🎄The Santa Claus Rally: A Reality or Illusion?

As we embrace the final days of 2023, whispers of the “Santa Rally” have begun circulating among investors. This phenomenon, suggesting a historical uptick in stock prices during December and January, carries a certain romantic appeal. Why, you may wonder? Well, as creatures of habit, humans tend to find comfort in traditions and patterns.

The Santa Rally has become a recurring event, almost like a financial tradition. Investors appreciate this predictability, as it instills a sense of reassurance and positivity amidst the uncertainties of the market.

However, the Santa Rally had always been commonly associated with the western markets. Only in the last decade or so has the Indian stock market joined in on the fun… or has it? Let’s analyse.

Examining the Evidence

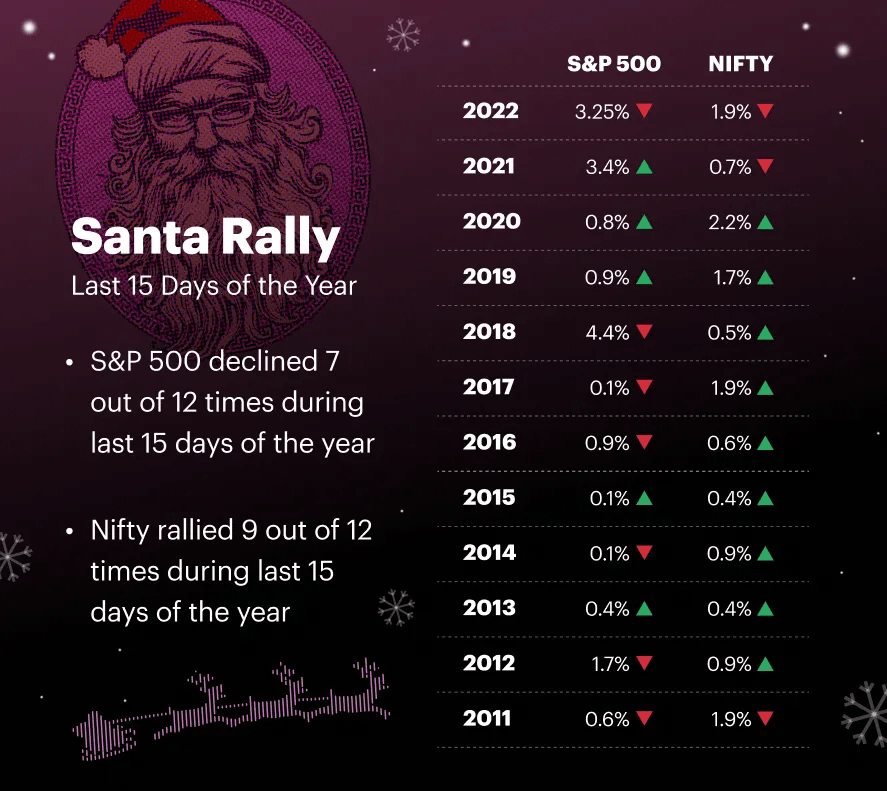

Advocates of the Santa Rally point to its historical presence in major markets like the US. The Stock Trader’s Almanac compiled data during the 73 years from 1950 through 2022 and showed that a Santa Claus rally occurred 58 times (or roughly 80% of the time), with growth in the S&P 500 by 1.4% Proposed explanations range from positive holiday sentiment to institutional investors buying more stocks of companies that did well.

Considering the Caveats

Yet, portraying the Santa Rally as a guaranteed success story is overly simplistic. Firstly, past performance doesn’t ensure future results. Several years have bucked the trend, leaving investors disillusioned. Secondly, the rally’s strength and occurrence vary across markets and years. India, for example, exhibits a less consistent pattern compared to the US.

From 2011 to 2022, the S&P 500 dipped 4 times while Nifty rallied 5 times. But from 2017 to 2022, Nifty has rallied 9 times compared to S&P 500 rallied only 5 times. Does this mean Santa Rally exists in India? The answer isnt simple.

Although historical data offers promise, it falls short of being a definitive phenomenon. By emphasizing research, long-term goals, and prudent risk management, investors can navigate the festive season with a healthy dose of skepticism and approach the market with confidence, irrespective of Santa’s presence.

Guiding Principles for Investors – Therefore, approaching the Santa Rally with cautious optimism is essential.

Remember:

Focus on Long-Term Goals: Don’t get tempted by short-term gains. Align your investment decisions with long-term financial objectives.

Prioritize Thorough Research: Don’t blindly follow festive trends. Analyse individual companies, grasp their fundamentals, and evaluate their long-term prospects before investing.

Acknowledge Inherent Volatility: Anticipate price fluctuations, especially with reduced trading volume during holiday periods. Invest wisely and avoid excessive exposure to risk.

Seek Professional Guidance: When uncertain, consider consulting a qualified financial advisor who can tailor strategies to your specific situation. Lastly, remember that a prosperous portfolio is one grounded in solid fundamentals, not fleeting festive trends!