Constructing the Timeless Asset Allocation smallcase

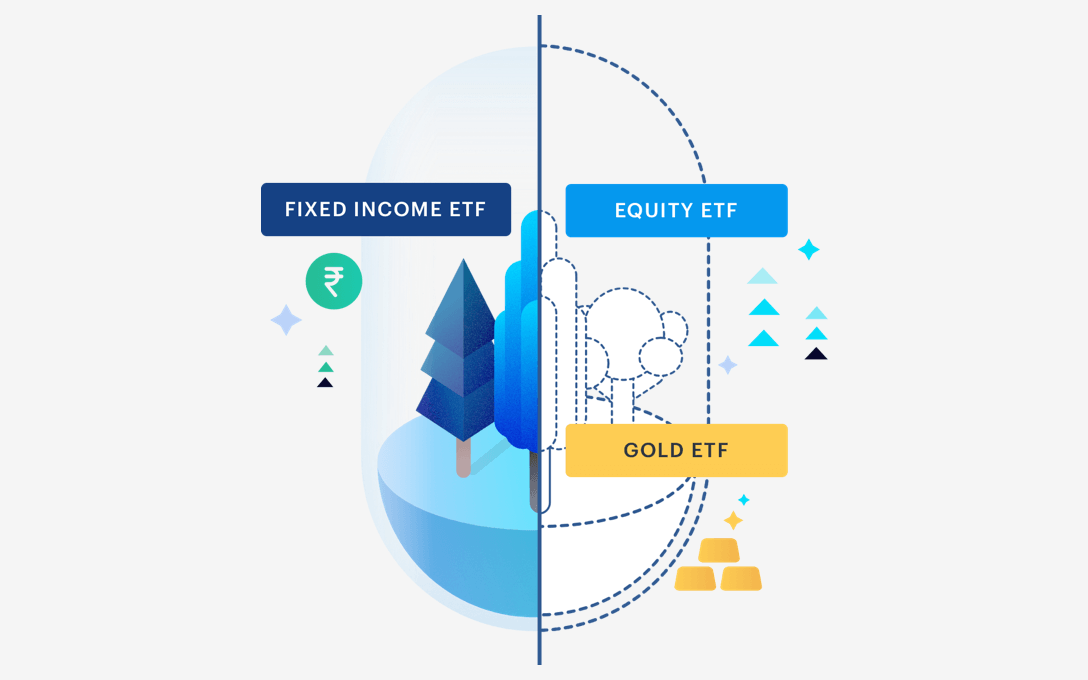

The Timeless Asset Allocation smallcase (previously known as the All Weather Investing smallcase) is a recession-proof way of creating wealth over the long term. This smallcase has four ETFs spread across three asset classes – equity, fixed income, and gold. Investing in the Timeless Asset Allocation smallcase is the best way to start building your core-satellite investment portfolio.

In this post, we will dig deeper to understand how this smallcase is built

Objective

The idea for the Timeless Asset Allocation smallcase arose from a need to build an investment product that can be used by investors in all circumstances–whether the markets are up or down. This smallcase would generate Equity (stock market-like) returns over the long term, but would also significantly reduce fluctuations to provide a smooth wealth creation journey

Identifying the Constituents

To significantly reduce risks (fluctuations in the investment value), it is very important to diversify beyond Equity by investing in other asset classes like Gold and Fixed Income. At the same time, we wanted to offer a product where people can invest and redeem instantaneously with the click of a button. Hence, dealing in physical gold or bank fixed deposits was out of the question. So, we decided to go ahead with exchange-traded funds (ETFs)

ETFs are like mutual funds, but investors can buy and sell them on exchanges like stocks. Every ETF tracks an underlying, which could be Nifty, price of gold etc.

For example, a Nifty Index consists of 50 stocks. So if you want to invest in the Nifty index, you can just buy the Nifty ETF, instead of buying all the 50 stocks in the same proportion as the Index. If the Nifty generates a return of 5%, the Nifty ETF will also generate approximately the same returns. Similarly, if you invest in a gold ETF, it will give you the returns of gold

After our research, we decided to include the following ETFs in the Timeless Asset Allocation smallcase. We also ensured that we select only liquid ETFs, where enough investors are buying and selling these ETFs on the exchange. This ensures that there are sellers available when you want to buy them and you are not charged a premium because of the lack of supply.

Asset Allocation Strategy

After identifying the constituents, the next step was to build an algorithm that decides how much money should go into each asset class. Our research team studied many algorithms like Maximum Diversification, Inverse Volatility, Equal Risk Contribution, Minimum Volatility, etc. We ultimately went ahead with an algorithm that maximizes the Sharpe Ratio of the portfolio.

The Sharpe Ratio calculates the excess returns generated per unit of risk. If we are given two investment products (portfolios, stocks, asset classes) and asked to pick one of them for investment, the best way is to pick the one with the higher sharpe ratio. Higher sharpe means that the product generates more return without taking extra risks

After conducting multiple studies, writing numerous computer programs and running 1000s of simulations, we were able to generate an algorithm that can efficiently distribute your money in the selected asset classes. A computer program will run the algorithm every quarter to decide the optimal weighting scheme as per the prevailing market conditions.

Testing in Timeless Asset Allocation smallcase

Once we had the strategy ready, the next step was to test the performance of the same under different economic and market cycles. For this, we selected a period starting from 2007. This ensured that we were able to check the performance of the strategy in one of the worst stock market crashes in recent history. The table below shows the performance of the strategy in various periods when the markets crashed.

| Time period | Nifty | Timeless Asset Allocation |

|---|---|---|

| Feb’15 – Feb’16 | -3% | |

| Oct’10 – Dec’11 | -23% | +1% |

| Jan’08 – Oct’08 | -53% | -18% |

Final Result

After extensive testing, we are confident that the Timeless Asset Allocation smallcase provides the perfect asset allocation mix for long-term wealth creation. In the last 11 years since its inception, it has generated a CAGR (the yearly rate at which your investment would have grown if you had invested in 2007) of 11.28%. This is much better than the Nifty CAGR of 8.24%. The strategy offers over 50% higher Sharpe than Nifty, by significantly reducing the risk.

Now, there’s a better, cheaper, and more efficient way to build wealth for the long term. Also, you can invest in the Timeless Asset Allocation smallcase in just 2 clicks for no additional fees. Pay only when you like the product and commit to the long-term.