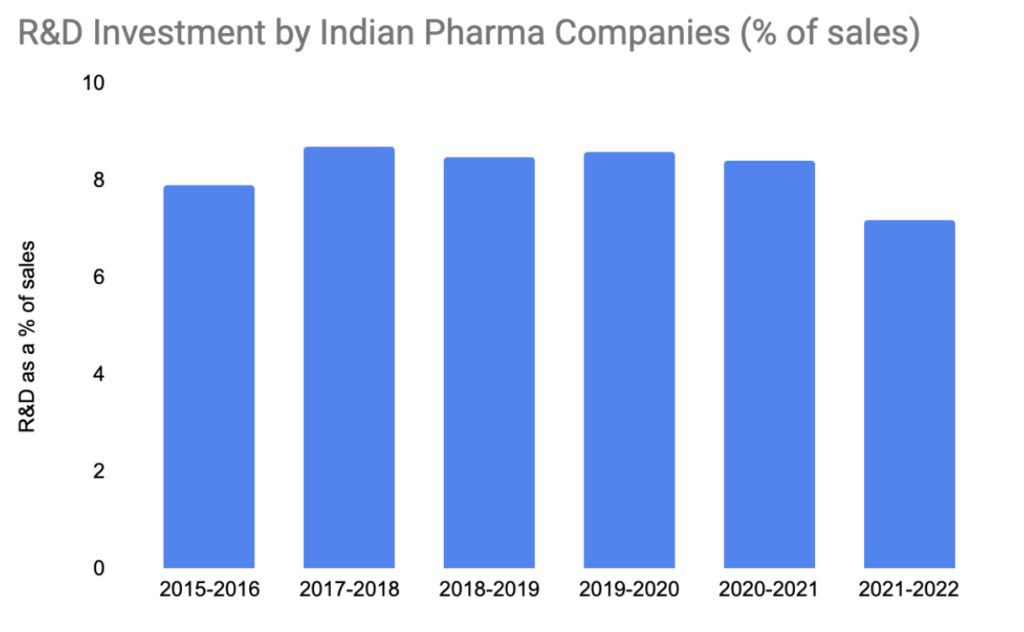

- Indian pharma companies have been trying to differentiate their offering by investing heavily in research and development activities. While R&D expenditure as a percentage of sales was just 5.3% in the financial year FY12, it has increased to 7.2% in FY22.

- Indian pharma companies have been focusing on newer geographies to improve their turnover. Between FY17 and FY22 drug and pharma exports from India to the Middle East have doubled to $342.47 mn. While the dollar value of exports to these regions is still low when compared to exports to North America and the EU, their share has been growing at a fast pace.

- Multiple international NGOs involved in public health use generic Indian drugs for affordable treatment in African and Latin American countries. According to an appraisal by ‘Doctors Without Borders’, treatment of AIDS using generic Indian drugs is significantly cheaper compared to using branded drugs.

Key developments in Indian pharma

Policy support

- In the Union Budget 2024, a new initiative will be introduced to promote innovation in the pharmaceutical sector through centers of excellence. Moreover, at the grassroots level, the government has announced its intention to construct 157 nursing colleges in conjunction with government medical colleges, bolstering the country’s healthcare and educational infrastructure.

- In September 2020, the Indian government unveiled a production-linked incentive (PLI) scheme valued at 15,000 crore for the pharmaceutical industry. The primary objective of this scheme was to incentivize domestic manufacturers to produce critical key starting materials (KSMs), drug intermediates (DIs), and active pharmaceutical ingredients (APIs). In line with this initiative, the government provided financial support amounting to $932.66 million to support the development and production of essential pharmaceutical components within the country.

- The “National Health Policy 2017” seeks to increase public health expenditure to 2.5% of the GDP from the existing 1.15% of GDP. The policy also seeks to promote setting up of infrastructure for the development of the pharma industry as well as boost research & development in the industry. The policy also specially focuses on the production of Active Pharmaceutical Ingredient (API), which is a critical aspect of the generic formulations industry.

- In July 2016, Government amended the FDI policy to allow 100% FDI in greenfield pharma projects and up to 74% FDI in brownfield projects via the automatic route.

- In 2017, Biotechnology Industry Research Assistance Council (BIRAC) launched an Innovate in India program to boost the development of biopharmaceuticals.

Role of health insurance

The health insurance industry is at a nascent stage with only about 18% of people in urban areas & 14% population in rural areas covered under any kind of health insurance scheme.

- The health insurance industry in India is the fastest-growing segment in the non-life insurance sector, registering a compounded annual growth rate of 13% between 2016-2023.

- In Sept 2018, the government launched the Ayushman Bharat Yojana as part of National Health Policy. The scheme aims to provide health coverage at secondary and tertiary level to the bottom 40% of poor of India. The scheme provides coverage of ₹5 lakh per family per year for medical treatment in empanelled hospitals.

- Increased demand buoyed by health insurance coverage will push the growth of the pharma industry.

- Investments, mergers and acquisitions

- The Indian pharma sector has received a cumulative foreign direct investment of $20.96 bn over the previous 22 years. As of August 31, 2021, the Production-Linked Incentive (PLI) scheme garnered a positive response from the industry, receiving a total of 278 applications, which is expected to benefit 55 manufacturers. The government has given its approval for 19 applications, totaling ₹4,623.01 crore (US$ 633.68 million) in committed investments.

The takeaway

The growth of the Indian pharmaceutical industry is propelled by several key drivers. Firstly, the rising healthcare needs of a growing population and increasing awareness of health and wellness have resulted in a surge in demand for pharmaceutical products. Secondly, India’s cost-effective manufacturing capabilities and a large pool of skilled professionals have positioned the country as a global pharmaceutical manufacturing hub. Thirdly, the government’s initiatives, such as the production-linked incentive (PLI) scheme, encourage investments in research and development, leading to innovation and new product development. Additionally, India’s strong presence in the generic drug market and its ability to produce high-quality medicines at competitive prices have contributed significantly to the industry’s growth. Moreover, the booming medical tourism sector has further bolstered the demand for pharmaceuticals in the country. As these factors synergise, the Indian pharmaceutical sector continues to chart a path of robust growth and remains a vital player in the global pharmaceutical landscape.

The Pharma Tracker smallcase allows you to efficiently track and invest in the pharma sector. The smallcase consists mostly of large and midcap stocks.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in this article is for informational and educational purposes only and should not be construed as professional financial advice nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary. Disclosures: bit.ly/sc-wc